Why did Cainiao fire the first shot of Alibaba's split?

Cainiao has officially submitted its IPO application to the Hong Kong Stock Exchange. Since Alibaba's "1+6+N" initiative, the spin-off listing of various business segments has become a focus of the secondary market. Previously, Hema(盒马)and Aliyun were considered as potential candidates for the first listings.

Why did Cainiao make the first move?

The most important reason is the current financing environment. As A-share market has tightened its listing requirements for consumer companies, and the valuation of consumer companies in the Hong Kong stock market continues to be under pressure, making the listing environment unfavorable for Hema. Although cloud service companies are popular in Hong Kong。

Based on the performance of the past two years, Cainiao is also the most suitable candidate to lead the way. Alibaba Cloud may still be testing the profitability waters, and Hema's performance is affected by seasonal factors, while Cainiao's logistics business is deeply integrated with Taobao Group, with a higher level of business maturity and sufficient profit-making capability.

Brief Review of Prospectus

Cainiao has established a smart logistics network with end-to-end logistics capabilities worldwide and provides a range of innovative logistics solutions, primarily serving businesses and brands in China and around the world, e-commerce platforms, and consumers.

Cainiao's business is divided into three main segments: international logistics, domestic logistics, and technology and other services.

In terms of international logistics, based on parcel volume in 2022, Cainiao is the world's leading cross-border e-commerce logistics company and ranks first in both China's export and import e-commerce logistics.

In domestic logistics, based on 2022 revenue, Cainiao is one of China's top three quality e-commerce logistics companies. Based on parcel volume for the three months ending June 30, 2023, Cainiao is China's largest provider of reverse logistics solutions.

In technology and other services, based on the number of stations as of December 31, 2022, and parcel volume processed in 2022, Cainiao has established the world's largest digital station network through Cainiao Stations. Based on average monthly active users in 2022, Cainiao operates the world's largest logistics app.

As of June 30, 2023, Cainiao's global network covers more than 200 countries and regions, including two e-Hubs with a tot

al construction area of over 150,000 square meters, more than 1,100 warehouses with a total construction area of approximately 16.5 million square meters, and over 380 sorting centers. In the 2023 fiscal year, Cainiao processed over 1.5 billion cross-border parcels, serving 100,000 brands and merchants, with the world's largest cross-border e-commerce warehouse network spanning over 3 million square meters. They have also created the world's largest digital logistics network with over 170,000 Cainiao stations, processing more than 80 million parcels daily. Additionally, they have the most widely used logistics app globally, with over 60 million monthly active users (MAU).

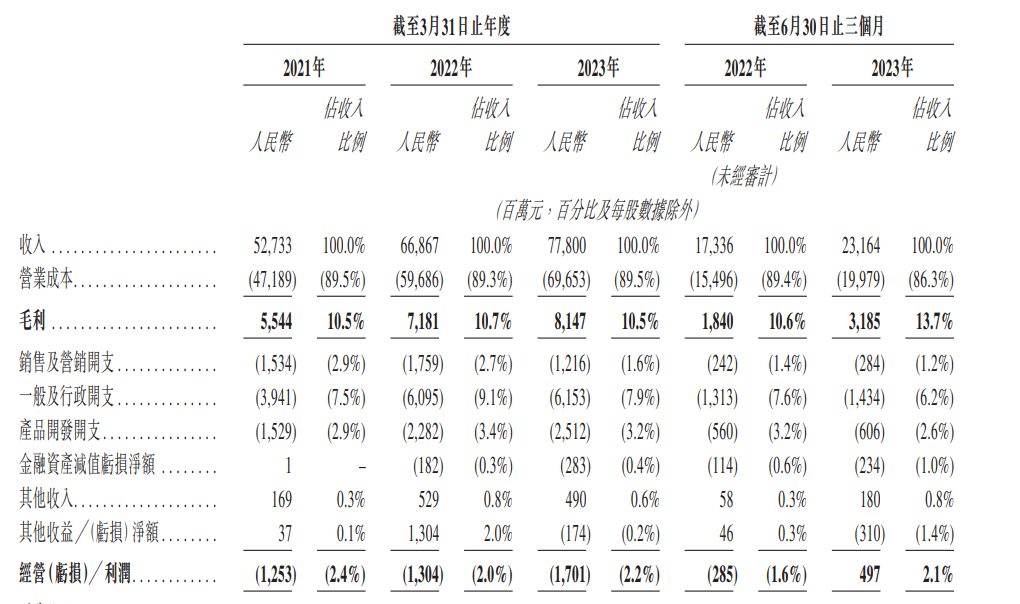

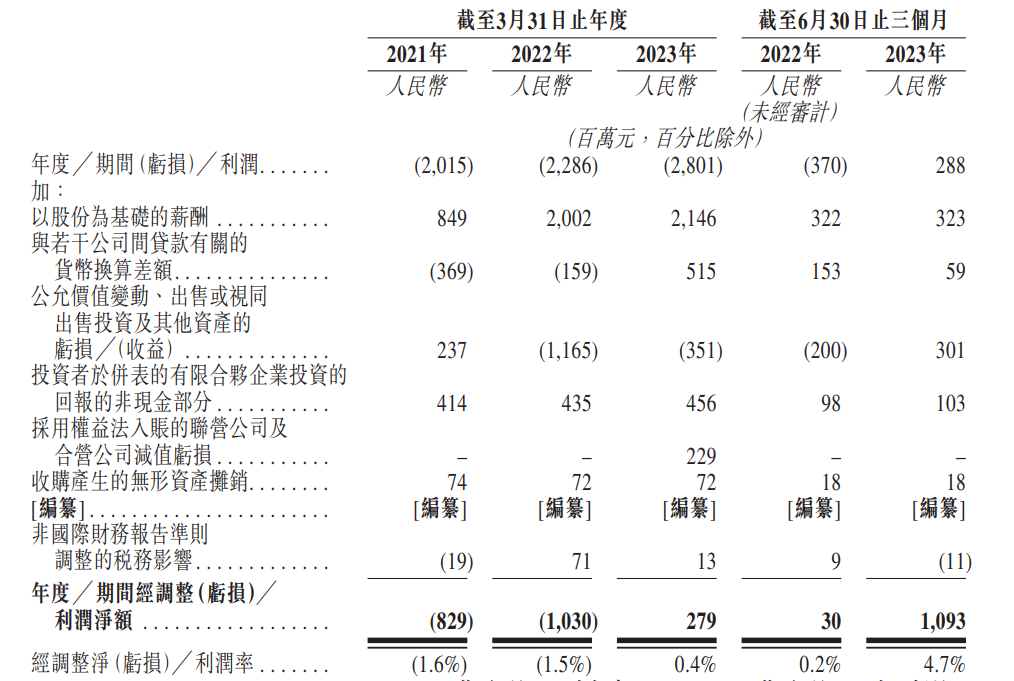

In terms of performance, from the fiscal year 2021 to 2023, Cainiao's revenue was CNY 52.7 billion, CNY 66.8 billion, and CNY 77.8 billion, respectively, with a compound annual growth rate of 21%. During the same period, adjusted EBITDA was CNY 1.036 billion, CNY 1.155 billion, and CNY 2.873 billion, respectively.

In the first quarter of the 2024 fiscal year, Cainiao's adjusted EBITDA increased significantly from CNY 634 million in the same period of the 2023 fiscal year to CNY 1.807 billion. The adjusted EBITDA profit margin also more than doubled from 3.7% in the same period of the 2023 fiscal year to 7.8%.

$Alibaba(BABA)$ $Alibaba Group Holding Limited(BABAF)$ $Alibaba(09988)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

According to their announcements, only the Cloud business will spin off for now. Cainiao will just go public and Alibaba will hold 50+ % of it.

Industrial production in China out this morning up 17% and China stocks are barely green should be up big ? Shows economy is rebounding .

is there written in their statements that for the planned listings they will pay special dividends to existings BABA shareholders?

我不认为他们分拆菜鸟。他们会把它公之于众。截至目前,只有云将剥离。

after tonight Alibaba will never be the same again... woohooo!!!