Higher-for-Longer Interest Rate May Squeeze The Market For Much Longer Time Than We Expect

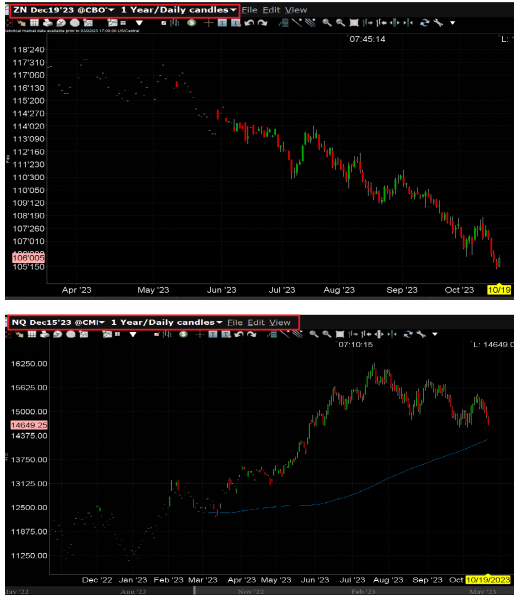

The first chart below is the price change chart of American 10-year bond futures (ZN), and the other one is the price trend of American Nasdaq stock index futures (NQ) in one year.

As of October 20th, the 10-year bond interest rate in the United States has reached the highest level since the late 1970s: 5%, when the Great Depression was caused by global inflation because of the energy crisis.

Last month, the Federal Reserve made Wall Street investors shudder when it said at a news conference after the open market meeting that US interest rates might be higher and last longer.

Obviously, the negative impact of high interest rates caused by inflation on the stock market is far from over. 2024 will be a more challenging year for interest rates and the stock market.

Historical facts have proved that high interest rates will have a certain degree of negative impact on the stock market, which is due to the following five reasons:

1. Increased attractiveness of bond market: Under high interest rate environment, bond market usually becomes more attractive because investors can obtain higher fixed income. This may lead to the transfer of funds from the stock market to the bond market, thus posing competitive pressure on the stock market.

2. Rising borrowing costs: High interest rates usually lead to rising borrowing costs, including financing costs for enterprises. This could have a negative impact on companies' profitability, as they need to pay more interest to repay their debts. This may have a negative impact on the stock performance of companies, especially those with high debts.

3. Reduced consumption: High interest rates increase financing costs, which may lead consumers and enterprises to reduce consumption and investment. That could slow economic growth and have a negative impact on corporate earnings, which could affect the stock market.

4. Decreased return on investment: High interest rates make investments in the stock market more risky than those in the bond market. Because the bond market provides higher fixed income, investors may prefer bonds to stocks, which leads to a decline in the valuation of the stock market.

5. Rising cost of capital: In a high interest rate environment, the cost of capital of a company usually rises, and companies should choose projects and investments more carefully. This may weaken the growth potential of the company, thus adversely affecting the stock market.

To sum up, the road will never be smooth for the American stock market in 2024, but investors can still achieve considerable returns by making full use of various stock market index derivatives, designing reasonable trading strategies and managing risks well.

$NQ100 Index Main Connection 2312 (NQmain) $$Dow Jones Main Connection 2312 (YMmain) $$SP500 Index Main Connection 2312 (ESmain) $$Gold Main Connection 2312 (GCmain) $$WTI Crude Oil Main Connection 2312 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Nice