[Options Strategy] Is Q3 earnings a turning point for JD's share price?

$JD.com(JD)$ will release its third quarter 2023 financial results on November 15. Analysts expect Jingdong Group to achieve a total revenue of 246.9 billion yuan (YoY+1%) in 2023Q3, of which commodity revenue is expected to be 193.2 billion yuan (YOy-2%), and service revenue is expected to be 53.7 billion yuan (YoY+15%); Jd.com's retail revenue is expected to be 212 billion yuan (flat year-on-year).

It is estimated that the Non-GAAP net profit of Jingdong Group is 9.2 billion yuan (YoY-9%) in 2023Q3, and the Non-GAAP net profit rate is down 0.4 pct year-on-year to 3.7%, of which Jingdong retail operating profit margin is expected to be 4.8%.

The year-on-year growth rate of total revenue is expected to slow down, mainly considering the macro consumption is still recovering, the impact of organizational structure adjustment is still continuing, the high base in the same period of Q3 last year and the growth pressure of charged categories brought by seasonal mismatch; Non-GAAP net profit margin and operating profit margin of Jingdong's retail business are expected to remain stable under the controllable rhythm of the company's marketing investment.

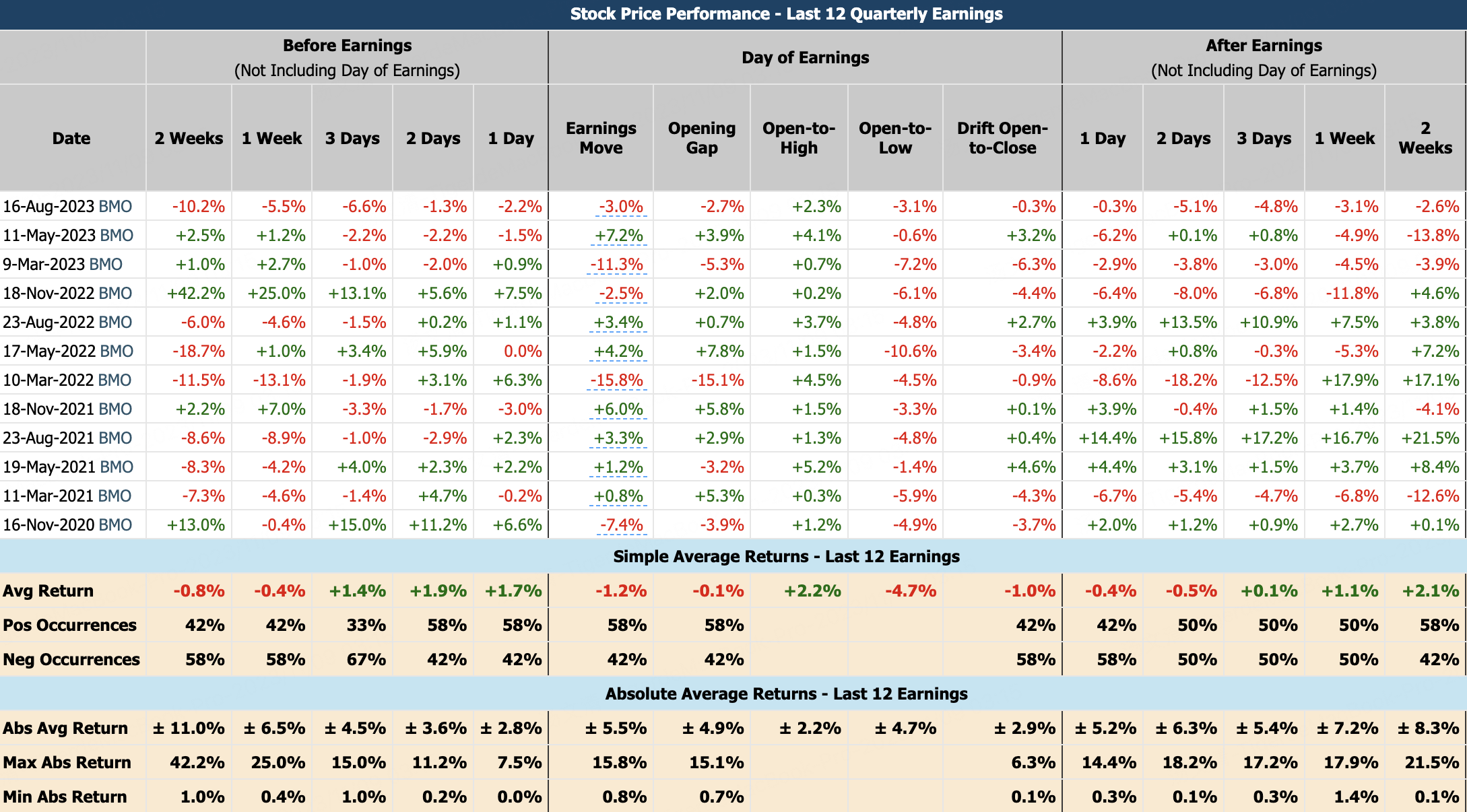

Historical earnings share performance

Prior to JD earnings releases, the average expected earnings move was ±7.6%. The actual move averaged ±5.3%, which is 2.3% below the average predicted move. The opening gaps averaged ±4.5% while the stock drift after the open tended to move ±3.4%.

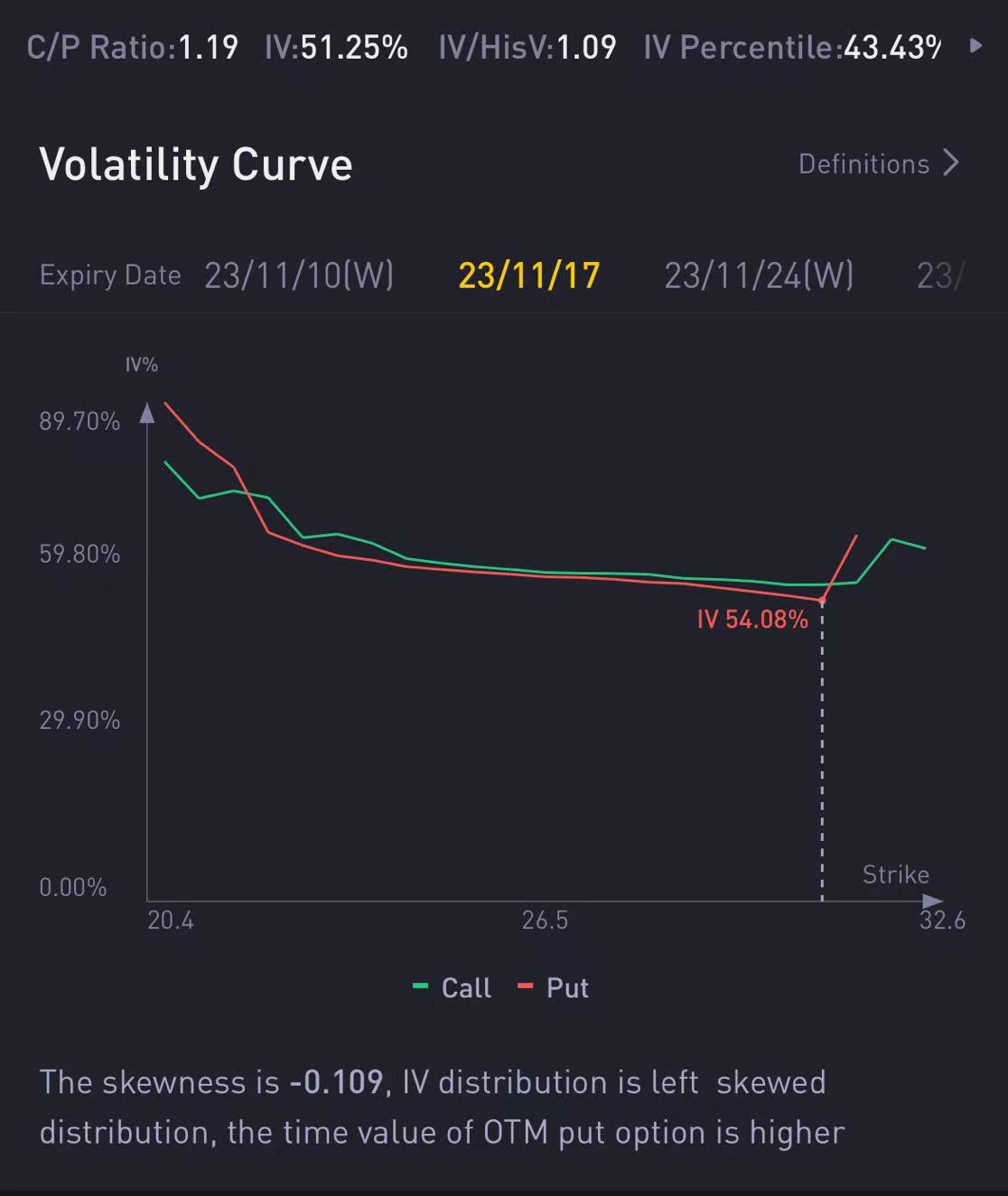

Option expectation

The implied volatility of options expiring in the reporting week is 58%, the company's expected stock price trend during the reporting period is ±2 US dollars, the expected price range is 24.4 ~ 28.4, and the maximum expected rise or fall is 7.5%.

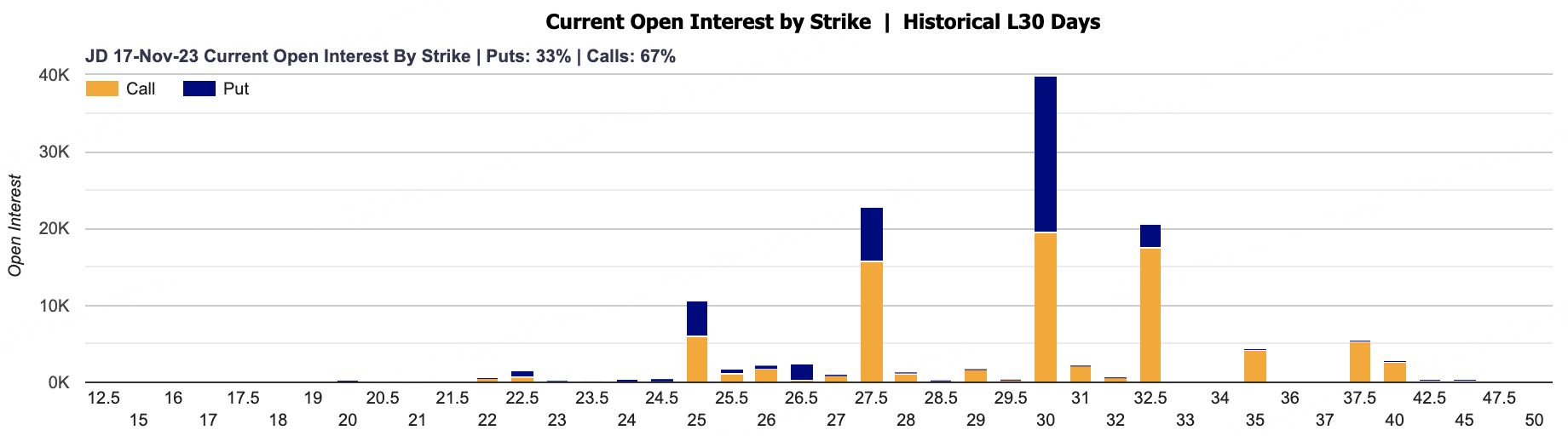

In the report week expiration (November 17) options, the open position of call options accounted for 67%, and the exercise price of the highest open position was 30, of which the put option accounted for 51% $JD 20231117 30.0 PUT$ . The exercise price with the largest proportion of open position is 27.5 and 32.5.

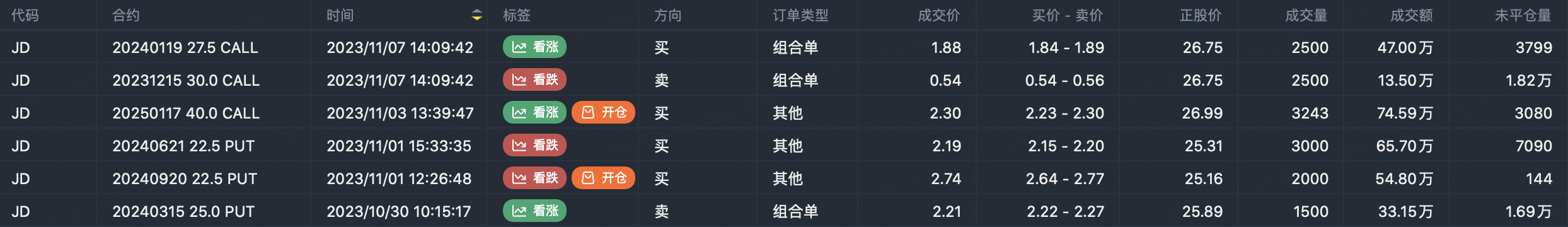

options active

At present, Jingdong's stock price is in the bottom range, and option orders show that institutions have different views on the trend of Jingdong's stock price:

Option strategy

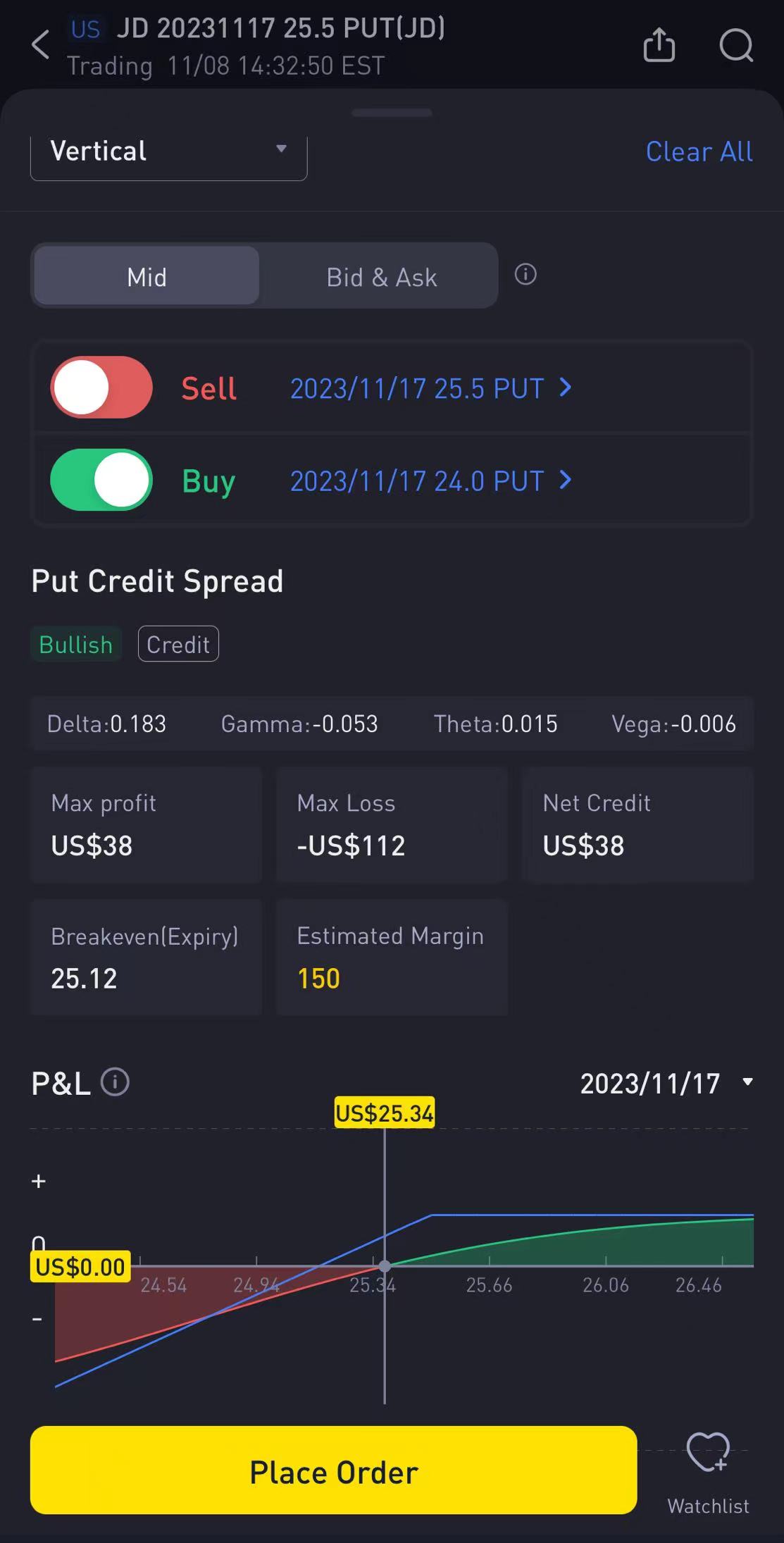

According to Figure 1 pre-earnings share price performance, the strategy with the highest current win rate is the bull put spread strategy:

According to the calculation of the combination option computer on November 17, when the stock price of Jingdong is more than 25.12, the profit will be $38, and the total margin of the strategy will only be $150.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?