Options Spy | Options orders suggest that Nvidia will gain more than 10%

With the Thanksgiving holiday approaching, US stocks edged higher in thin trading on Monday morning.

The market awaits the minutes of the latest Federal Reserve meeting and Nvidia's earnings report, and Nvidia shares hit a record high. Despite OpenAI's infighting, Microsoft quickly recruited Altman, the father of ChatGPT, sending its stock to new highs. Retailers Best Buy and Kohl's were all lower ahead of the results.

U.S. stocks jumped in late trading after a $16 billion auction of 20-year Treasury notes saw strong demand, boosting sentiment further and sending the 10-year note's interest rate plunging to 4.4 percent.

With so much focus on what the Fed will do next with interest rates, the minutes of the Oct. 31-Nov. 11 meeting are remarkable. Markets are almost fully pricing in the possibility that the Fed will leave rates unchanged in December, with a rate cut increasingly likely next summer.

Richmond Fed President Thomas Barkin said on Monday he still needs to be convinced that inflation is slowing, but the Fed's job of reducing inflation is not done and must stay the course to see results. This is not a great time to give forward guidance on interest rates.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Special commend: How to achieve an 8%* annualized yield on your Tiger Vault Fund?

FANNG option active

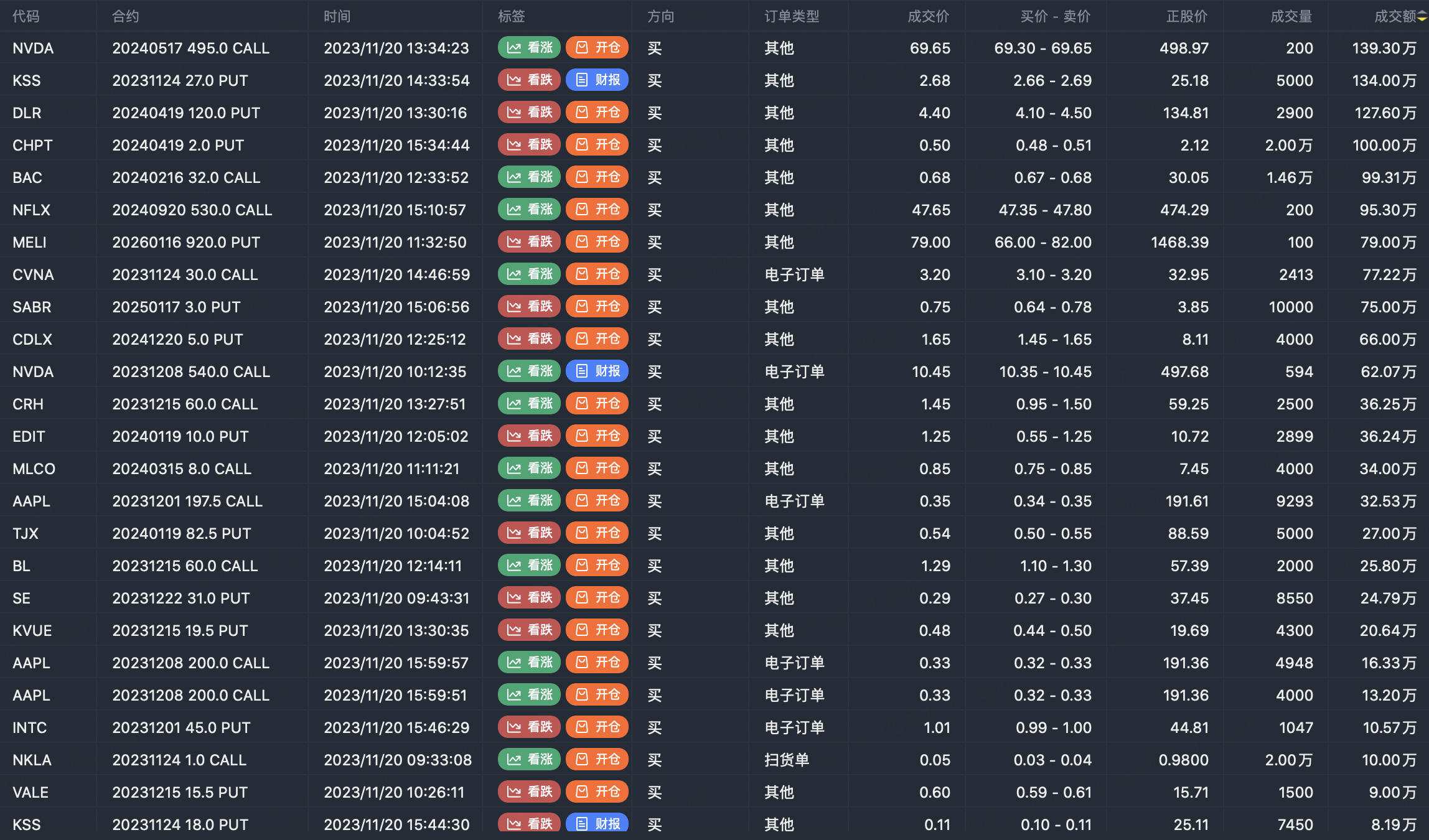

$NVIDIA Corp(NVDA)$ Buy call option order $NVDA 20231208 540.0 CALL$ $NVDA 20240517 495.0 CALL$ . The option break-even level implies a 10% + gain for Nvidia shares this week.

$Apple(AAPL)$ Buy call option order $AAPL 20231208 200.0 CALL$

Option buyer open position (Single leg)

Buy TOP T/O:

$NVDA 20240517 495.0 CALL$ $KSS 20231124 27.0 PUT$

Buy TOP Vol:

$CHPT 20240419 2.0 PUT$ $NKLA 20231124 1.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$CVX 20231215 165.0 PUT$ $MS 20240216 87.5 CALL$

Sell TOP Vol:

$MS 20240216 87.5 CALL$ $WBD 20231229 9.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

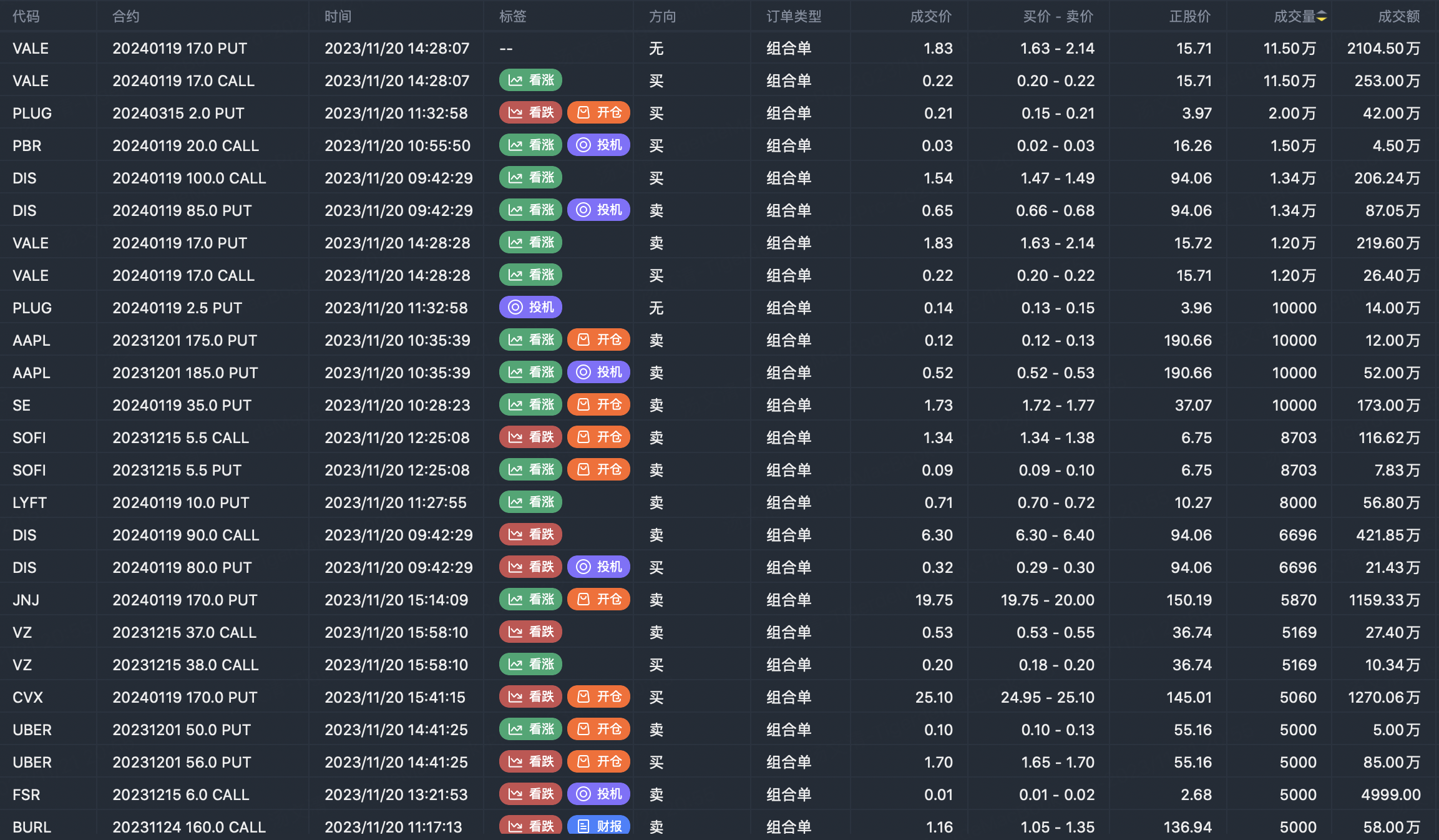

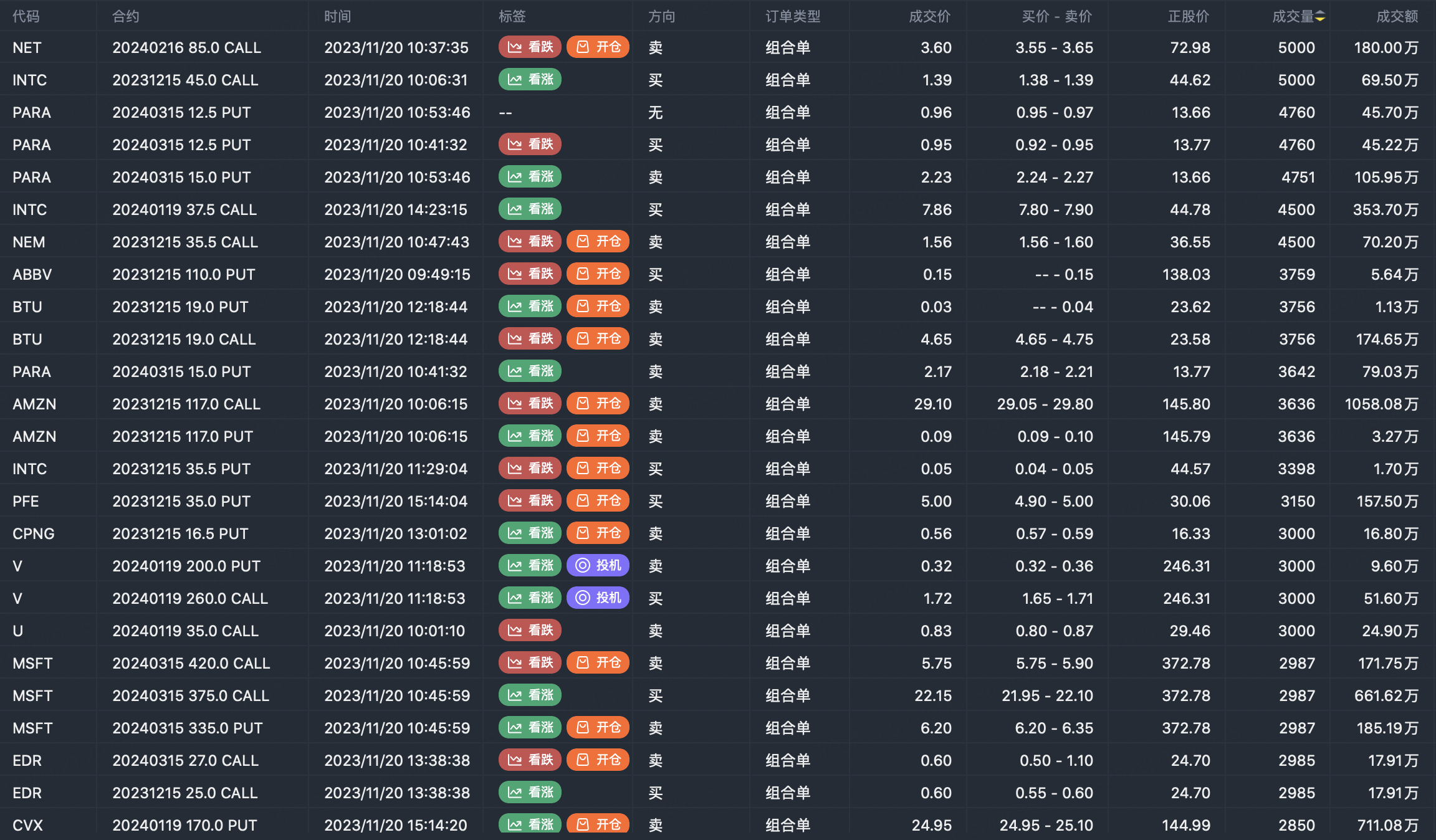

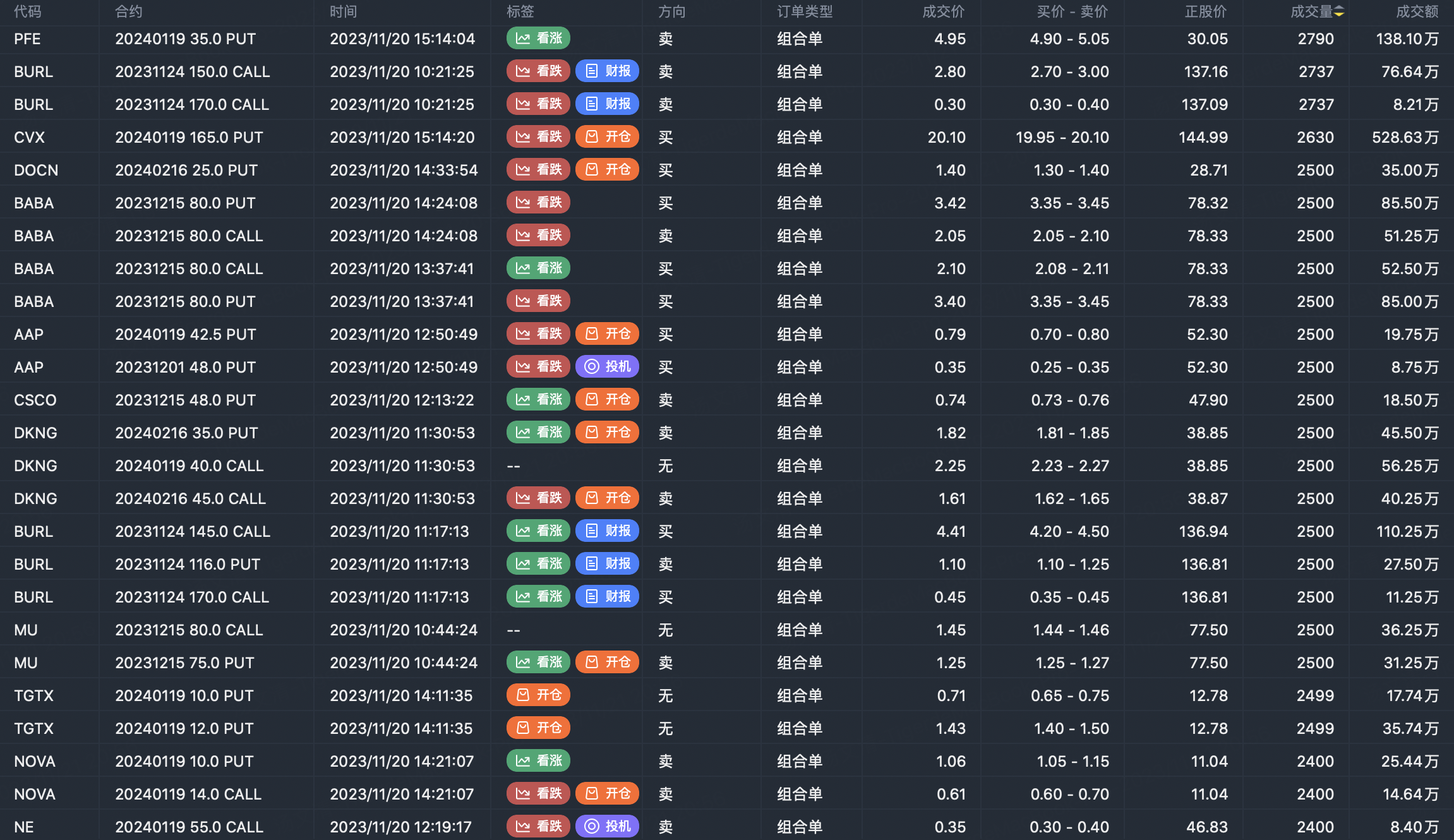

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Your analysis about Nvidia, OpenAI, Apple, CHPT, CVX and MS is serous and comprehensive. The graph you gave is also quit clear and helpful.