How About Alaska Airlines Acquisition of Hawaii Airlines?

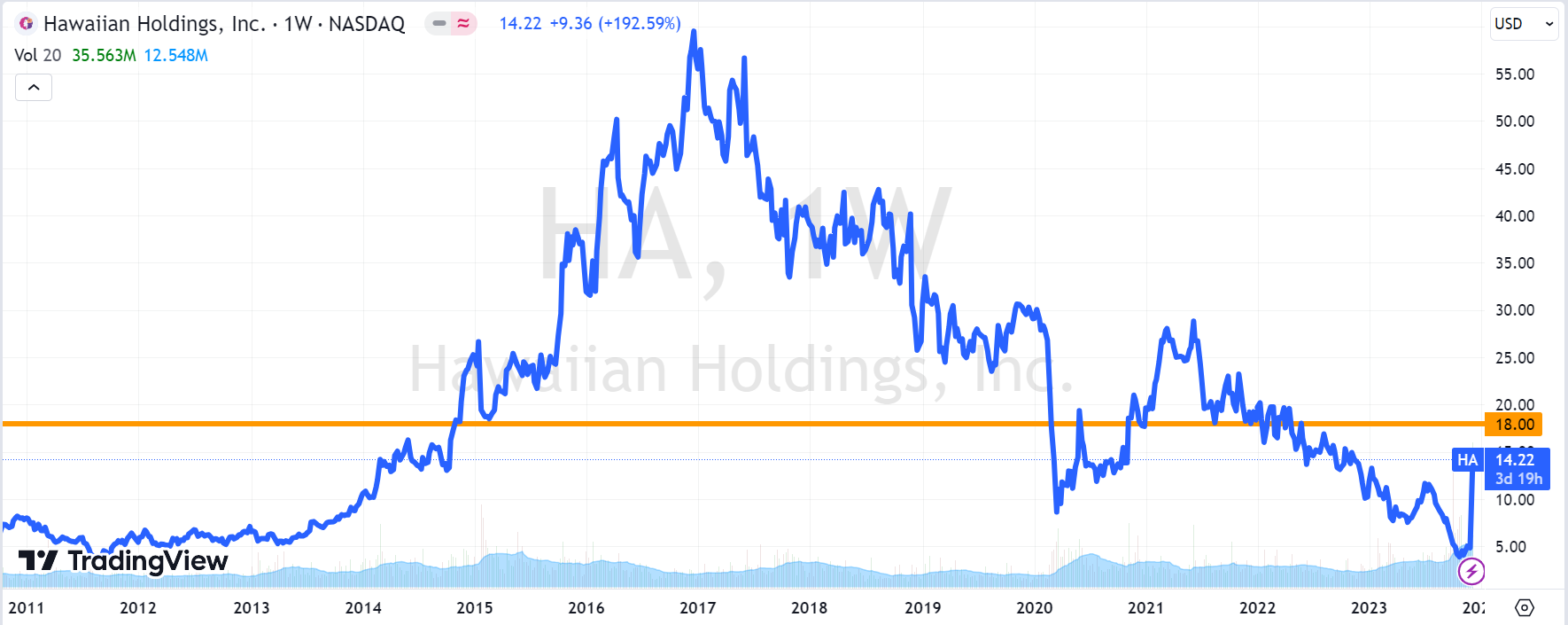

When $Alaska Air(ALK)$ announced its agreement to acquire $Hawaiian(HA)$ on Sunday, HA's stock price was only a little over $4 because it had been cut in half this year. The acquisition price was $18, so when the market opened on Monday, the stock price jumped to around $14. It closed at $14.25, with a premium of 26%.

This premium is not high for a company that has just received a tender offer, as the cases of $Spirit Airlines(SAVE)$ and $JetBlue Airways(JBLU)$ have been pending for a long time (mainly due to regulatory issues).

This also indicates that investors believe there is not much regulatory risk in the ALK and HA case.

Pros

1. Both companies are regional airlines and do not have much international business (mainly in Canada and Mexico), so they do not require approval from other countries' regulators.

2. After the merger, they will still be regional airlines. Although they are the fifth-largest airline in the United States, the impact of industry concentration should not be too difficult to pass through regulatory approval.

3. Both are regional airlines with strong complementarity, and it is said that the synergy effect can reach over $2 billion.

Cons

1. HA has high debt and low operating efficiency. Therefore, if the acquisition fails, the actual value of HA will be relatively low and may experience a significant decline.

2. In more than half of the past 10 years, HA's stock price has been higher than $18. If the major shareholders' cost of holding the stock is higher than $18, there is a possibility of shareholder opposition.

Therefore, shareholder voting may be the biggest obstacle in this case.

Currently, a 26% premium to the uncertainties and an unclear timeline are really not much.

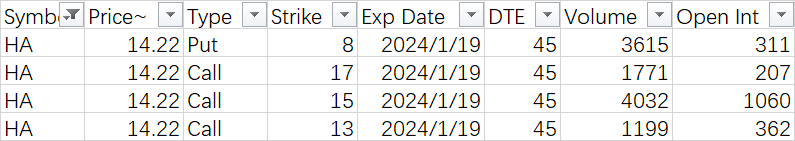

Looking at the abnormal options on December 4th, there are also many open positions for calls at $15. It is unlikely that it can be resolved through legal means or even have enough time for shareholders to reach a consensus within a month. Apart from some speculators taking small bets, it means that investors holding covered positions believe that the stock price will not exceed $15 in a month.

Therefore, I would think that until new information comes out, the fluctuation range will not be significant in this case, and trading volatility is a good choice.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

This increase makes me very happy hahaha

HA’s stock price performance is really exaggerated

Keep going up, 20 is not going at all

I didn't expect it to go up so much

Is now a good time to buy HA?