Why investors feel indifferent about AVGO Q4 Earnings

$Broadcom(AVGO)$ fell about 3% in after-hours trading on Thursday, just after announcing its Q4 earnings following the completion of its acquisition of $VMware(VMW)$ . Although the earnings exceeded expectations and the guidance for the next fiscal year was strong, there was no upward momentum.

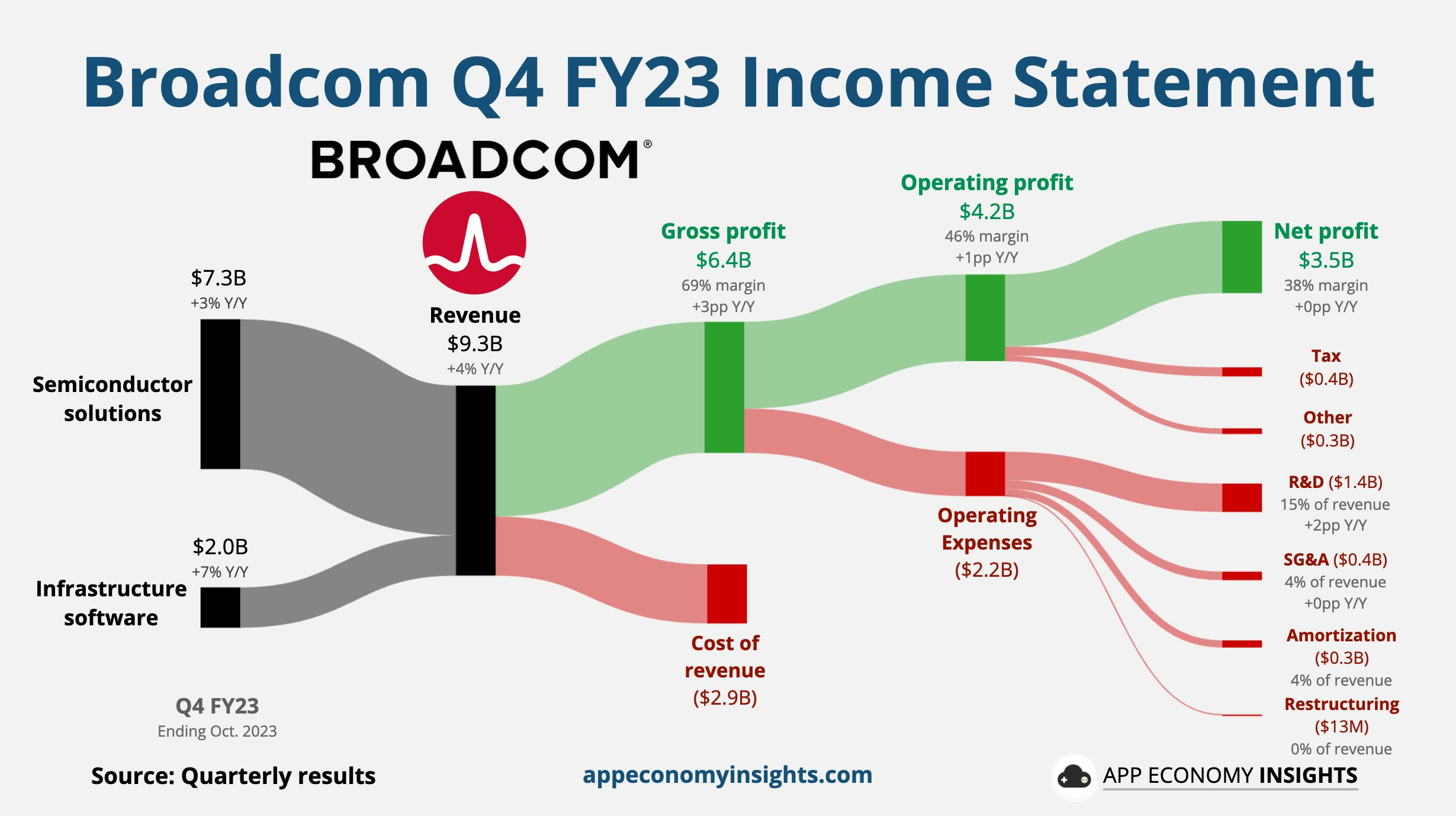

In terms of Q4 earnings, total revenue was $9.3 billion, higher than the market's expected $9.28 billion. Semiconductor solutions revenue was $7.33 billion, higher than the expected $7.27 billion, a year-on-year increase of 3%. Infrastructure software reached $1.97 billion, a 7% increase from the previous year. Operating activities generated $4.82 billion in cash, with capital expenditures of approximately $105 million. The quarterly dividend increased by 14% to $5.25 per share. Free cash flow reached $4.72 billion, accounting for approximately 51% of the revenue.

Regarding the guidance for the 2024 fiscal year, the company expects revenue to reach approximately $50 billion, with semiconductor revenue growing at a high single-digit rate, partly benefiting from the recent acquisition of VMware. Previously, market expectations for revenue excluding VMW were $39.17 billion. The adjusted EBITDA profit margin may reach 60%. The annual dividend for common stock in the 2024 fiscal year was also raised to $21.

The lukewarm after-hours market reaction is mainly due to the inclusion of VMW lowering the surprise of the revenue guidance exceeding expectations. Additionally, some investors have expressed doubts about the synergies brought by VMW.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

The acquisition of VMWARE was completely beyond my expectations

Don't worry, Broadcom will rise eventually

It seems that no one approves of this acquisition.

This income situation is still very good

A dip is an opportunity to buy Broadcom