BIG TECH WEEKLY | Does MSFT tops AAPL mean a bear market??

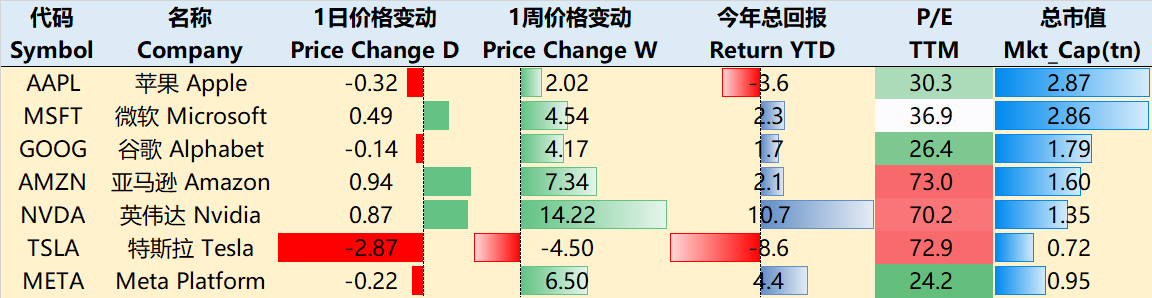

Big-Tech’s Performance

After a pullback in the first week of 2024, tech stocks rebound again, big-techs taking capital inflows. Unexpected CPI receded the previous market aggressive pricing for rate cuts, but still a "soft landing"consensus.

In addition, the approval of the Bitcoin ETFs has also added to the market's risk appetite.

As of the close on January 11th, the best-performing large tech companies in the past week were $NVIDIA Corp(NVDA)$ +14.22% (up for two consecutive weeks), followed by $Amazon.com(AMZN)$ +7.34%, $Meta Platforms, Inc.(META)$ +6.5%, $Microsoft(MSFT)$ +4.54%, $Alphabet(GOOGL)$ +4.17%, $Apple(AAPL)$ +2.02%, and $Tesla Motors(TSLA)$ -4.5% (down for two consecutive weeks).

Big-Tech’s Key Strategy

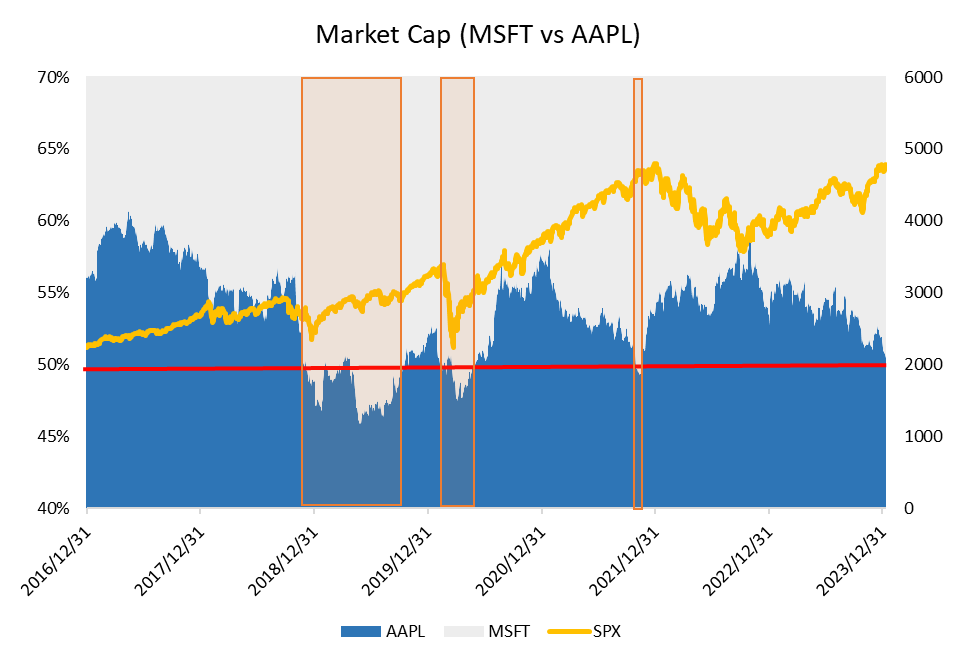

What does Microsoft tops Apple’s market value to mean?

Over the past 10 years, Apple has not always been the world's largest company by market value. There have been three times when it was surpassed by Microsoft, lasting nearly 11 months from December 2018 to October 2019, nearly 4 months from February to May 2020, and less than a month in November 2021.

Interestingly

1. Apple's Beta is greater than Microsoft's, with a five-year adjusted β=1.07:0.97. This means that as long as it's a bull market, Microsoft is basically impossible to surpass Apple, only showing "more resilience" during a downturn.

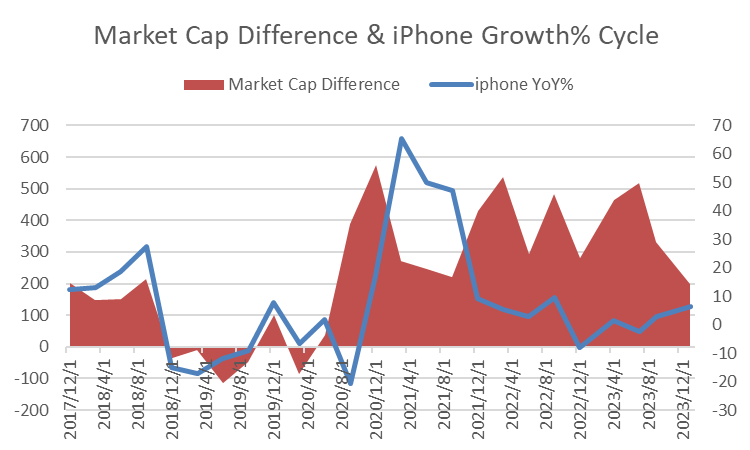

2. The pullback of AAPL is "more important" than that of MSFT, reflecting the 10-year cycle of iPhone sales.

What's different in 2024 from previous situations is that MSFT is leveraging AI (although Microsoft's own monetization capabilities are not the strongest), and Apple has also adjusted its strategy to reduce the reliance on iPhone, For example, it has opened up service revenue, launched VR products, and even expects to exit AIGC products this year. However, this still does not prevent analysts from lowering their target price.

Big-Tech Weekly Options Watch

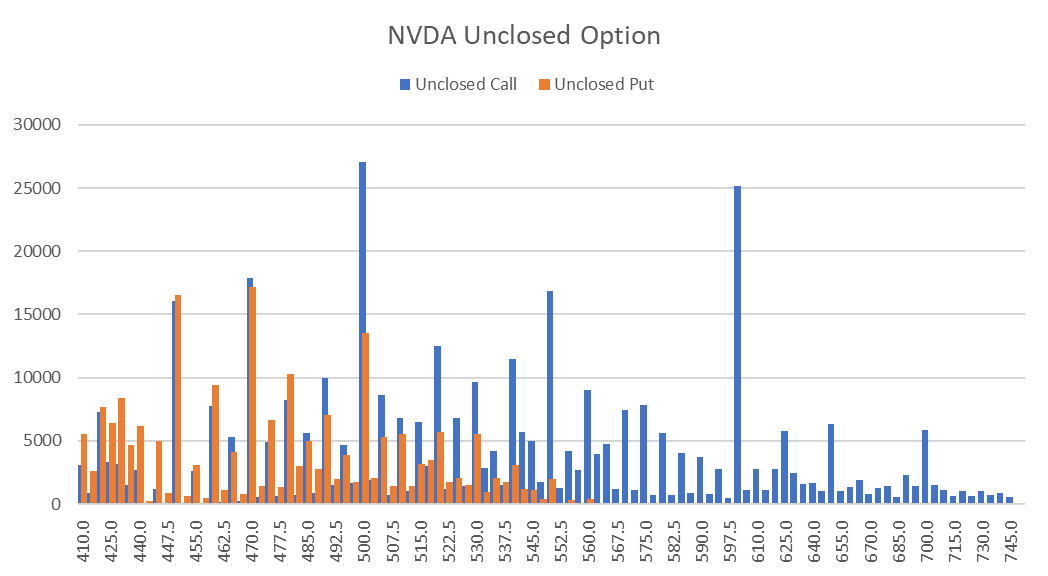

The two most prominent "eye-catching packages" among the top seven tech giants this week—NVDA rose the most, while TSLA fell the most.

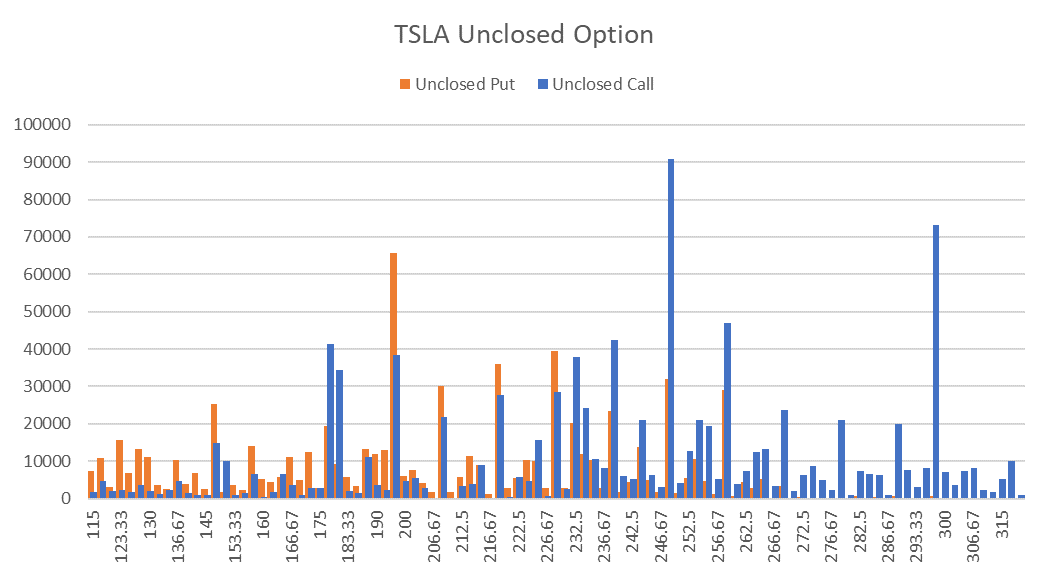

From the perspective of uncovered Call and Put options, NVDA's Call is clearly right-skewed, with a median around 540; TSLA's Call is left-skewed, with a median around 250.

The Puts are close to normal, with NVDA's Put centered around 470 and TSLA's around 200.

Big-Tech Portfolio

tech portfolio outperforming the market again.

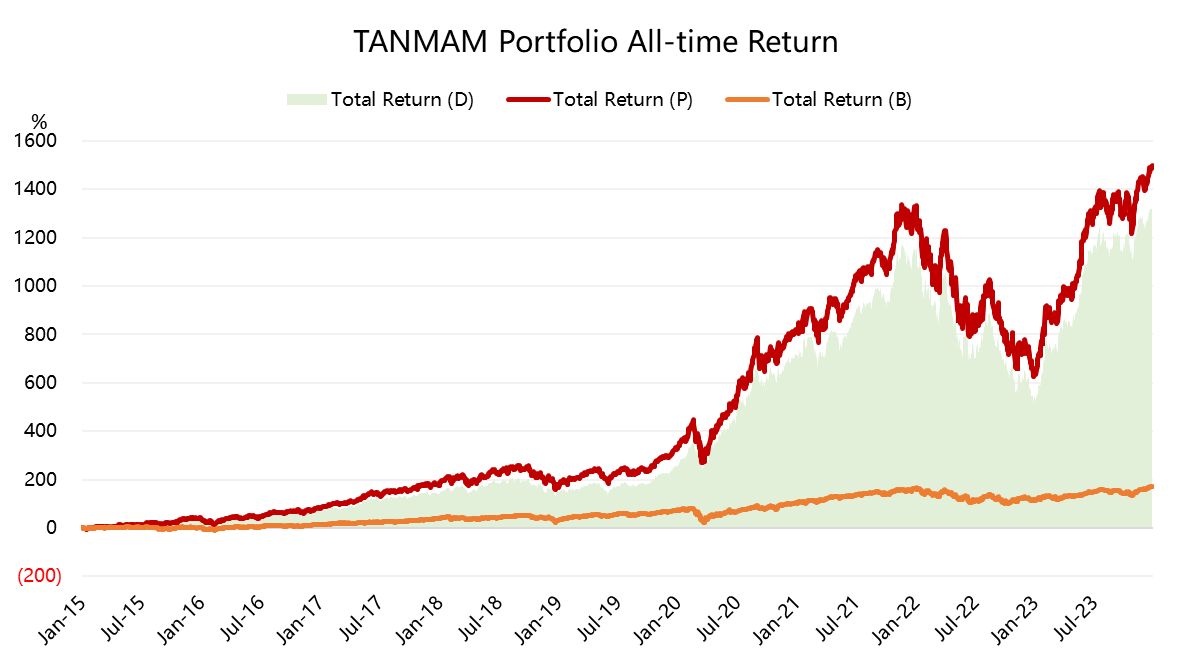

Combining the "Magnificent Seven" into an investment portfolio ("TANMAMG" portfolio), with equal weights and quarterly rebalancing. The backtesting results since 2015 have far outperformed the S&P 500, with a total return of 1501% compared to 172.6% for the same period for the $SPDR S&P 500 ETF Trust(SPY)$ , reaching a new high.

The return so far this year is 1.24%, surpassing SPY's 0.22%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.