BIG TECH WEEKLY | NVDA Greed or Fear?

Big-Tech’s Performance

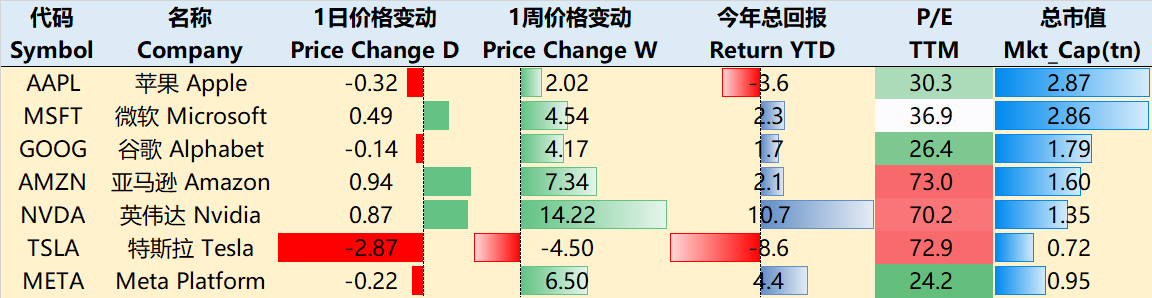

Despite cautionary statements from Federal Reserve officials about being overly optimistic about interest rate cuts, relatively positive data continues to boost overall risk appetite. The rebound in heavyweight stock Apple and the strong performance of semiconductor companies have helped propel the market to new highs.

As of the close on January 18th, the best-performing major tech companies over the past week were Nvidia +5.07% (top for two consecutive weeks), followed by Microsoft (MSFT) +2.90%, Meta Platforms (META) +1.53%, Apple (AAPL) +1.31%, Google (GOOGL) +0.84%, Amazon (AMZN) -0.15%, and Tesla (TSLA) -9.43% (bottom for two consecutive weeks).

Big-Tech’s Key Strategy

Is Nvidia expensive? (Greed or Fear?)

Since the official launch of the MI300 accelerator in early December last year, $Advanced Micro Devices(AMD)$ stock price has reached new highs, and Thursday's financial report from $Taiwan Semiconductor Manufacturing(TSM)$ also showed strong demand in the chip industry, especially with a complete shortage in 3nm chips.

The biggest beneficiary of AI-driven chip demand is still Nvidia, with the market expecting its data center division's revenue to exceed $90 billion by 2024, expanding its market share. This growth rate has become the strongest support for its valuation.

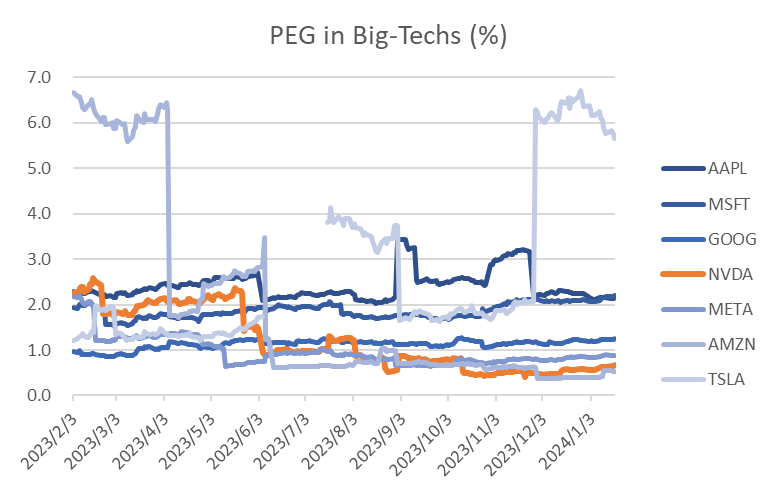

Currently, the main reason for fear of Nvidia's high stock price is concern about its "pricing power." Although tech companies only need to train models once, if competitors gradually catch up, the market will become sensitive to chip prices, leading to price elasticity effects, as tech companies may purchase chips based on budgets rather than quantity.

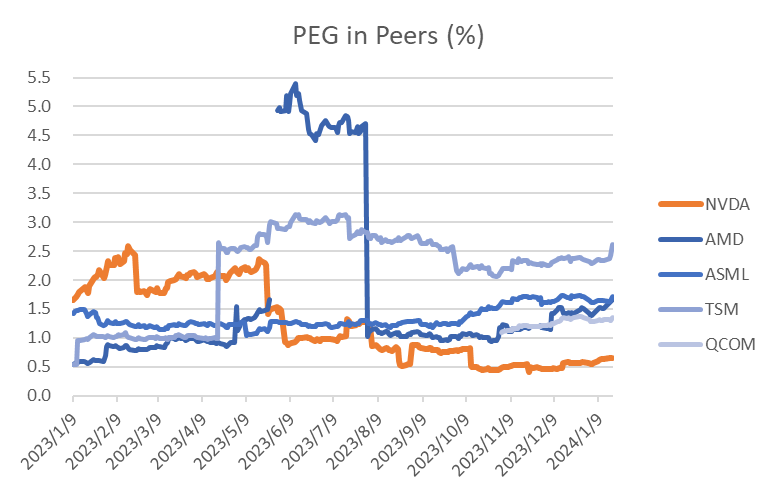

Of course, the reason for investors' greed is more clear, based on valuation levels from a growth perspective. Nvidia is even one of the lowest among its peers and among big-techs.

Big-Tech Weekly Options Watch

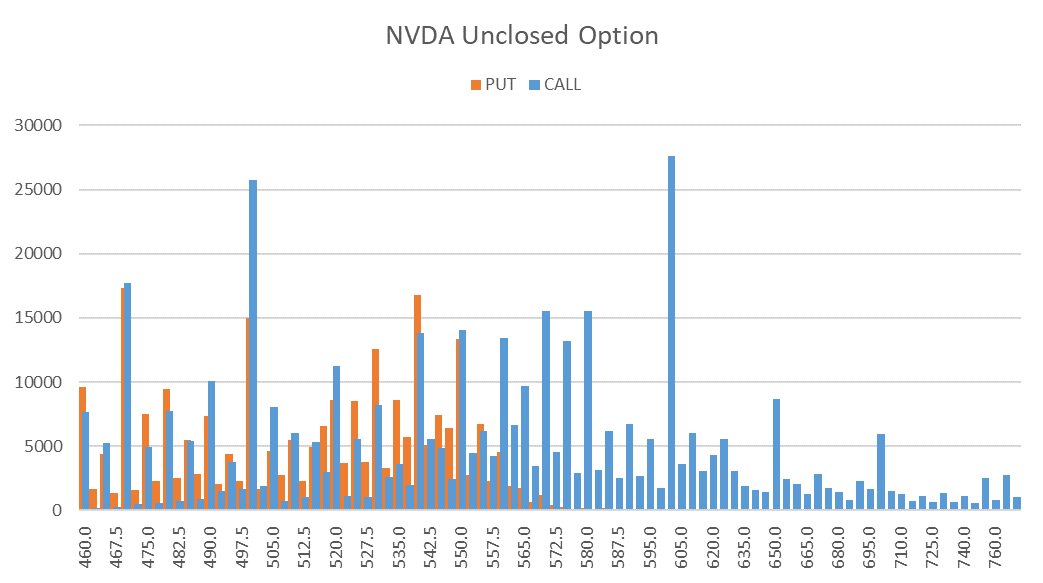

NVDA saw the largest increase in stock price, with an increase in options trading volume.

The open interest for Call options at various strike prices has also risen, indicating optimistic market sentiment. Looking at the open interest for both Call and Put options, the median of open interest for expiring NVDA Call options this week is around 580, with a significant amount of open interest at the 600 strike price.

The open interest for Put options has shifted closer to a normal distribution, with the center moving up to 540.

Big-Tech Portfolio

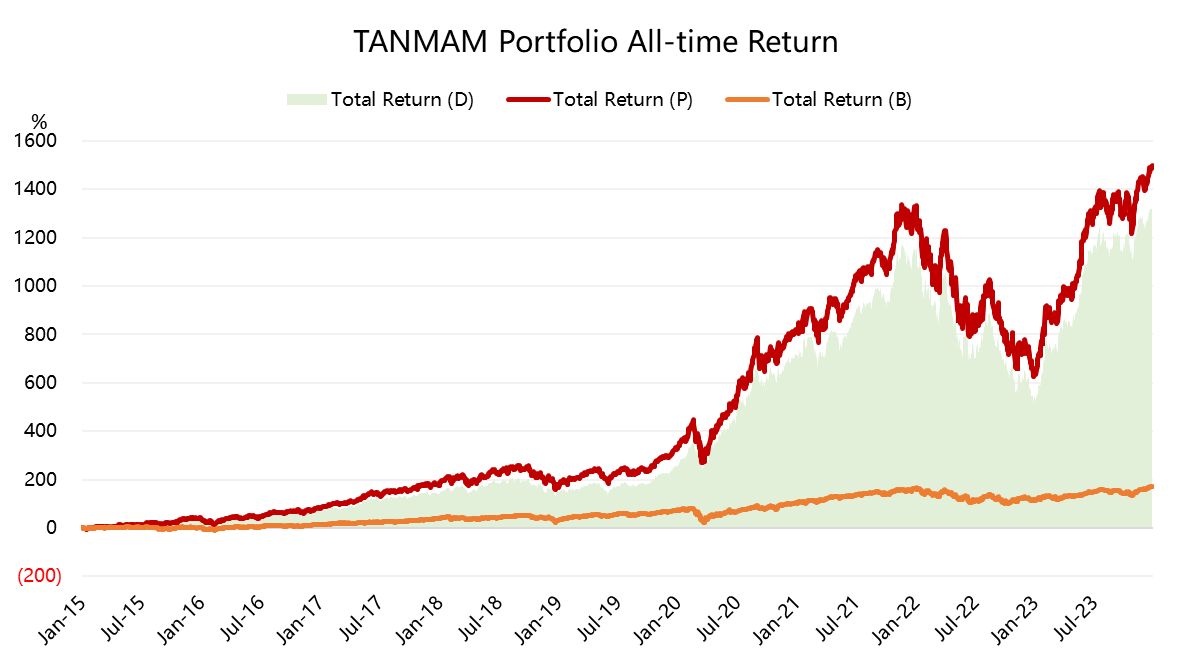

tech portfolio outperforming the market again.

Combining the "Magnificent Seven" into an investment portfolio ("TANMAMG" portfolio), with equal weights and quarterly rebalancing. The backtesting results since 2015 have far outperformed the S&P 500, with a total return of 1501% compared to 172.6% for the same period for the $SPDR S&P 500 ETF Trust(SPY)$ , reaching a new high.

YTD return so far this year is 1.24%, surpassing SPY's 0.22%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- tothehill·2024-01-25Fear is so last season. Bring on the greed! 💸LikeReport

- meurasian77·2024-01-20could be a bull trap [Great]1Report

- Choo CH·2024-01-20Good article. Makes for pondering...1Report

- Gloria112·2024-01-25👍 Informative analysis! 👏LikeReport