Expedia: Well-Positioned For Growth Amid Online Travel Boom

Summary

- Expedia’s stock has shown strong momentum over the last 12 months, with major tailwinds blowing in its favor.

- The IATA expects passenger travel to hit an all-time high in 2024, while researchers project the online travel market to grow to $1.56 trillion by 2030, a CAGR of nearly 13%.

- Expedia is making solid headway in the fast-growing Asia-Pacific region led by the B2B China segment, which grew 150% YoY in Q3.

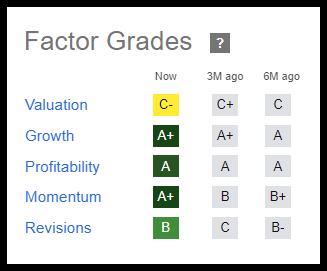

- Strong momentum, profitability, and growth have Expedia among Seeking Alpha’s top Quant-rated stocks in the Hotels, Resorts, and Cruise Lines industry.

- Although Booking Holdings is my number one stock pick for 2024, Expedia offers strong upside potential in a massive industry and could be trading at a relative discount based on key metrics like PEG Forward ratio.

HAKINMHAN

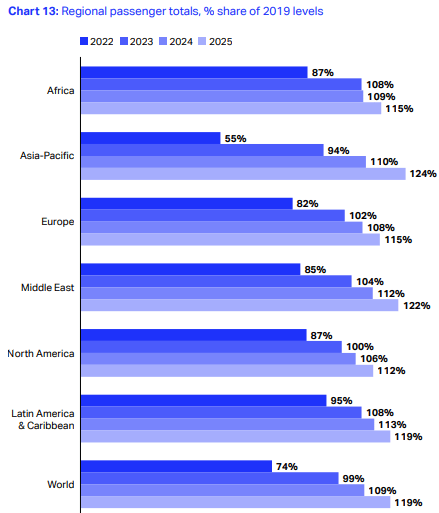

The easing of pandemic restrictions unleashed pent-up travel demand in 2023, and 2024 could be another banner year with airlines projected to hit record traffic and revenue. According to the IATA, nearly 4.7 billion people are projected to travel in 2024, a record high surpassing the 2019 pre-pandemic level of 4.5 billion. Global passenger totals in 2023 reached 110% of 2019 levels and could hit 120% by 2025, driven by explosive growth in the Asia-Pacific region.

IATA Passenger Growth Forecast by Region

IATA Passenger Growth Forecast by Region (IATA Global Outlook for Air Transport)

The online travel industry is projected to grow to $1.56T by 2030, a CAGR of almost 13%, according to a study by Research and Markets, a favorable trend offering a great opportunity for my stock pick, Expedia Group, Inc.

Expedia Group, Inc. Stock

Market Capitalization: $20.68B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 1/19/2024): 37 out of 527

Quant Industry Ranking (as of 1/19/2024): 5 out of 38

The travel trend allows investors to invest in a highly profitable and fast-growing industry titan, Expedia Group, Inc. (NASDAQ:EXPE), among the top picks on Seeking Alpha’s Quant-Rated Hotel, Resort, and Cruise stocks list. Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. Expedia Factor Grades include A’s in growth, profitability, and momentum, a B in consensus revisions, and a C- in valuation, with an overall Quant Rating of 4.59.

EXPE Stock Factor Grades (SA Premium)

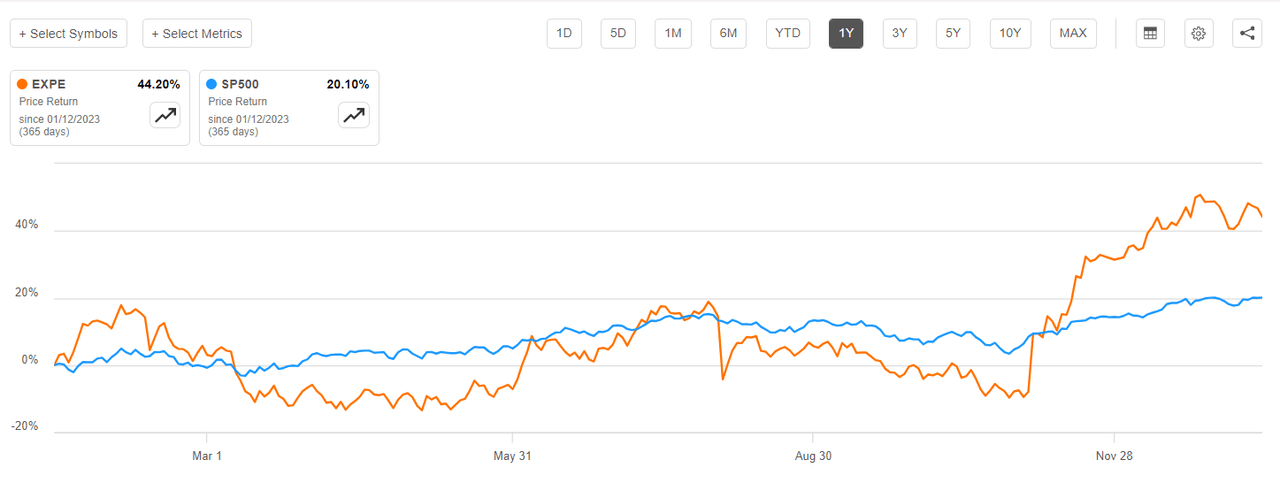

Expedia has crushed the S&P 500, up over 40% in the past year, despite falling 13% in a single day in August after missing Q2 gross bookings expectations. The stock soared in November on positive Q3 earnings and news that activist investor ValueAct Capital Management accumulated a stake.

EXPE Stock vs S&P 500 (1yr) (SA Premium)

The stock offers solid upside potential if profit margins grow due to operational and technological improvements. As consumer behaviors change and incorporate generative AI tools, the evolving travel trends of 2024 could lead to greater growth and profitability.

Growth & Profitability

Expedia booked a record-high Q3 revenue of $3.9 billion, a 9% year-over-year increase, and EPS of $5.41, beat by $0.41. The online travel company reported adjusted EBITDA growth of 13% to $1.22B vs. $1.15B consensus. B2B business grew 26%, including bookings from China partners, up over 150% year-on-year.

In 2021, Expedia began migrating its core retail brands, Expedia, Hotels.com, and VRBO, onto a unified technology front-end infrastructure to increase operating efficiencies. New partnerships that include a loyalty program with Mastercard and customer collaboration with SoFi highlight Expedia’s desire to expand. Following strong B2B revenue growth in 2023 and new tech features for optimizing customer travel experiences, Expedia CEO Peter Kern said in the Q3 conference call that the launch of the VRBO app marks the last major migration associated with its multi-year transformation strategy. Instead of spending money on doing “surgery,” Kern added, Expedia will focus on growth, innovation and efficiency.

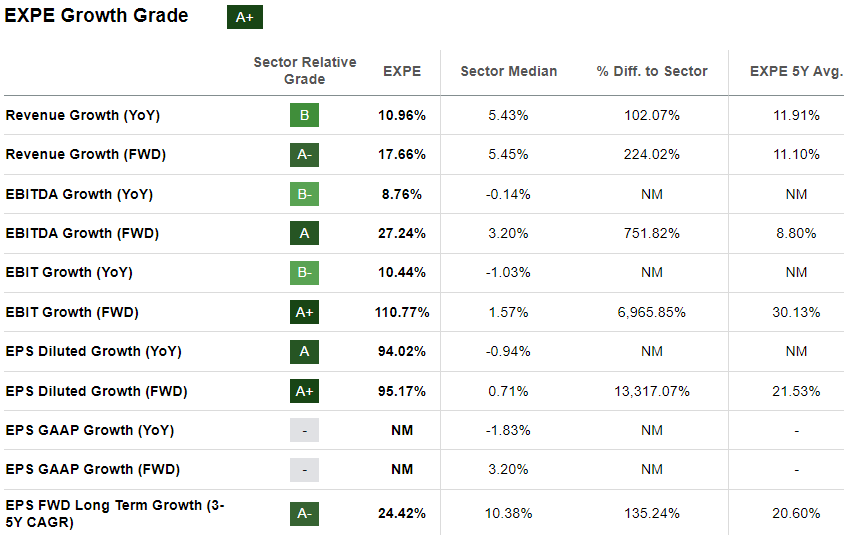

Expedia has secured an overall A+ Growth Grade with strong underlying forward sales and profit metrics. Revenue growth FWD is approximately 17%, EBITDA 27%, and EBIT 110%, all significantly above the sector median.

EXPE Stock Growth Grades (SA Premium)

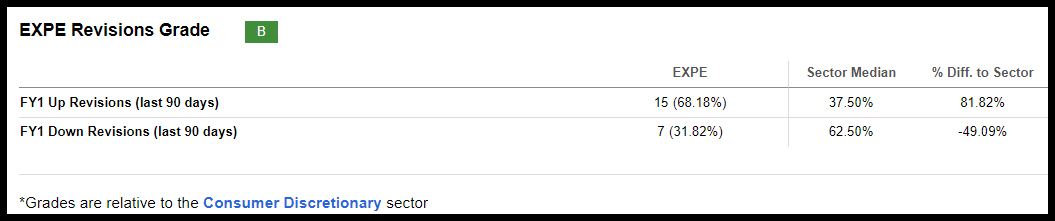

Another encouraging sign is that more than 60% of consensus earnings revisions have favored Expedia over the past 90 days.

EXPE Revisions Grade (SA Premium)

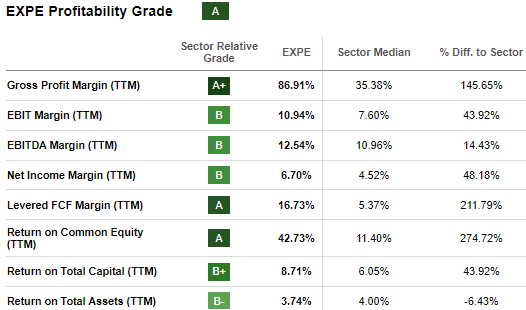

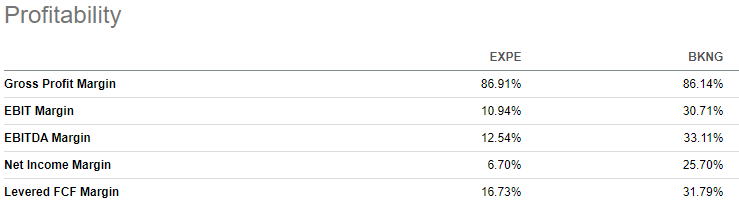

Compared to the sector median, Expedia’s margins look solid, especially its levered FCF margin of almost 17% and ROE of 42%, driving its Profitability Grade.

EXPE Profitability Grade (SA Premium)

Valuation

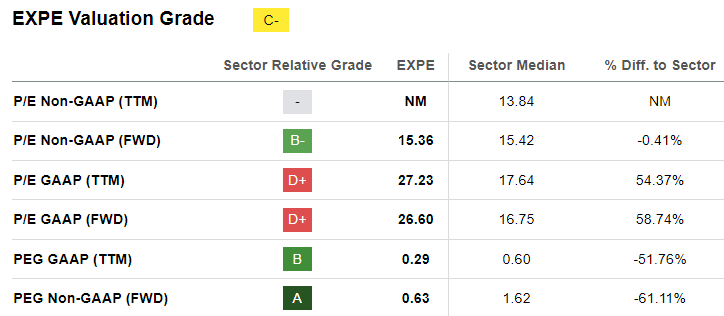

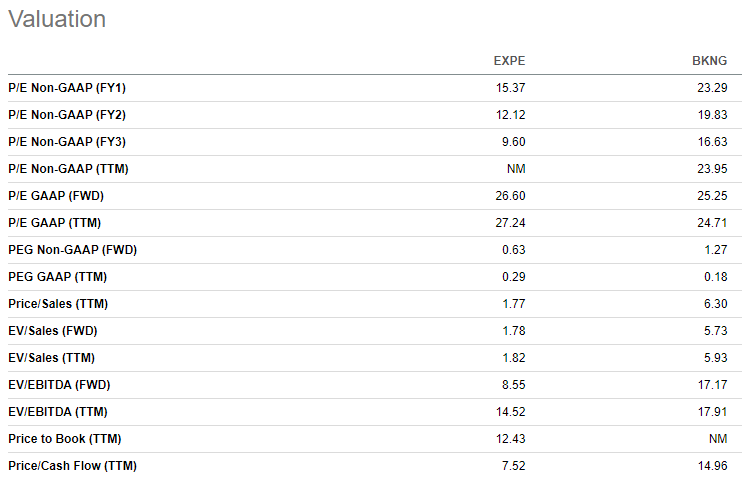

Although Expedia’s Valuation Factor Grade is a C-, the company secures a solid score for the critical PEG ratio, which measures price/earnings but factors in growth. Expedia’s PEG forward is about 60% below the sector median.

EXPE Stock Valuation Grade (SA Premium)

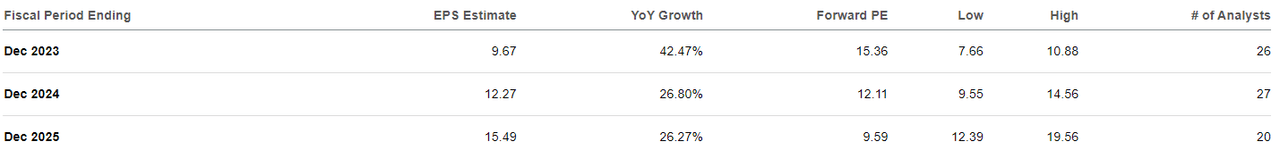

The long-term Forward P/E ratio is also important. The consensus estimate has EPS growing about 60% by 2025 and forward P/E falling to around 9.5.

EXPE Stock Consensus Estimates (SA Premium)

Although the online travel giant does not pay a dividend, Expedia announced a $5 billion buyback plan, which comes on top of the record $1.8 billion worth of shares the company has repurchased year-to-date and possesses many of the attractive qualities of its rival and my #1 stock pick for 2024.

Expedia vs. Booking

My number one stock pick for 2024 is Booking Holdings (BKNG), another online travel agency with similar service offerings as Expedia. Like Expedia, Booking has robust fundamentals relative to the sector, as reflected in its high profitability and growth factor grades. Both companies are well-positioned to exploit the favorable industry trends, including solo travel, blending business and leisure, and seeking unique destinations and experiences globally. I believe Booking and Expedia exhibit characteristics that make them attractive potential investments. However, there are some qualitative and quantitative differences related to company size, margins, growth, and valuation.

Booking Holdings is the global online travel market leader, with a wider geographic presence than Expedia Group. BKNG also has a broader offering with the restaurant-only reservation site OpenTable™, versus Expedia, which focuses on three core business segments.

EXPE Stock Profitability Metrics (SA Premium)

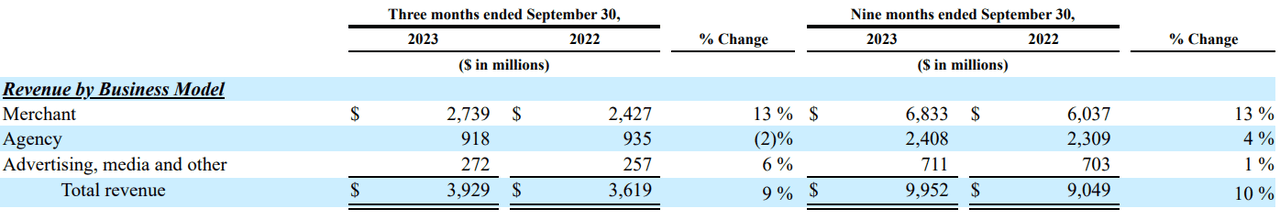

Booking is driven by wider profit and FCF margins, and one of the drivers behind the gap is that Expedia relies more heavily on the lower-margin merchant business model. In the merchant model, the customer pays the online travel agency (OTA), who then pays the service providers, thereby incurring additional expenses. In the agency model, the customer pays the service providers, and the OTA gets a commission. In Q3, roughly 70% of Expedia's revenue ($2.739 of $3.929B) derived from the merchant model. Booking, in contrast, only drew about 54% of revenue ($3.945B of $7.341B) via the merchant business model.

EXPE Stock Revenue Business Model (Expedia Q323 10-Q SEC Filing)

Expedia could also potentially boost cash flow if the major initiatives and “surgery” are truly behind them. As mentioned earlier, Expedia EPS is projected by Wall Street Analysts to grow 60% from 2023 to 2025. In contrast, consensus estimates put Booking EPS growth at 40% - from $150.43 to $210.68 - during the same period. Expedia also might be trading at more of a discount than Booking based on a range of key metrics, including P/E, EV/Sales, EV/EBITDA, and PEG FWD. Booking’s price/cash flow ratio is almost 2x higher than Expedia’s. Although Expedia’s price/book ratio is about 3x-4x higher than the sector median, Booking has negative shareholder equity.

Expedia vs Booking Holdings Valuations (SA Premium)

Risks

Expedia faces intense competition in the evolving online travel agency industry, especially from market leader Booking Holdings. If Expedia fails to close the profit margin gap, Booking may use the edge to invest in expanding offerings, enhancing the platform, and boosting its competitive advantage. In addition to the threat of losing market share to Booking and online travel agencies like Airbnb (ABNB) and Trip.com (TRIP), Expedia also faces competition from Google and other search engines.

Global, regional, or national crises such as conflicts, pandemics, and natural disasters could adversely impact travel and tourism demand. In addition, recessions and interest rate movements, along with other macroeconomic factors, could adversely impact Expedia’s bottom line. As an international company, Expedia is also exposed to currency risks and could be impacted by unfavorable exchange rate fluctuations.

Expedia’s business relies heavily on technology and internet applications accessed by millions of users daily. Expedia also must protect sensitive customer payment data. Expedia faces persistent risk of cybersecurity-related attacks that could compromise data and disrupt business flow.

Expedia’s 222% debt/shareholder equity ratio is high and has grown over the past five years. Too high a leverage could heighten financial risk, reduce cash flows due to debt payments, and lead to unstable earnings. However, Expedia has significant cash, a low net debt/EBITDA ratio, and sufficient operating profits to cover debt payments.

Concluding Remarks

I believe Expedia is poised to benefit from the expected global boom in travel, especially within the Asia Pacific region. The company continues to post quality financial results, including a record high in revenue in Q3. Expedia’s B2B business grew 26% in the third quarter, with bookings from China partners up over 150% YoY. Over the trailing twelve months, revenue is up 10%, and EBITDA rose 13%.

Underlying growth forward metrics reveal Expedia is likely to grow even faster. Expedia has secured high factor grades in every quant category, including momentum, profitability, and valuation. Despite the stock price soaring 60% in the past year, there is still solid upside potential, which is why Expedia is near the top of Seeking Alpha’s list of Quant-Rated Hotel, Resort, and Cruise stocks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.