Booking Holdings: My #1 Stock Pick For 2024

Summary

- Showcasing five consecutive top-and-bottom-line earnings beats, I’ve selected a market-leading Consumer Discretionary stock for the New Year, with gross bookings of $40B in Q3 2023.

- Seeking Alpha’s Quant Ratings and Factor Grades highlight company fundamentals and whether a stock is strong or weak on key investment metrics.

- In 2024, consider a top Quant-ranked Consumer Discretionary with a diversified portfolio of companies. This stock benefits from strong brand recognition and offers growth, upward analysts’ revisions, and profitability that outpaces its sector.

- In 2023, I chose SMCI as my top stock pick when it was trading at $81 per share. It has since soared an impressive 294%, trading over $318!

2d illustrations and photos

I’m selecting a high-quality global stock with tremendous growth and profitability prospects in the New Year. My #1 Stock Pick for 2024 is the world’s leading online travel booking provider in terms of revenue, offering exceptional brand recognition and a diversified portfolio of companies. Booking management promotes that their portfolio of companies employs some of the most innovative technologies. Launching its AI Trip Planner, Booking integrates the travel planning experience using a travel Chatbot and visual list of destinations. Booking CEO Glenn Fogel highlights,

“The recent developments with generative AI are accelerating the work we’ve been doing for years with machine learning to enhance and improve every aspect of the customer experience on our platform, whether it’s optimizing the right order to display a hotel’s photos to surfacing the most relevant reviews. Our new AI Trip Planner is simply the next step in our ongoing journey to explore how we can bring even more value, and hopefully enjoyment, to the entire trip planning process.”

Where travel and adventures make life richer, my #1 stock pick for 2024 can do the same in the new year!

While past performance does not guarantee future results, my #1 Stock Pick for 2023 and a Top 10 Performing Stock, Super Micro Computer (SMCI) continues to outperform. Up more than 294% since my pick on January 10, 2023, SMCI offered both value and growth.

Booking Holdings Inc. (NASDAQ:BKNG) Stock

Market Capitalization: $118.9B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 1/8/2024): 15 out of 530

Quant Industry Ranking (as of 1/8/2024): 3 out of 38

With an all-encompassing travel system, Booking Holdings, Inc. (BKNG) presents itself as the world’s leading online travel provider and offers a vast network of local partners spanning more than 220 countries and territories.

In addition to solid financials, Booking Holdings' emphasizes its customer service, continued investment in technology, and expansion into new countries and vacation rentals. Its user base is increasing. Strong leisure travel demand led to Booking’s surge in customer bookings of $40B for Q3 2023, a year-over-year increase of 24%.

“I'm encouraged by the strong results we are reporting today and by the strong leisure travel demand environment that we continue to see. In the third quarter, our traveler customers booked 276 million, or more than a quarter of a billion room nights, which was an increase of 15% year-over-year, and we had gross bookings of $40 billion, which was an increase of 24% year-over-year,” said CEO Glenn Fogel.

Tapping multiple travel segments, Booking’s six primary consumer-facing brands include:

Priceline

Agoda

KAYAK

OpenTable

In addition to these popular names, BKNG also operates a network of value subsidiaries like Cheapflights, Fareharbor, and Rocketmiles. With a strong and expanding presence in Europe and Asia-Pacific, I believe that Booking’s transportation, vacation rentals, restaurant bookings, and experiences are fully connecting customers to “all-inclusive” trip offerings saving customers time, just as more people look to mobile applications for booking for a seamless experience and responsive customer support. BKNG focuses on having highly competitive travel options and is growing organically while strengthening its network, in my view. BKNG maintains its dominant global position and showcases strong fundamentals, as highlighted in strong Factor Grades.

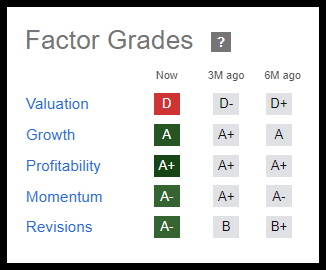

BKNG Stock Factor Grades

BKNG Stock Factor Grades (SA Premium)

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. BKNG Factor Grades include A’s in growth, profitability, momentum, and consensus earnings revisions, with an overall Quant Rating of 4.87. With an A+ for Profitability and an ‘A’ Growth Grade, BKNG is one of the most profitable companies in its sector.

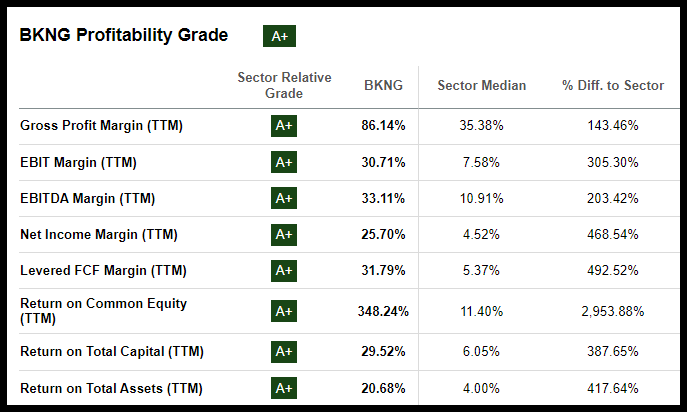

Profitability

BKNG has secured an A+ Profitability Factor Grade, highlighted by underlying metrics like a gross profit margin of 86%, which is 143% above the sector median. BKNG has delivered a gross profit margin of at least 80% over the last five quarters and 8 of the last ten.

BKNG Profitability Grades (SA Premium)

BKNG also beats the sector median soundly in operating margin, net income, return on total capital, and return on total assets. BKNG’s remarkable 348% return on equity is nearly 30x higher than the sector median of 11.4%. The high ROE and ROTC numbers (TTM) indicate the company is efficient and effectively deploying shareholder investments and capital. Booking has chosen to invest cash in growing the business and boosting margins instead of awarding dividends.

In the most recent quarter’s earnings results, BKNG’s EPS of $72.32 beat consensus estimates by $4.40, while revenue of $7.34B beat the target by $80M. BKNG has beaten EPS targets in 11 of the past 12 quarters, and its Q3 earnings beat was among the top upside EPS surprises.

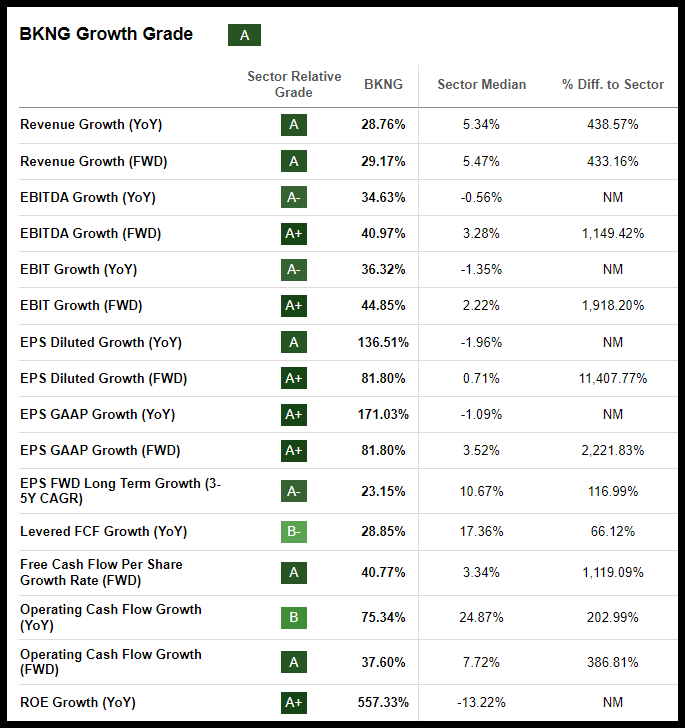

Growth

Technological advancements such as travelers relying on tablets and smartphones for real-time bookings could help drive the global online travel market to a staggering $1.56 trillion in 2030, a CAGR of almost 13%, according to a Research and Markets forecast. Booking is looking to exploit this long-term trend with its AI-enabled Connected Trip vision, which will capture more components of customer travel. During the Q3 Earnings Call, Fogel highlights,

“We have always envisioned AI technology at the center of the Connected Trip, and we have a long history of investing in AI technology and incorporating it in our platforms across our company. I previously spoke about the hard work our teams have been doing to integrate Generative AI into our offerings in innovative ways, including Priceline’s generative AI travel assistant, named Penny, and Booking.com’s AI Trip Planner.”

As Seeking Alpha contributor Amit Peretz highlights in his article,

BKNG's main mission is to create a comprehensive travel system, offering flight booking, accommodation reservations, car rentals, and restaurant reservations through its various platforms.

The company is seeking to expand the APAC market segment, where travel recovery is ongoing. Showcasing tremendous figures, BKNG sales have grown year-over-year by 28%, while forward Revenue Growth, which calculates the previous fiscal year versus consensus targets two years forward, is at 30%. EBIT forward growth is almost 2,000% above the sector median, and EPS GAAP (FWD) is +80% versus a sector median of 3.52%.

BKNG Growth Grades (SA Premium)

Booking’s growth expectations also continue to rise based on consensus estimates. BKNG has an A- Revisions Grade with 21 upward earnings revisions in the last 90 days, and the company announced plans for $24B of share repurchases within four years. During the Q3 2023 Earnings Call, Booking CFO David Goulden said,

“We repurchased $7.7 billion of our shares through the first three quarters, which represents 8% of our year-end 2022 share count. The repurchases so far this year take our combined authorization down to $16 billion from the total of $24 billion we discussed earlier in the year…We expect to spend more on buybacks in Q4 than we did in Q3. We remain comfortable with our ability to complete the full $24 billion of share repurchases within 4 years from when we started the program at the beginning of this year, assuming no major downturn in the travel environment.”

In addition to strong growth, in my view, BKNG has tremendous brand recognition and a global reach and is consistently looking to expand its market and segments. Despite BKNG’s relative premium valuation, the PEG ratio, which factors in growth drivers, continues to be compelling.

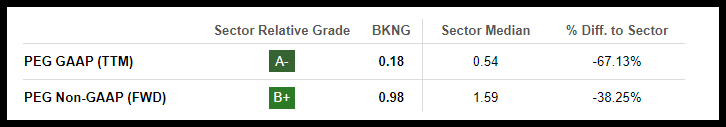

Stock Valuation

Booking Holdings is up 55% over the last year. Although its overall valuation grade is a ‘D,’ one of BKNG’s critical underlying metrics soundly outperforms the sector. The PEG ratio is a valuation metric that factors in growth by taking the P/E ratio and dividing it by EPS YoY growth. BKNG’s 0.18x PEG ratio for the trailing twelve months is almost 70% below the sector median, while the forward metric is almost 40% under.

BKNG Stock looks undervalued on trailing PEG figures

BKNG Stock is undervalued on trailing PEG figures (SA Premium)

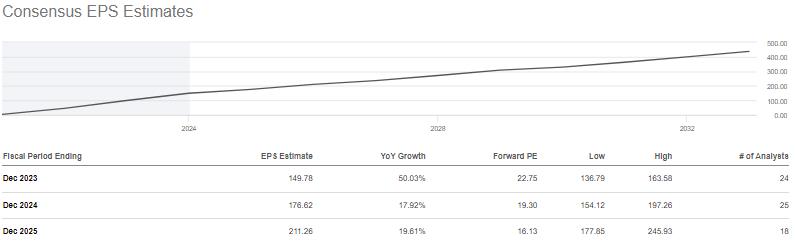

The P/E Non-GAAP forward ratio of 22.75 looks high, but when you factor in the aforementioned projected EPS growth, the number drops to 16 by fiscal year 2025, according to consensus estimates.

Booking Holdings also repurchased $7.7B, or 8% worth of shares, through the first 3 quarters of 2023. As of their last report date, they also have $16B left in their share buyback authorization, and CFO David Goulden stated, “We expect to spend more on buybacks in Q4 than we did in Q3."

Consensus estimates are strong

Consensus estimates are strong (SA Premium)

Despite a strong outlook for revenue and earnings growth, there are still risks to consider when investing in Booking Holdings.

Risks

Booking Holdings has a significant foothold in the Hotels, Resorts, and Cruise Lines industry, which can face risks, including cybersecurity threats and potential glitches, should its tech infrastructure falter. BKNG’s recent appointment of a new CFO could lead to changes in company operations.

Competition is always a factor, and dependence on partnerships can affect the availability of inventory and services. Some of the major players in the industry include Expedia (EXPE) and Airbnb (ABNB), and as consumer behavior changes or is affected by macroeconomic factors, travel demand may be impacted, thus, revenue and profitability. Another key risk for the company is a slowdown in the economy or a recession. Many economists have highlighted the potential for this economic risk, and the Federal Reserve Chair has indicated the U.S. Central Bank is likely to pause rate hikes. However, CFO David Goulden stated the data is showing a different story.

“What we're seeing is a very healthy consumer profile right now…growth rates are strong…If things do slow down, which is kind of what's on the back of people's mind, it manifests itself in two ways. People will either trade down from a higher star to lower star property, or they'll shorten their length of stay. We're not seeing that in any of our markets, and moreover, we're actually seeing the length of stay increase.”

As a global company, currency fluctuations can affect sales and profitability. Because travel tends to be cyclical and affected by inflation, declines in paid advertising, changes in economic growth cycles, and exogenous events like natural disasters, health crises, and wars can result in booking decline.

“Globally, we saw a slowdown starting the second week of October due to cancellations, drop in new bookings after the start of the war in the Middle East,” said Chief Financial Officer David Goulden.

Despite shares falling in November, the stock continued to gain through December, recording an all-time high of $3,479 on December 15th. Coming into the New Year, the stock rallied higher, with Wedbush Securities lifting its price target on BKNG to $3,850 as its top online travel pick for 2024 and Wells Fargo lifting the stock’s rating. Crushing expectations and a bullish outlook for 2024, I consider BKNG as my #1 stock pick for 2024.

Concluding Summary

Booking Holdings offers tremendous upside potential in my view. As the world’s leading online travel provider, BKNG is a thriving global company with a strong long-term outlook, primed for growth and offering substantial buybacks. With its diversified brand portfolio and local partners spanning more than 220 countries and territories, BKNG is supported by strong financial performance and consecutive earnings beats.

Seeking Alpha’s quant ratings and investment research tools help take the emotion out of investing to ensure you have the best resources to make informed investment decisions. The quant system shows many stocks with strong buy recommendations. Consider BKNG for your portfolio, or you can filter stocks using Stock Screens to find stocks that interest you. Alternatively, Alpha Picks might be ideal if you're interested in two monthly stock picks of the top 'strong buy' quant stocks. Happy investing!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- FrankRebecca·2024-01-25Great pick! Booking Holdings has huge potential for massive growth in the coming years.LikeReport

- WernerBilly·2024-01-25🔥 Impressive insights! 👏LikeReport

- ojomojo·2024-02-03Great ariticle, would you like to share it?LikeReport