All Time High AI techs apart from AMD&NVDA

After a surge in the stock price of $Advanced Micro Devices(AMD)$, the semiconductor industry once again saw a new high. Many companies related to AI and with optimistic performance have reached new highs, such as $Applied Materials(AMAT)$ and $Lam Research(LRCX)$

The Largest Etching equipment supplier

In addition to the main etching equipment, LRCX also provides deposition tools, which also exceeded expectations in the just-released FQ2 financial report, with revenue reaching 3.76 billion USD, higher than the expected 3.7 billion USD, and an adjusted EPS of 7.52 USD, higher than the expected 7.14 USD.

At the same time, the company raised its guidance, expecting FQ3 revenue to be between 3.4 billion and 4 billion USD, while the market expected 3.7 billion USD. The adjusted EPS is expected to be between 6.50 USD and 8 USD, higher than the market's expected 6.67 USD.

It is worth noting that China remains LRCX's largest customer, although its revenue share has decreased from 48% to 40%. The company stated that the new restrictions on semiconductor exports to China will not have a significant impact on the company.

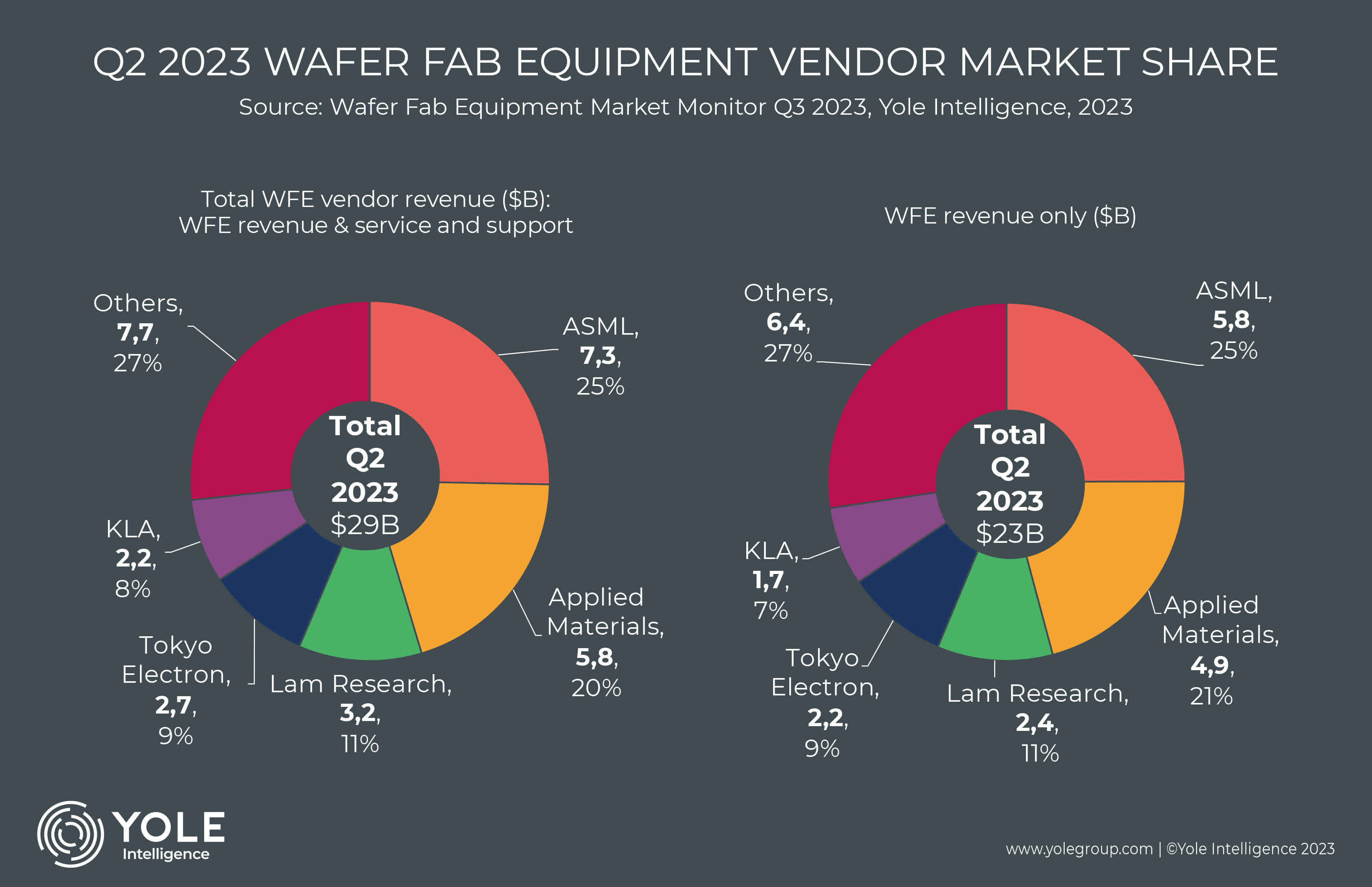

In the wafer fab equipment market share, a few large companies dominate the market, and LRCX is one of the main suppliers.

KLA Corporation will also release its financial report tonight.

$KLA-Tencor(KLAC)$ is one of the few major players in the world's wafer fabrication equipment (WFE) market. Each leading WFE company has either found a niche market targeting one of the major manufacturing processes (deposition, etching, lithography, implantation, and testing), or has established relationships with one or two major manufacturers.

KLAC has found its market in quality control testing, with its 295x series in-line defect inspection equipment becoming an industry standard.

KLAC has found its market in the field of quality control testing, with its 295x series in-line defect detection equipment becoming the industry standard.

$ASM International N.V.(ASMIY)$ holds a 55% market share in the atomic layer deposition market.

$Tokyo Electron Ltd.(TOELF)$ has a 100% market share in the coating/developing market.

As for $ASML Holding NV(ASML)$ , it goes without saying that it holds a 100% market share in the EUV lithography field.

Due to the different specialized processes, but overall being part of the same industry, the performance of these companies and their technologies is highly correlated with global semiconductor industry spending. Currently, KLAC's valuation is relatively high within the industry, but with significant growth and market position. The long-term trend and mid-term catalysts of the industry are optimistic, thus the new high stock price is also reasonable.

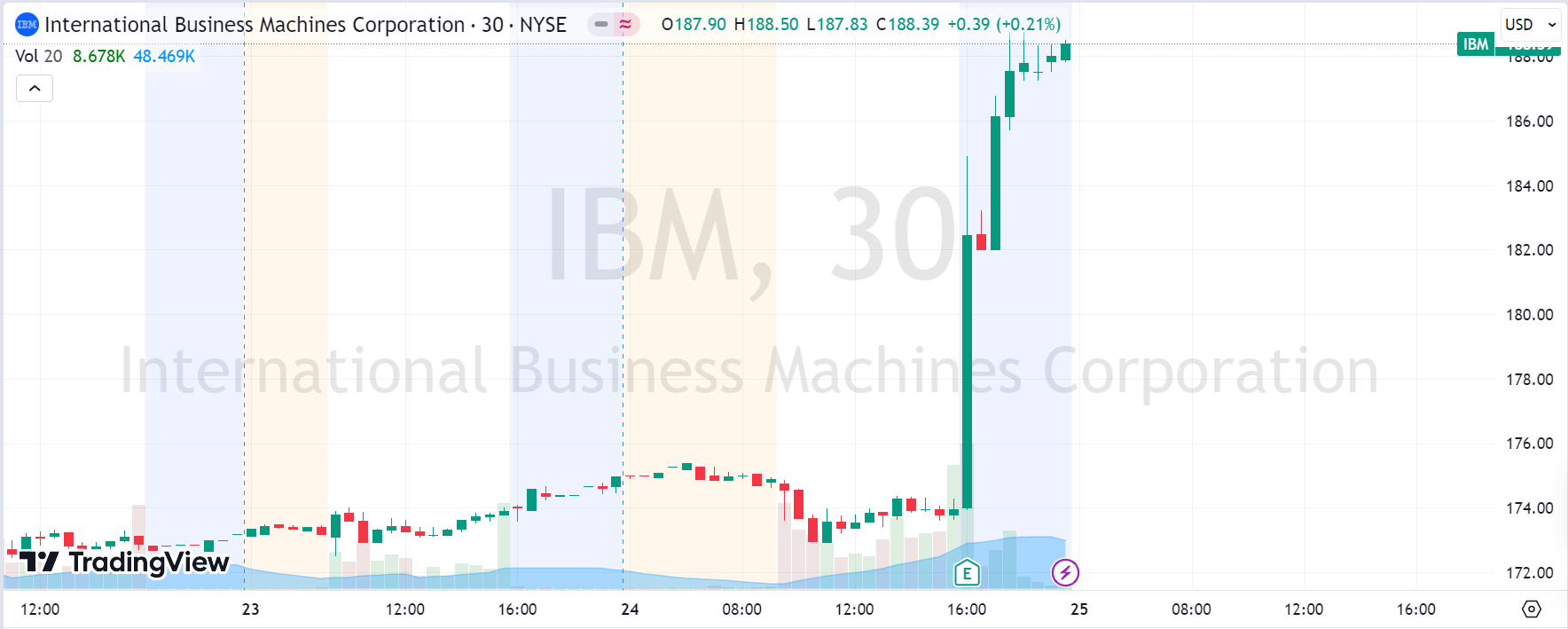

IBM also achieve a new high?

IBM, which just released its Q4 financial report, also saw a 4% year-on-year increase in revenue this quarter, with an EPS of 3.55 USD, surpassing last year's 2.96 USD. Free cash flow reached 11.2 billion USD, exceeding the management's previous expectation of 10.5 billion USD. The software revenue increased by 3%, consulting services revenue increased by about 6%, and the distributed infrastructure category, including servers with IBM Power chips, saw an accelerated growth rate of 8% year-on-year, which is the most promising part of the market.

Of course, the market also noted that the Q4 gross margin reached 59.1%, the highest level since 1999. This is due to the accelerated growth of high-margin service businesses. In addition, the revenue of AIGC and Watsonx products doubled from the previous quarter, giving the market a high expectation of "continued profit margin improvement". Currently, IBM's competitiveness in cloud services, artificial intelligence, and quantum computing is very considerable.

After-hours trading saw an 8% surge, which can be seen as a valuation of future performance. Of course, with the stock price reaching a historical high, it's unknown what Buffett's feelings are.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- PhoenixWhitman·2024-01-26Bravo! Bullish on AI! 👏LikeReport

- a9032·2024-01-26I totally agree! 🚀LikeReport