Unusual Options| Why INTC would decrease one more week?

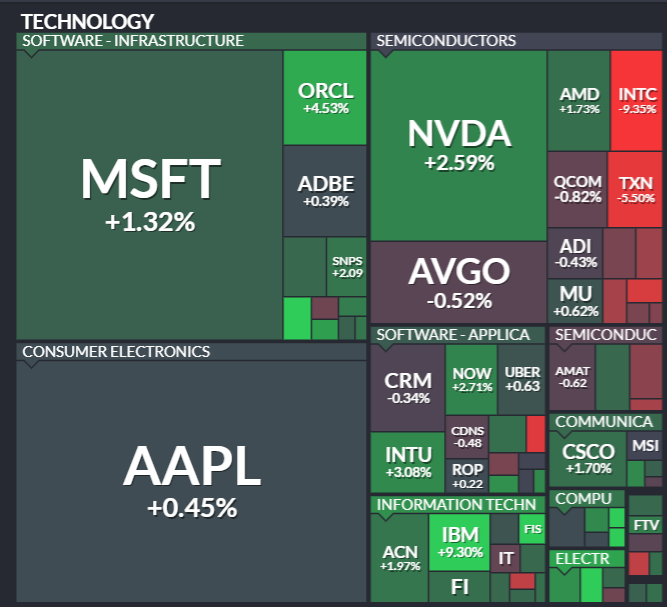

One of the most disappointing chip stocks last week was $Intel(INTC)$ The financial report was okay, but the expectation was disappointing. The key issue was the underperformance in the data center business, which directly benefits from the AI industry, leading to market abandonment. Fortunately, it did not drag down the entire chip sector.

From an investor's perspective, it can be viewed as follows:

1. The AI industry is booming, but if INTC is not performing well, its market share will be further eroded.

2. Consequently, the "reverse" synergy effect may lead to abandonment of its core chip business by customers, resulting in even worse expectations.

Therefore, the 11% plunge is seen by the market as just the beginning. Instead of allocating to the chip sector, it may be better to invest in some stronger individual stocks such as $NVIDIA Corp(NVDA)$ or $Advanced Micro Devices(AMD)$

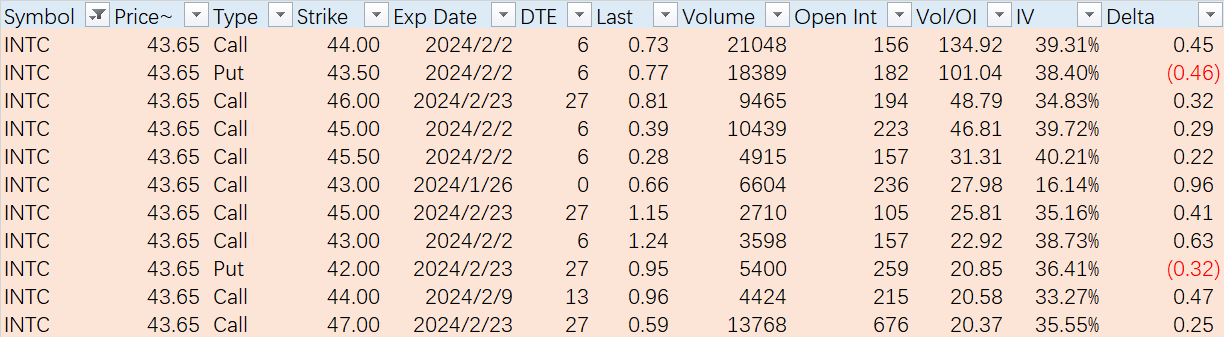

In terms of options trading, a large number of next-week calls were closed out due to unusual movement.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.