Unity is still not united? Uncertainty makes a 20% plunge

$Unity Software Inc.(U)$ released Q4 earnings report after market close on February 26, with a significant drop of 19%.

Since the former CEO’s inappropriate comments in Q3 last year regarding the "payment policy change", the company's management issues have also shown some consequences.

Continuous layoffs and business adjustments (reducing loss-making businesses) have brought a lot of uncertainty to the company. The company expects to complete the restructuring by the end of Q1 and revise its performance expectations for Q1.

The most anticipated Vision Pro and AI-related businesses have not yet brought in revenue, at least until the market begins to take shape in Q3 of this year.

Investment Highlights

Overall, it fell short of expectations. Adjusted revenue, after deducting $99 million in revenue from the Wētā FX acquisition, was $510 million, a decrease of 2% year-on-year, lower than the market's expected $561 million. This also indicates that the current changes have not made the company's operating efficiency very high.

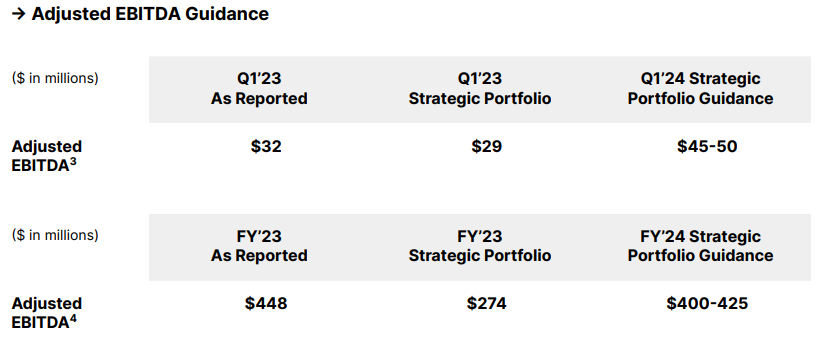

Although the profit side is in deficit, there is an overall improvement. GAAP EPS was $0.66, a loss greater than the market's expected lower limit of $0.45. The net loss was $254 million, slightly better than the net loss of $288 million in the same period last year. Adjusted EBITDA was $84 million, with a corresponding profit margin of 16%, an improvement from 5% last year.

In terms of business segments, the most stable Create Solutions business saw a 47% year-on-year increase in revenue to $290 million. SaaS revenue can be sustained at the existing net dollar retention rate. The more promising Grow business can also better support the company's profit margin due to an increase in advertising revenue. Core subscription volume increased by 18% year-on-year, excluding China. Industry users accounted for 23% of core users in 4Q23 (19% in the same period last year).

Large-scale layoffs and long-term management instability have increased the company's uncertainty. The former CEO mainly used acquisitions, which added a lot of redundant assets and reduced personnel efficiency. The current CEO, on the other hand, considers from the perspective of a major shareholder and reduces loss-making businesses, with nearly 25% layoffs, stopping independent development of professional art tools, and exiting the Luna business, which has had a certain impact on business stability.

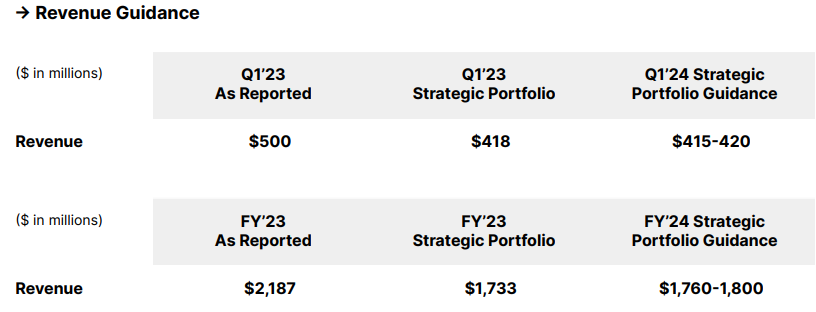

Fom one of the indicators of interest in the gaming industry—deferred revenue, Q4 long-term deferred revenue decreased by 90%, reflecting contract changes due to previous payment adjustments, which also affected future revenue potential. In terms of guidance, the company expects Q1 24 revenue to be between $415 million and $420 million, lower than the market's expected $536 million. Full-year revenue is expected to be between $1.76 billion and $1.8 billion, lower than the market's expected $2.32 billion. Of course, this guidance from management is Strategic Portfolio Guidance, including core businesses such as engines, cloud, and advertising, excluding exiting businesses like Luna, so it is not very comparable.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.