What risk assets will benefit from outflows of Chips mania??

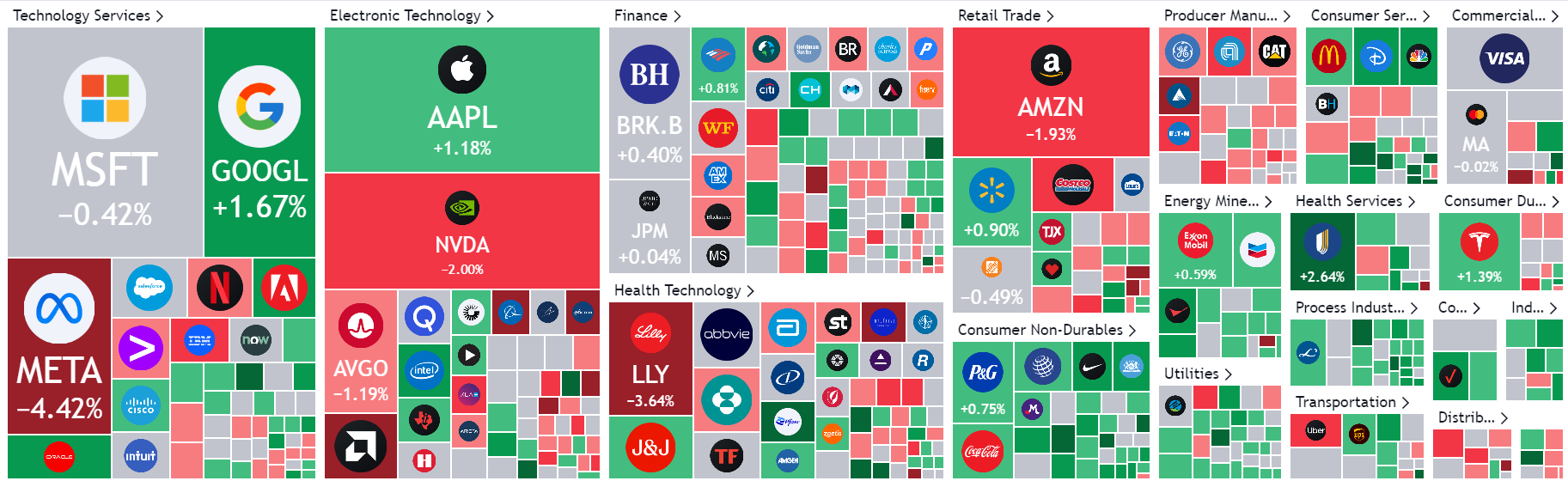

Market's concentration began to disperse and be redistributed to other risky sectors.

Last Friday, chip stocks started to rise and fall, continuing until Monday, causing the market's risk sentiment to become mixed. There is a rotation between sectors, with funds starting to flow into safe-haven sectors.

There are also differences among technology stocks, as star chip stocks with high gains in recent weeks have begun to pull back, including companies like $NVIDIA Corp(NVDA)$ $Advanced Micro Devices(AMD)$ , and $Micron Technology(MU)$

but companies that previously declined, even if they are AI concepts, have also seen rebounds, such as $Alphabet(GOOGL)$ $Alphabet(GOOG)$ , $Intel(INTC)$ $Adobe(ADBE)$

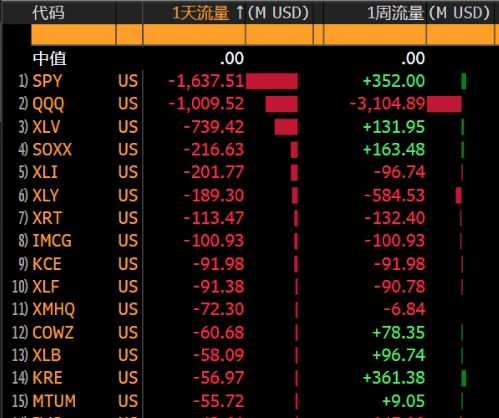

From the perspective of passive ETFs, concepts related to $S&P 500(.SPX)$ have both inflows and outflows, tending towards outflows overall.

$Invesco QQQ Trust-ETF(QQQ)$ saw outflows of $3.1 billion in the past week.

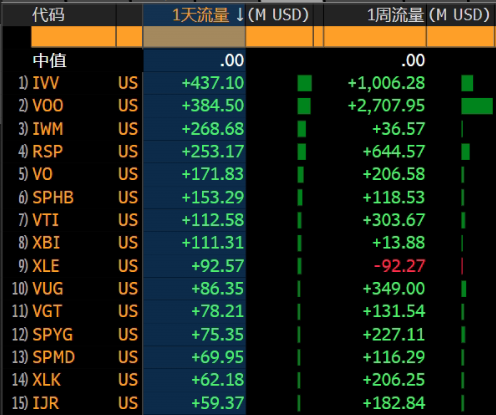

In addition, mid-cap stocks, small-cap stocks, and biotechnology have all received significant inflows.

Even the sluggish Chinese concept stocks have seen a long-awaited rise, with the $CSI China Internet ETF(KWEB)$ also receiving over $200 million in inflows since the beginning of this year, but there have been no significant outflows in the past month, and the price has risen considerably.

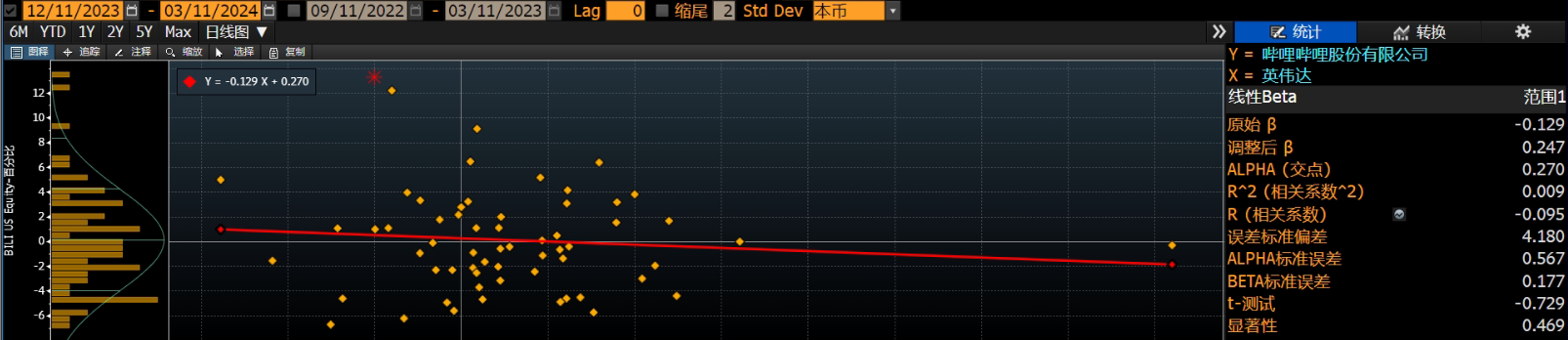

An interesting phenomenon is that Chinese concept stocks like $Bilibili Inc.(BILI)$ have intersected with chip stocks in market trends this year.

Because BILI is a high-beta Chinese stock, the correlation with NVDA in the last three months is miraculously -0.095. A negative correlation means that as chip stocks rise, Chinese concept stocks fall.

Even with KWEB, the correlation with NVDA is nearly 0.

It is highly likely that a large amount of risk-seeking capital is concentrated in trading of chip companies related to AI, where Chinese concept stocks have made many risk compensations and liquidity compensations.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.