How did market react to Quadruple witching day?

Quadruple witching day refers to the expiration settlement day of derivative financial products in the US stock market on the third Friday of March, June, September, and December each year.

The last trading hour of the day is called the Quadruple witching hour, from 3 p.m. to 4 p.m. New York time.

There are four types of products for expiration settlement, hence called Quadruple witching day:

stock index futures $SP500 index 2403 (ES2403)$,

stock index options,

stock options, and

individual stock futures.

Individual stock futures trading in the US market started on November 8, 2002, before that it was referred to as Triple witching day or Triple witching hour.

The main impact of Quadruple witching day is a significant increase in trading volume, as in-the-money options contracts automatically expire, leading to an overall increase in market trading volume.

However, the increase in trading volume may not necessarily affect the market.

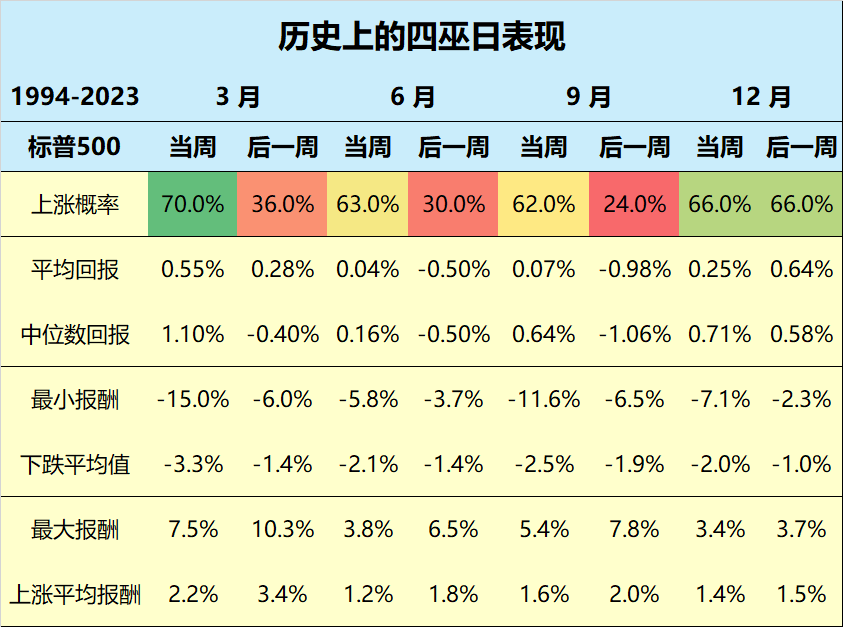

Historically, 70% of March Quadruple witching days have seen an uptrend in the week, while the post-week of Quadruple witching days in March, June, and September are more likely to decline. December's Quadruple witching day performs the best.

$S&P 500(.SPX)$ $Invesco QQQ Trust-ETF(QQQ)$ $NASDAQ(.IXIC)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.