Why Quarterly Rebalancing Matters?

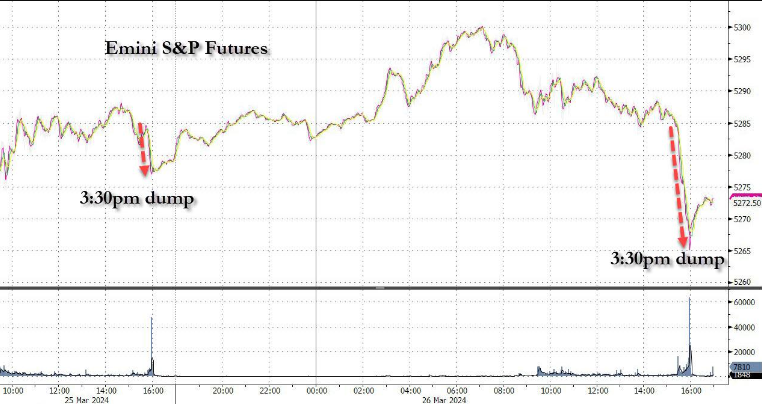

March 28 is the last trading day of Q1 this year. According to a recent research report from $Goldman Sachs(GS)$ , it is estimated that $32 billion worth of stock assets will be sold off, mainly from pension funds. The sell-off in the U.S. stock market on the afternoon of March 26 is related to this.

It is important to note that quarterly rebalancing is different from the 'index rebalancing' familiar to individual stock investors.

Index rebalancing often does not occur on the final day of the quarter. For example, $S&P 500(.SPX)$ rebalances at the close of the third Friday of March, June, September, and December.

Quarterly rebalancing generally refers to rebalancing asset portfolios (asset classes) and is a type of 'calendar rebalancing' that involves time-based reallocations, more like 'passive adjustments'.

For instance, if an investment portfolio consists of 60% stocks and 40% bonds, and the stock market is expected to outperform bonds in the near future, the allocation will change, possibly resulting in an 80% stocks and 20% bonds portfolio.

At such times, passive selling of stocks and buying of bonds is required for rebalancing.

Since the beginning of 2024, the S&P 500 index has risen by 10%, while global bonds have fallen by around 2%, leading to further rebalancing.

It is worth mentioning that a Bitcoin ETF went live in Q1 this year, attracting funds into entities like $Grayscale Bitcoin Trust(GBTC)$ increasing the frequency of risk trades.

Although all these securities are alternatives to Bitcoin, they are held by traditional brokers, meaning that if any of these securities are transferred into a new ETF, tax rules apply similarly to regular stocks.

1. Tax exemption remains in retirement accounts.

2. Taxable accounts depend on realized gains and losses.

3. The Wash Sales Rule still applies, meaning that losses incurred for tax avoidance must not be reinvested within 30 days of selling, or else they become taxable.

This implies that the capital available for reinvesting in ETFs is effectively diluted by taxes.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- ss101·2024-03-30Great article, would you like to share it?LikeReport

- bubblyx·2024-03-28Thanks for sharing this insightful analysis!LikeReport

- Tom Chow·2024-03-29goodLikeReport