Is Gold in the Beginning of a Historic Short Squeeze?

At the beginning of each month, the focus of the market will always be on non-farm data. Especially recently, everyone has been keeping a close eye on the Fed's interest rate cut path, and the impact of economic data on market fluctuations is very important.

Friday night's non-farm data greatly exceeded market expectations. According to the data released by the US Department of Labor, the number of non-farm payrolls in the United States increased by 303,000 in March, far higher than the 200,000 predicted by economists and the 270,000 in February, the largest increase since May last year.

But what is even more surprising is that U.S. stocks rose unexpectedly after a short decline, and gold continued to hit a record high, which made many investors feel at a loss. This phenomenon of completely ignoring bad news usually occurs in the forced market in futures.

The current trend of gold price is unreasonable if it is simply summarized as the expectation of market speculation and interest rate cut. Otherwise, how can gold price didn’t fall after such good non-farm data?

If something goes wrong, there will be a demon. According to the past, the non-farm data from March to April usually leads to a slowdown in the trend of gold price, but Friday's trend is not the case, so trading gold in the market may be another logic. What logic is it? Short Squeeze logic. The so-called Short Squeeze in the futures market is the capital game behavior caused by the spot being less than the deliverable quantity of futures. To put it simply, the market is betting that neither the Federal Reserve nor the UK can deliver the corresponding amount of gold spot

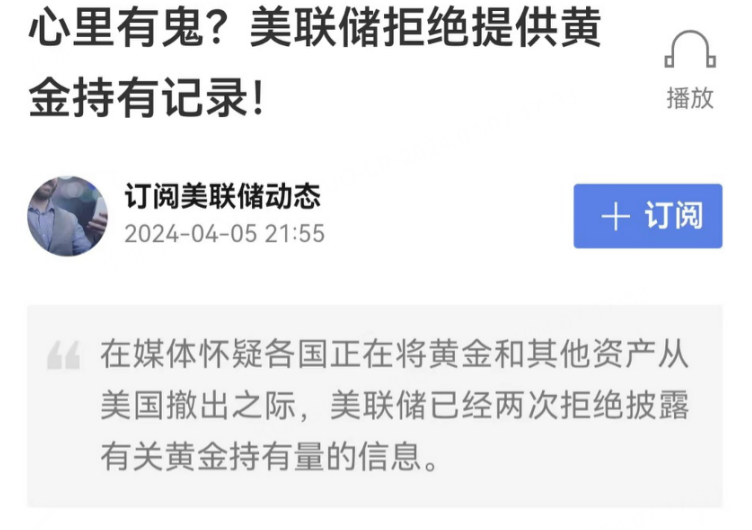

Since the conflict between Russia and Ukraine, the United States has frozen Russian assets, and many countries (including some Middle Eastern countries) have successively shipped the gold deposited in the Federal Reserve back to their home countries for storage.

However, this process is not open and transparent. As time goes by, the market thinks that the amount of gold available for delivery in the United States is too small, which leads to a capital game and forced positions. A typical example is the "nickel" of LME Exchange. Although gold prices are still not as wild as nickel, the rise in forced positions cannot be guessed, and reversals may come suddenly (the Federal Reserve announces gold stocks?) Therefore, if you have long positions, hold them. If you don't want to participate in the market, please use options to limit losses.

How to deal with it technically?

In the face of extreme market conditions, there are usually two types of treatment methods. One is to set up a small amount of losses to follow up, or use trend arbitrage combinations, such as option bull market spreads; The second is to buy the shadow varieties that are related but not as fast as the former, so as to obtain the supplementary income.

Silver, for example. With the continuous rise of gold price, the silver market started ahead of schedule, and the silver price of 26% changed from pressure level to support level. Therefore, if the silver price is adjusted back to this point in the future, we can consider buying it (whether there is a correction or not depends on whether gold has been adjusted), but it is also possible to chase a small amount of high in the current situation, because there is still a long way to go before measuring the increase, and we just need to carry the fluctuation.

$NQ100 Index Main Connection 2406 (NQmain) $$Dow Jones Main Link 2406 (YMmain) $$SP500 Index Main Connection 2406 (ESmain) $$Gold Main Connection 2406 (GCmain) $$WTI Crude Oil Main Line 2405 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- NicoleBryce·04-09🤩 Shiok ah, keep up the good work!LikeReport