Three Strategies to Profit Big from TSMC's Earnings Report!

As the world's largest dedicated semiconductor foundry, TSMC has been leading the technological development trends in the semiconductor industry. With its advanced 5nm and below process capabilities, TSMC has not only attracted orders from tech giants like Apple and Nvidia, but has also secured an important position in the emerging and hot AI chip market.

Recently, against the backdrop of the continuously booming AI field, the global demand for advanced process chips has surged, bringing strong growth momentum to TSMC's performance. Investors are also bullish on the company's prospects, with TSMC's stock price already up 40% this year and its market capitalization more than doubling.

Supported by multiple positive factors, TSMC's stock price continues to rise. With the arrival of the Q1 earnings season, this article will compare three different bullish strategies for investors as a reference for decision-making.

Another Major Positive Ahead of Earnings

Riding on the AI wave, global demand for chips, especially advanced process chips, has surged, driving TSMC's first-quarter 2024 sales to a year-over-year increase of 16.5%, the highest since 2022, reaching approximately NT$592.6 billion (US$185 billion), exceeding expectations.

Three positive factors continue to fuel TSMC's rising stock price:

TSMC announced that its AI revenue grew by 50% year-over-year, with strong demand for AI chips, benefiting from continued demand from tech giants like Nvidia for TSMC's advanced process AI chips.

To meet the growing demand from emerging fields like AI, reports suggest that TSMC will continue to expand its capacity by raising its 2024 capital expenditure to US$30-34 billion and actively building new fabs in the US, Japan, and Germany.

In the first three months of this year, TSMC's sales grew steadily, increasing 7.9% in January, 15.8% in February, and 34.3% in March.

Driven by these positive factors, market expectations for TSMC have increased significantly, with a widespread expectation that its 2024 revenue will grow by more than 20%, reversing the slight decline in 2023 and reaching new highs. In a report, Citigroup stated that driven by strong AI-fueled demand, it expects TSMC's second-quarter revenue to grow 4% quarter-over-quarter, while gross margins may slightly decline due to the impact of earthquakes. The firm also raised its target price by 28% to NT$950, forecasting TSMC's revenue to grow 26% and 29% year-over-year in 2024 and 2025, respectively.

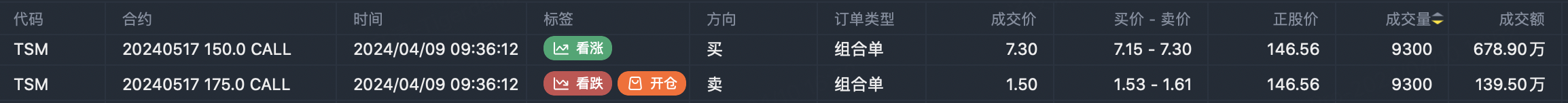

After the positive news was released, option activity detected a bullish option strategy on TSMC the same day: buying the $TSM 20240517 150.0 CALL$ and selling the $TSM 20240517 175.0 CALL$ , indicating an expectation that TSMC's stock price could reach above $150 but below $175 after the earnings release.

Technical Trend

$TSMC (TSM)$ is in a long-term uptrend channel, with funds continuously flowing in. The stock price is currently at the lower end of the uptrend channel, with no resistance to further upside. If negative news emerges, $135 is the most important support level.

Three Strategies

Here are three common bullish strategies with different risk-reward profiles for investors to choose from based on their preferences:

Buy Stocks

Buying stocks is the most common bullish strategy. The potential gain is the percentage increase in the stock price. If the stock price rises to above $150, the return would be around 2%. The downside is that it requires a larger capital investment; for example, buying 10 shares of TSMC would require $1,460, with a potential gain of $40. If the stock price remains flat, there would be no gain.

Buy Call Options

Compared to buying stocks, buying call options maximizes the use of capital leverage. Options are financial derivatives, and since one option contract represents 100 shares of stock but does not cost the same as 100 shares, options inherently have high leverage.

For example, buying the $TSM 20240517 150.0 CALL option expiring on May 17th, if the stock price rises above $150 after the earnings release, the potential return could reach 14.7%. One contract only costs $670, with a potential gain of $99. Further stock price increases can magnify the leverage and boost the return.

The advantage of buying call options is that the risk is controlled, while the potential upside is unlimited. However, the downside is that if the stock price falls, the entire option premium could be lost.

Sell Put Options

Compared to the above two strategies, selling put options has limited upside potential but can tolerate some downside risk. As long as the stock price does not experience a significant decline, selling put options can generate income from the option premium.

For example, selling the $TSM 20240419 142.0 PUT option expiring on April 19th, based on the strike price minus the option premium (142 - 3.1 = 138.9), as long as the stock price is above $139 on the expiration date, there would be no loss. The maximum potential return for selling this put option is 2.27%, or $310.

Selling put options has a high capital utilization rate and is more advantageous in a flat or slightly declining market, but the upside potential is limited when the stock price rises significantly. To increase the potential return, the strike price can be adjusted higher, such as selling the $TSM 20240419 146.0 PUT option, which has a maximum potential return of 3.52%, or $500, but the breakeven point is also raised to $141. Investors can adjust based on their risk tolerance.

In summary:

Buying stocks requires the largest capital investment, has higher downside risk, but unlimited upside potential.

Buying call options requires lower capital, has controlled risk, and higher potential upside.

Selling put options requires lower capital, has controlled risk, but limited upside potential.

Risk Warnings:

If the overall market declines, TSMC's stock price may also be affected. Overinvesting in a single company carries higher risks. If the actual earnings data falls short of expectations, the above strategies may face losses. Option strategies require precise calculations and execution, with some inherent uncertainty.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Leggo