AAPL Options Soar 22-Fold: AI Buzz Sparks Price Target Hike to $230~$270

On Tuesday, $Apple(AAPL)$ 's weekly and monthly trend breakthroughs were both quite impressive and important.

Last week I said that this year, $Apple(AAPL)$ has the least increase among the top ten market capitalization stocks, and it may rise to $200 by taking advantage of WWDC. Quick Hits: Nvidia Insider Alert & My Calls on TSLA, AMZN, APPL, AMD

On Tuesday, my call expiring on June 14th rose over 22 times. And I sold it in the first half of the transaction unfortunately.

See, I‘m not the guy that “letting the profit run”.

I am curious if there are any tigers who made a 20-fold profit.

How high can Apple's stock go this year?

1. Wall Street institutions are eagerly looking forward to the wave of iPhone upgrades, and have raised their target prices to $216, $230, and $270:

D.A. Davidson analyst Gil Luria raised Apple's rating from "neutral" to "buy" with a target price of $230.

Morgan Stanley analysts said: Apple's artificial intelligence capabilities will drive consumers to upgrade their iPhones, thereby accelerating the device replacement cycle. We are more confident that Apple is about to usher in a multi-year product update, which supports our overweight rating, $216 target price, and $270 bullish valuation.

2. From a technical perspective, analysts also say that the price may hit $240.

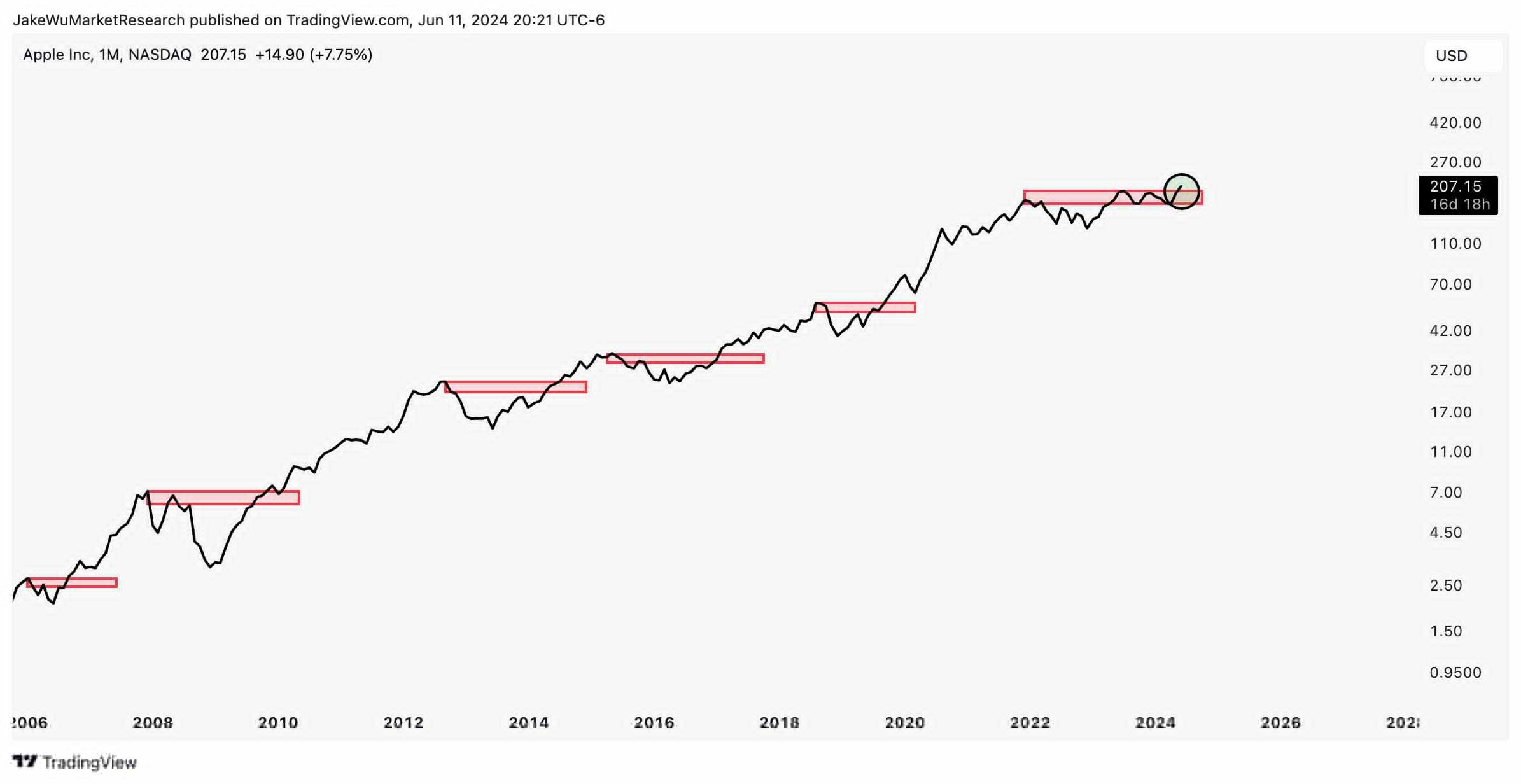

@Jake__Wujastyk pointed out that based on the trend since 2006, it is highly unlikely that $Apple(AAPL)$ will be bearish after such a breakthrough. “If took a quick look at history...Generally not bearish.”

@ElliottForecast, the master of wave theory analysis, pointed out: We expect to see $Apple(AAPL)$ rise to the $240 area in the third wave.

Can $Apple(AAPL)$ fundamentals support the rise in stock prices?

Apple is a mature business, and its main products include iPhone, iPad, Mac, Apple Watch, Apple TV, etc. It provides operating systems including iOS, macOS, watchOS and tvOS. Service businesses include iCloud, Apple Music, Apple Pay, App Store, etc.

Revenues have been declining since fiscal 2023. The question is whether $Apple(AAPL)$ can enter growth mode again. Over the years (actually decades), Apple has been able to build one of the most powerful product ecosystems.

As the world's most valuable brand, Apple has many levers that can stimulate future growth. Apple Intelligence is a major topic.

This Monday at the WWDC conference, Apple demonstrated a series of AI-related features and announced a partnership with OpenAI, and the iPhone will be connected to ChatGPT.

Apple's WWDC24 event received mixed reactions, ranging from "the best event since the launch of the iPhone" to "banning the iPhone."

From a valuation perspective, Apple is still overvalued, but the market expects Apple's cash flow to grow significantly in the future.

But considering its already high free cash flow margin and declining revenue, perhaps this target price is difficult to achieve?

What do you think, Tigers?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- breezzi·2024-06-12Impressive growth for AAPL optionsLikeReport