US deficit rate has risen again and again!

The fact that the market has pulled back is also inextricably linked to the macro! $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$ $NASDAQ(.IXIC)$ $Invesco QQQ(QQQ)$

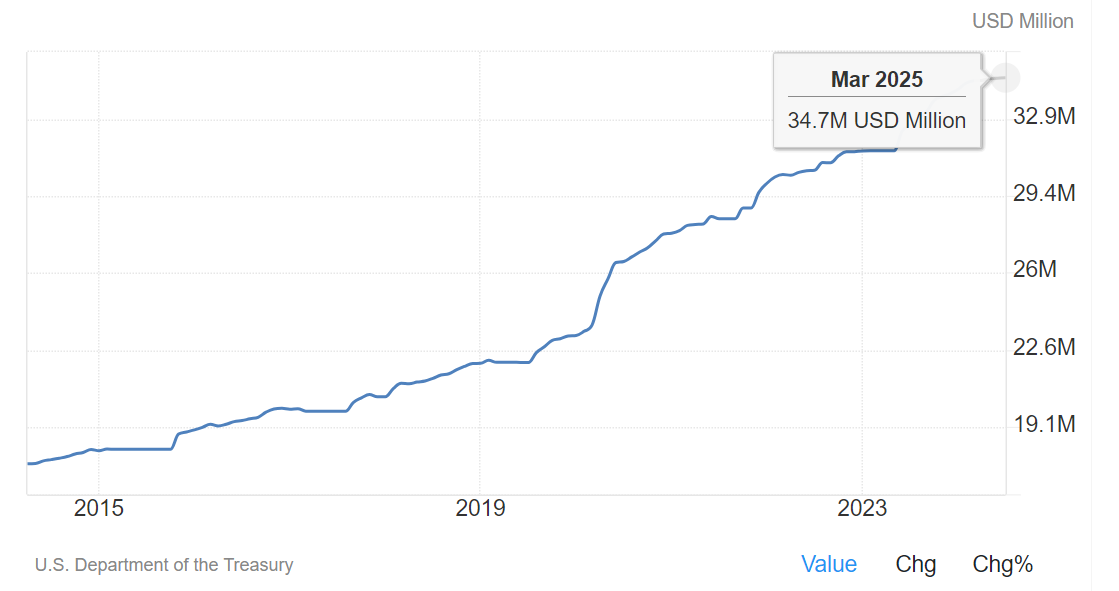

The latest report from the U.S. Congressional Budget Office expects the deficit rate to rise from 5.6% to 7% in fiscal year 2024, with the size of the deficit increasing to $1.9 trillion. This adjustment signals the further force of the U.S. fiscal policy, market liquidity and the real economy will be supported, but the urgency of the interest rate cut may therefore weaken.

Key Info

1. Behind the upward revision of the fiscal deficit: The upward revision reflects the further support of fiscal policy to the economy. The increase in the deficit rate is mainly due to the Biden administration's new student loan relief program, the resolution of bank insolvency issues, increased overseas appropriations, and adjustments to other livelihood-related expenditures.

2. Economic impact :It is expected that the strength of the fiscal policy will help consolidate the resilience of the U.S. demand, a positive impact on the global resources, capital goods, industrial goods, etc., and at the same time, the spillover effect on China is also worth looking forward to.

3. Monetary Policy Outlook : Despite the presence of inflationary pressures, the threshold for rate cuts is high.CBO's forecasts suggest that the force of fiscal policy could delay the Fed's rate cut move, weighing on market expectations for rate cuts.

Interpreting the data: the deeper meaning of fiscal deficits

Components of the fiscal deficit:

Revenue Expectations Lowered: Federal revenue expectations were lowered by $45 billion, likely reflecting lower-than-expected tax collections and the impact of slowing economic activity on tax revenues.

Spending Increases: The main components of the $363 billion in increased spending are:

Student Loan Forgiveness Program: an estimated increase of $145 billion, demonstrating the government's focus on the education sector and financial support for the younger generation.

Bank Insolvency Resolution: FDIC Increases Deposit Insurance Spending by About $72 Billion, Reflecting Maintenance of Financial Stability.

Overseas Appropriations: The 2024 Emergency Supplemental Appropriations Act involves $95 billion and is expected to generate about $60 billion in spending in FY2024, demonstrating an expansion of foreign policy and international influence.

Economic Impact Assessment:

Increased fiscal deficits may stimulate economic growth in the short term, but in the long term, attention needs to be paid to their impact on national debt levels and fiscal sustainability.

Global Perspectives: The Global Impact of U.S. Fiscal Policy

Global Effects of U.S. Demand:

Adjustments in the fiscal policy of the United States, the world's largest economy, have significant spillover effects on the global economy. Increased demand is likely to boost global markets for resource, capital and industrial goods, especially for those exporting countries that are dependent on the United States market.

Global supply chain linkages:

The fiscal stimulus in the United States could increase demand on global supply chains, especially for countries that provide intermediate goods and raw materials, which could lead to increased trade and investment.

Adjustments in global asset allocation:

Investors may adjust their global asset allocation in response to changes in U.S. fiscal policy, seeking to benefit from the U.S. economic stimulus, which could affect global capital market flows and asset prices.

Market Reaction: Investor Sentiment and Expectation Adjustment

Increased market volatility:

News of a deficit rate hike could lead to increased market volatility as investors need to reassess their expectations for the U.S. economy and monetary policy.

Investor expectations adjust:

Markets are likely to assess the sustainability and effectiveness of the fiscal stimulus, which may affect expectations for interest rates, exchange rates and equity markets.

Industry Impact Analysis:

Specific sectors, such as resources, industrials and consumer durables, may be directly impacted by U.S. fiscal policy, and investors may seek investment opportunities in these areas.

Long-term growth prospects:

While markets may react to fiscal stimulus in the short term, the long-term growth outlook will depend on the sustainability of the policies and the improvements they make to economic fundamentals.

Summary

The new direction of U.S. fiscal policy provides us with a new window into the dynamics of the global economy. With the CBO's upward revision of the deficit rate, we can anticipate a series of ripple effects of economic activity that will not only concern the United States, but also the future direction of the global economy.

$DJIA(.DJI)$ $SPDR Dow Jones Industrial Average ETF Trust(DIA)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- PageDickens·2024-06-25Uh ohLikeReport