Why Hedge Funds Are Selling And Shorting Stocks?

Recent market moves have raised concerns that hedge funds are selling and shorting stocks at the fastest pace in nearly two years. $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$

Market Behavior Analysis

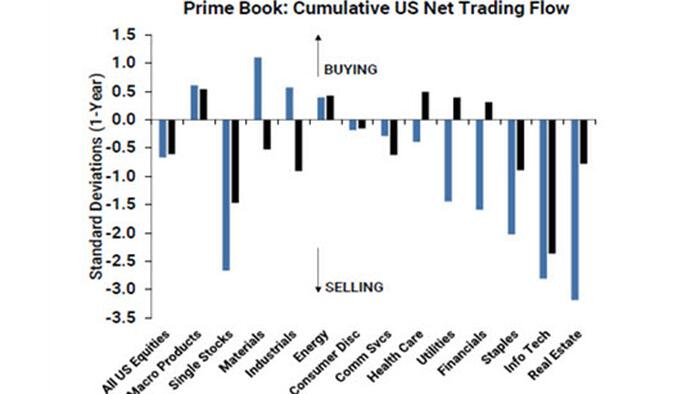

Net selling surges

Last week's net hedge fund selling reached its highest level since March last year

Short-selling volume surges to peak since May 2022

Shifting industry preferences

Tech Stocks: a Major Selling Target $Technology Select Sector SPDR Fund(XLK)$

Financials: attracting heavy buying demand $Financial Select Sector SPDR Fund(XLF)$

Characteristics of the transaction model

Long and short operations coexist

Overall net selling pattern

Concerns

Macroeconomic concerns

Inflationary Pressures Persist

Uncertain economic growth prospects

Monetary policy expectations

Fed likely to keep interest rates high

Markets skeptical about timing of rate cuts

valuation pressure

Valuations of some sectors are at high levels

Investors seek to reduce risk exposure

Market Outlook

Increased short-term volatility

Hedge fund behavior could trigger more selling pressure

Market sentiment tends to be cautious

Sector rotation accelerates

Funding shifted from high valuation sectors to low valuation sectors

Defensive sectors may benefit

Adjustment of investment strategy

Risk management in the spotlight

Rising importance of diversified allocations

This series of moves by hedge funds has certainly injected new uncertainty into the market. However, for keen investors, this may also be a good opportunity to reassess investment strategies and identify potential opportunities. In this challenging market environment, staying calm and analyzing rationally will be the key to victory.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Alex Tan·2024-07-01uncertainty in the market. we will never know whether it's bull or bear trapLikeReport

- chizzoo·2024-07-01Awesome analysis, really insightfulLikeReport