How did Nike lose?

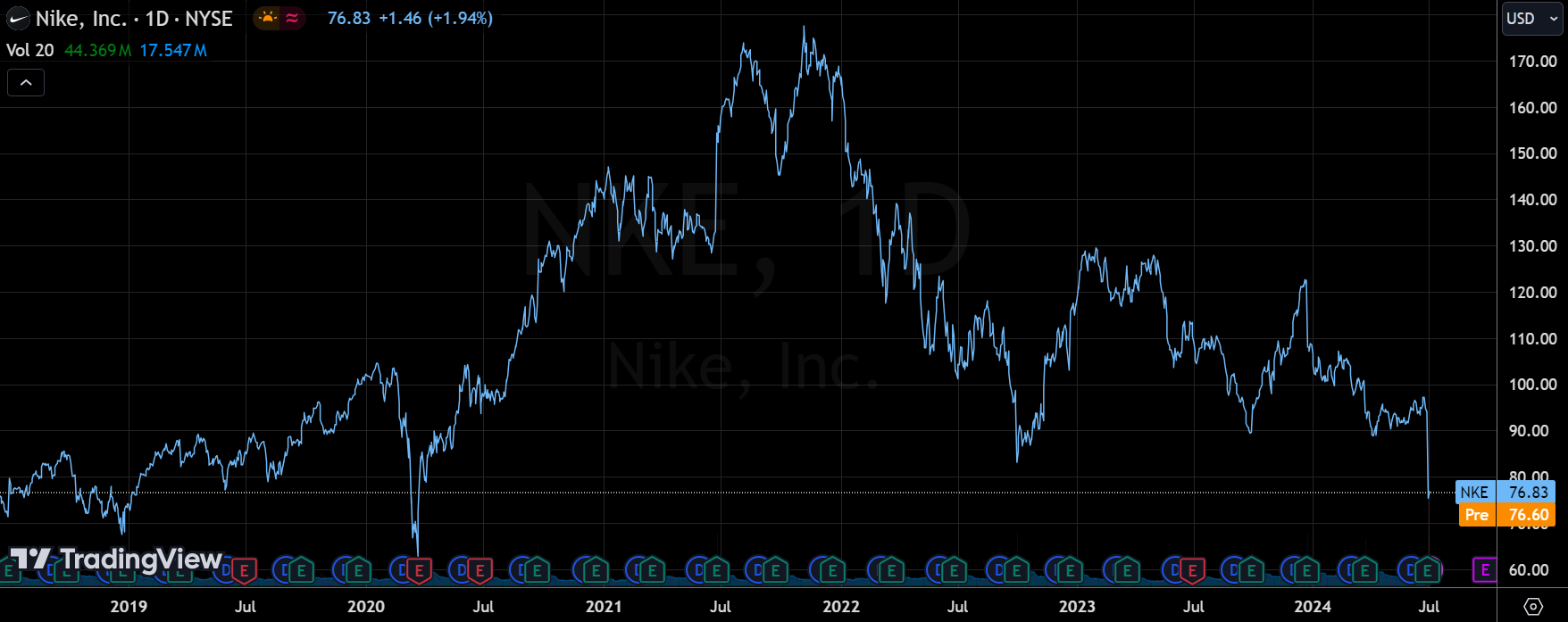

$Nike(NKE)$ plunged nearly 20%, and it could have been worse if not for a buyback. What went wrong with the world's No. 1 sports brand? Will the current pessimism in the secondary market continue to spread?

If we look at Nike's core product, footwear, we can see its business model in recent years and how it has missed out on the popularity of running culture.

Ignoring grassroots running communities. Compared to emerging brands in recent years such as New Balance, Hoka and Asics, Nike seems to have little interest in promotions such as community running events. For this grassroots style of marketing, Nike appears to be overly confident in its brand and reputation, and its lack of presence could lead to its alienation from the core running community.

Nike has long focused on the development of high-performance running shoes, such as the Vaporfly series, but as the popularity of running culture increases, the demand for comfortable and durable ordinary daily training shoes has increased. However, with the popularization of running culture, the demand for comfortable, durable, and common daily training shoes has increased.Nike may have focused too much on elite athletes and record-breaking products, while neglecting the needs of ordinary runners.

Imbalanced market positioning.Nike, as the world's largest sports brand, has a product line that covers a wide range of sports. This diversification strategy may lead to a lack of focus on the specialized running market, and an inability to understand and meet runners' needs as deeply as some brands that focus on running.

Brand image is out of touch with running culture. Nike's brand image is often associated with high-end, fashionable and elite sports. However, running culture in recent years has emphasized inclusivity, socialization, and healthy lifestyles.Nike may have failed to adapt its brand message in time to accommodate this cultural shift.

Neglecting the low and mid range markets. With the expansion of the running population, the demand for low to mid-priced running shoes has increased.Nike may have focused too much on the high-end market and neglected this fast-growing segment, leaving opportunities for other brands. At the same time, Nike is overly reliant on retro shoes such as Air Jordan, Air Force 1, and Dunk, and has neglected its core performance products, including running shoes.

Untimely adjustment of distribution strategy. Nike has emphasized direct sales channels in recent years and reduced its cooperation with some retailers. This may have led to a decline in its exposure to some key running specialty stores, affecting its access to the core running community.

Since vigorously promoting its Direct-to-customer(DTC), Nike's profit margins are indeed improving. After all, you can take the previous sales channel's share of the commission directly in the hand, but the downside of this is that once the brand influence is less than before, the lack of exposure to the channel, it may affect the sales of the product.

In fact, footwear is just one of the write-ups. It's Nike that has previously given $lululemon athletica(LULU)$ the perfect head start on growth because of its lack of attention to women's sports brands as well.

Let's go back to what company executives said on Earnings Call

The Lifestyle business showed declines, including men's, women's and Jordan brands;

Sales of classic footwear franchises were weak;

Double-digit drop in offline sales in Greater China, trend in EMEA too

As a result, the entire fiscal year 2025 (which begins next quarter) will become more challenging, with the company expecting revenue to fall in the mid-single digits and continue to trend down year-over-year in the beginning quarters. Since the decline was not yet evident in the fiscal quarter of May, it should be the case that the company is seen a related trend in its sales flow since June.

The call had analysts questioning CEO Donahoe directly, though founder Phil was still very supportive of Donahoe.

Still, as a result, the investment bank lowered its price target on NIKE:

Bank of America cut its price target to $104 from $113;

Citi cut its price target to $102 from $125;

Evercore cut its price target to $105 from $110;

Guggenheim cut its price target to $115 from $130;

BAYER cut its price target to $100 from $125.

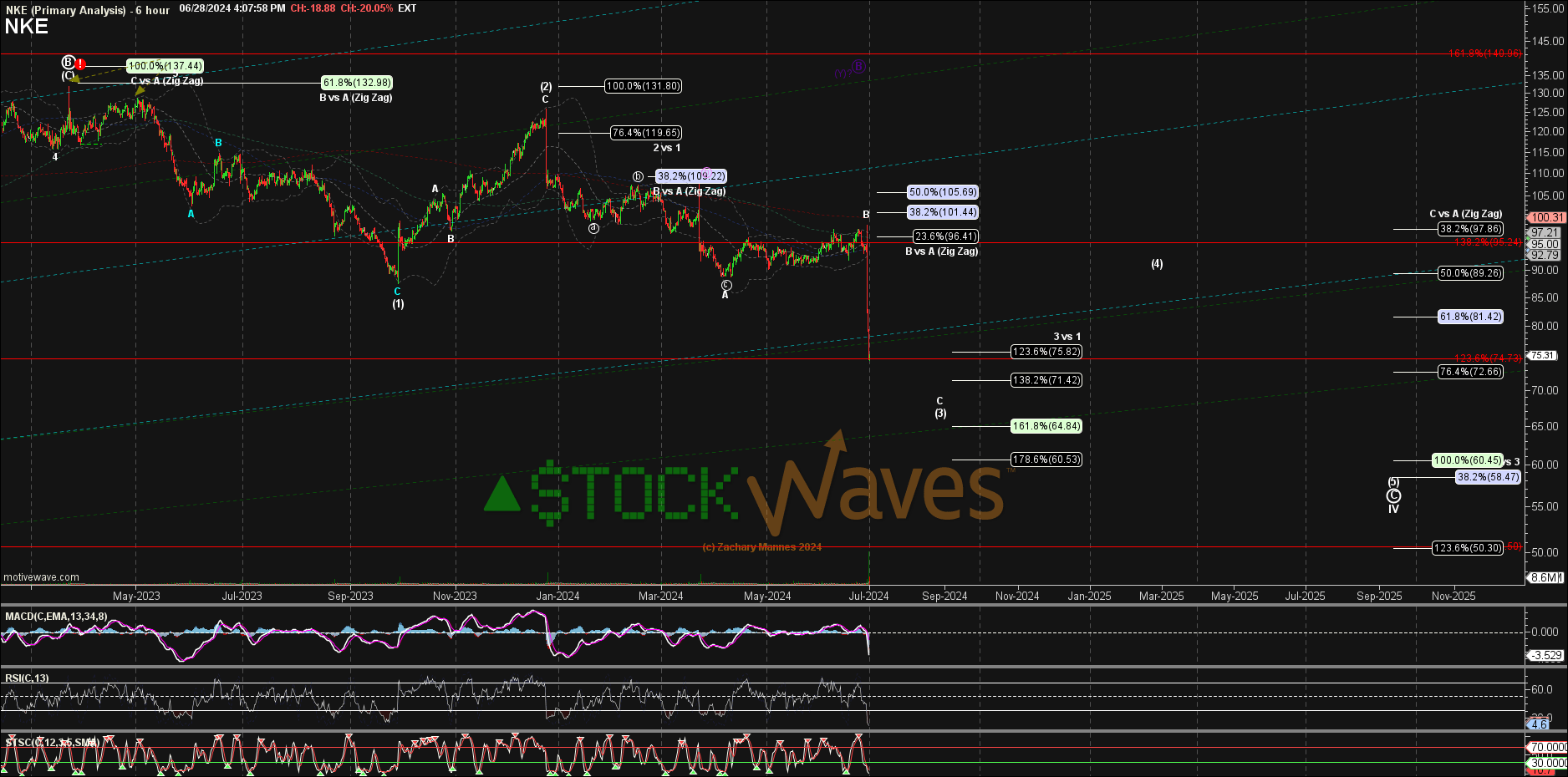

From a technical perspective, some technically minded investors who have studied Elliot's theory more deeply believe that Nike is likely to continue all the way down to the $60-62 target range after falling from $105 to $76.

Nike NKE

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.