BIG TECH WEEKLY | Tesla's Next Squeeze is coming

Big-Tech’s Performance

July 3 was the highest positive return day for the S&P since 1928 (72.41%), and the broader market continues to trade back and forth to new highs.The first half of July was also the best two-week trading period of the year for the S&P 500 in terms of median returns.The S&P 500 has had nine consecutive years of positive July returns, averaging 3.66%.

And Tesla's majestic week has pulled the overall Big Tech Index return to new highs once again, with the Magnificent 7's return differential relative to the rest of the S&P 500 coming in at a new high.

By the close of trading on July 3, the best performers over the past week were $Tesla Motors(TSLA)$ +25.47%, $Apple(AAPL)$ +3.89%, $Amazon.com(AMZN)$ +2.06%, $Microsoft(MSFT)$ +1.90%, $NVIDIA Corp(NVDA)$ +1.49%, $Alphabet(GOOGL)$ $Alphabet(GOOG)$ +1.06%, and $Meta Platforms, Inc.(META)$ -0.62%.

Big-Tech’s Key Strategy

Tesla As A Big-Tech

The seven U.S. tech giants, while some investors have questioned Tesla's crotch-pulling performance so far this year, no investor has questioned Tesla's tech prowess.It's only up 25% in a week, and it's not even earnings season, not only recovering lost ground so far this year, but also pulling overall big tech returns up to new highs.

Tesla's valuation controversy has always been a market focus

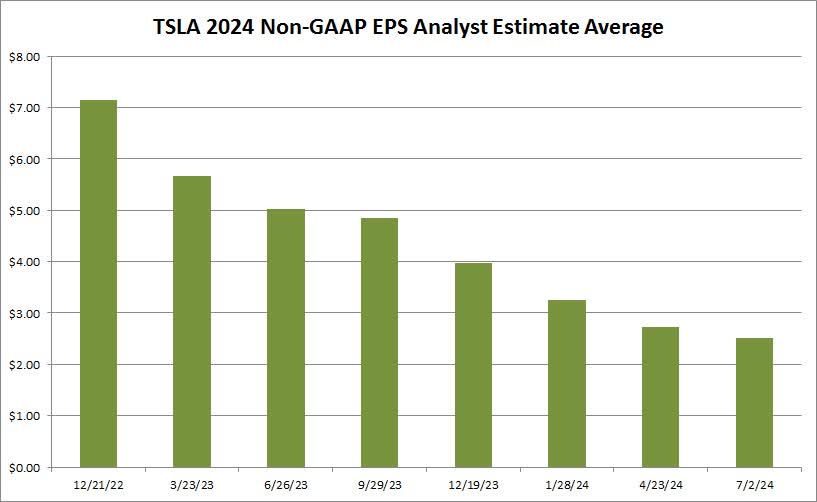

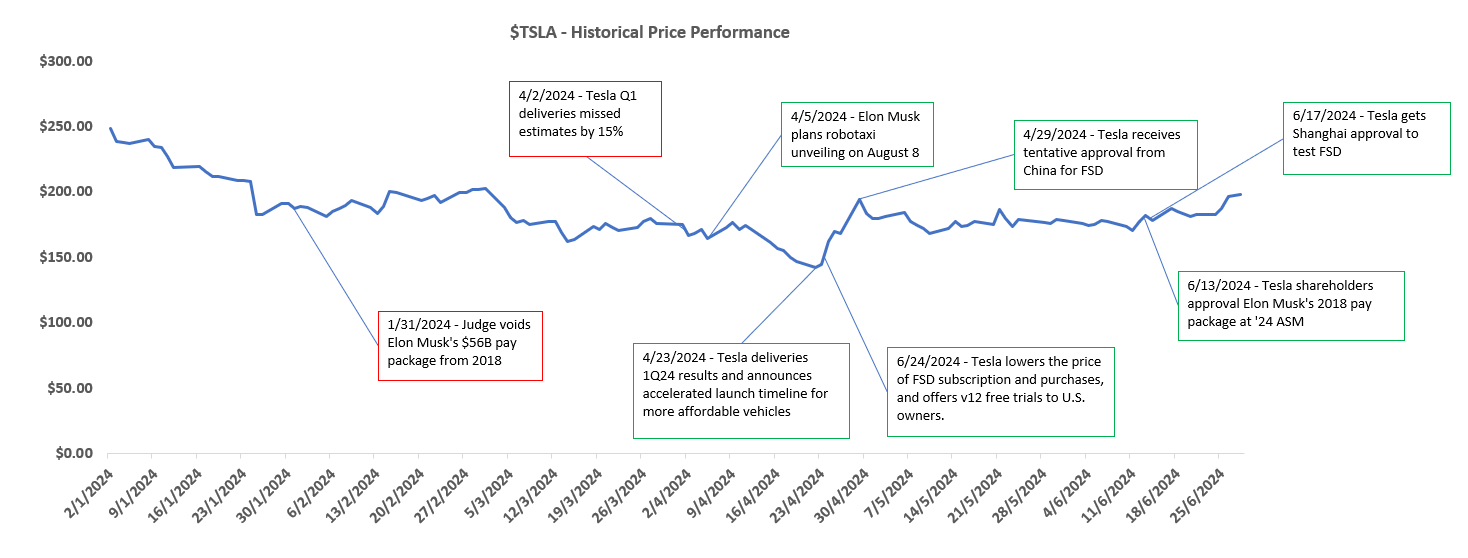

If one were to price Tesla just in terms of EV companies, then the current industry supply/demand relationship is indeed not favorable for the company's future growth.In terms of financial metrics, revenue expectations for the full year 2024 are still down 2%, despite Q2 deliveries hitting 443,956 units ahead of expectations.

The current price is a better representation of the valuation basis if future development of its technology business is factored into the expectations.

First, FSD uses an end-to-end neural network to control its vehicles, demonstrating more natural, human-like driving behavior, while Autopilot's vehicles are only involved in one collision every 5.39 million miles, which is eight times safer than the U.S. average; the Robotaxi launch event was held on August 8, and FSD's advances are closely related to that

Second, the latest advances in AI and robotics: upgrades to Optimus, the second-generation humanoid robot, with significant improvements in walking speed, weight and dexterity.Walking speed has increased by 30% and weight has been reduced by 10 kilograms.Meanwhile, it shares the underlying model with FSD technology and uses neural network model and vision technology to continuously optimize the algorithm.

In addition, Tesla's energy storage business is becoming a new growth driver for Tesla, with Q1's energy storage business revenue +36% YoY. Tesla's Shanghai energy storage super factory will produce Megapack, an ultra-large commercial energy storage battery, with an initial annual production capacity of 10,000 Megapacks and an energy storage scale of nearly 40GWh.

At the same time, because Elon Musk is not currently "buy Twitter" such large-scale expenditures, there is no previous large number of selling pressure on Tesla shares, the market shorts also in the stock price sideways three months after the surge have retreated, and volatility is greater than the general technology stocks Tesla, has always had a history of GammaSqueeze history, pushed further, making it difficult for the stock to meet resistance on the upside at the moment.

Big-Tech Weekly Options Watcher

The second week after Tesla received a large inflow of money, short option closures increased, and the July 19 expiration (two weeks from now) of monthly options added a large number of open Calls, and the pivots continue to move upward, with the midpoints all exceeding 250.

Yet there are still not many options open above the 250, which could easily create, if this trend continues, a new "Gamma Squeeze" by pushing the stock price even higher.

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are a far outperformer of the S&P 500 since 2015, with a total return of 2,121%, while the $SPDR S&P 500 ETF Trust(SPY)$ returned 218% over the same period, before pulling back after hitting record highs.

This week the broader market hit a new high and the portfolio's year-to-date return hit a new high of 40.4%, outperforming the SPY's 16.8%.

The portfolio's Sharpe Ratio for the past year is 2.5 compared to SPY's 1.9 and the portfolio's Information Ratio is 1.9.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?