What did Netflix Q2 Earnings Tell Us?

$Netflix(NFLX)$ took the lead in announcing Q2 results after the bell on July 18th, and the quarterly (Q2) results were good, and also slightly exceeded a little bit with the market's expectations, except for a little bit of a dip in the growth rate of free cash flow.The guidance for Q3 is slightly conservative, with revenue expectations slightly lower than the market by about 0.8%.

There was a huge shock just after the bell when the earnings report came out, moving up and down more than 8% in a matter of minutes, but ultimately holding steady near the closing price, which set the tone for this earnings season:

After back-to-back upward bull markets, the market has become quite flush with expectations for big companies, so a slight bit of Miss can sensitize investors;

The outflow of capital from the rotating tech sector has made it harder to realize the "good" from earnings reports into stock prices, making it easier to go down than up;

Trading on volatility may be the dominant theme of this earnings season.

A comprehensive overview of the earnings report

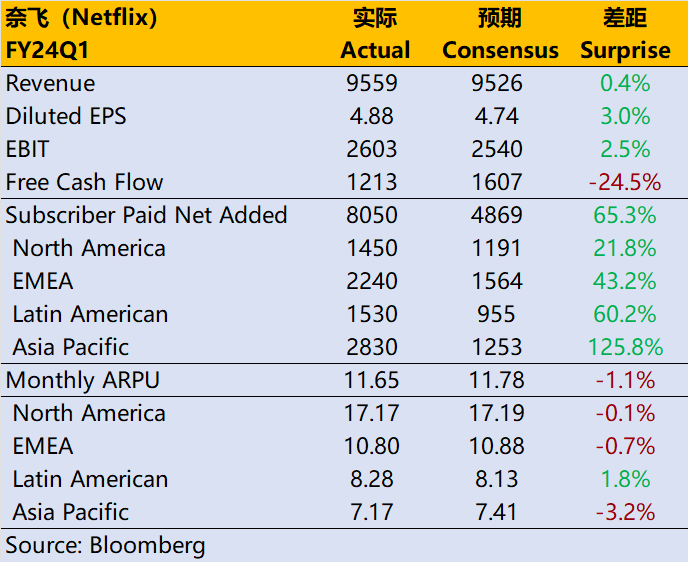

Revenue growth of 17% year-over-year continues to be the best in two years, a little higher than market expectations.The stock is also up more than 20% since last earnings season.It also expects revenue growth of 13% to 15% in FY2024.Nifty's 2024 revenue growth is dependent on the results of the crackdown on shared accounts and the growth of the advertising business;

Profit continued to grow with operating margins remaining at 27%, continuing to benefit from growth in the high margin advertising business.Full year operating margin guidance was raised to 26% from 25% in the prior quarter;

Net subscriber growth of 8.05 million was marginally above market expectations, although guidance for the next quarter appears conservative, with the company saying it will be lower than last year's growth.This miss is understandable because last year's Q3 was the first quarter when the crackdown on shared accounts began, so the base became larger.On the other hand, the growth is still driven by Asia, such as Japan, India, Indonesia and other regions, increasing the penetration rate of these regions, which also has a strong effect on the subsequent promotion of the light business.

The growth of advertising business is obvious, the ad-supported package user growth of 34%, at the same time, in the countries that provide advertising, about 30% of the new registered users to choose ad-supported package, in the overall landed advertising package market, the proportion of users who choose advertising has reached 45%, this kind of package has a relatively lower pricing, and therefore also pulled down the overall ARPU, but on the other hand, also to theThe market has already reached 45% of users opting for advertising packages, which have relatively lower pricing and therefore lower overall ARPU.

Is the guidance miss or not?This also requires to keep an eye on the impact of exchange rates.Q2 FX-neutral (excluding exchange rate effects) revenue growth came in at 22%, up from 17% in USD terms.The five points came mainly from the impact of the strong US dollar, with a major devaluation of the Argentine exchange rate in Latin America, resulting in revenue growth in local currency terms (9.9%-18.5%) that did not show an advantage.On the other hand, Q3's revenue guidance of 14% year-on-year growth would have been 19% growth at neutral exchange rates, even more than this quarter.So the exchange rate factor is important.Next if the Fed is expected to cut interest rates in September, it could make the dollar weaker and give the company more exchange rate advantage.

The dip in free cash flow may not be bad news.Last year's wave of strikes by Hollywood screenwriters kept all the streaming vendors from investing much in content, and Neflix ate into a wave of dividends because of its own large content inventory.And now it's starting to continue to invest in content, which may have an impact on cash flow, but it's also a way to further bolster its content inventory.In addition, the company continued its $1.6 billion buyback in Q2.If the decline in cash flow is significant, it's possible that this trend can't be sustained.

The earnings report comes at a time when tech stocks are pulling back, so Nifty's shares have already pulled back a bit.Coupled with the fact that investors were more focused on a few miss points when the earnings report was first announced, it was down over 7% at one point, but then it also reacted to the fact that the guidance wasn't actually miss, and that the exchange rate headwinds may start to change in Q3, while the impact on margins will often need to be reflected in the stabilization of the advertising business growth rate, and so investors are still happy to maintain the current valuation.

Q2 Earnings Data

Subscriber growth.

Added 8.05 million paid subscribers, exceeding market consensus expectations.

Total global subscribers reached 277.65 million.

Financial performance.

Revenue amounted to $9,559 million, up 17% year-over-year and slightly ahead of expectations of $9,530 million.

Earnings per share of $4.88 were in line with expectations.

Advertising.

Ad-supported program users grew by 34 percent.

In countries where advertising programs are offered, approximately 30% of new registrations opt for ad-supported programs.

Content Investment.

Maintain $17 billion in annual content spending.

Profitability.

Operating margin improved to 27.2%, up nearly 5 percentage points year-over-year.

Full-year operating margin target raised to 26%.

Cash flow.

Free cash flow was $1.213 billion, below analysts' expectations of $1.6 billion.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Futures are up after Netflix, NFLX, posted the first Big Tech earnings, while the Russell is down slightly due to a small bounce in the 10 years yield

NFLX with full expectations seems to be inline, but it is unclear whether it is acceptable to have such a large increase in membership and weak sales guidance.

Netflix's result NFLX exceeded estimates, but shares fell after hours due to weaker-than-expected guidance.

The earnings of NFLX were better than expected, but were not quite as well received after-hours

Free Cash Flow decreased slightly compared to the same quarter last year but remains strong.