NFLX Q2 Overview: A high-growth model to high profitability.

Despite post-market volatility, $Netflix(NFLX)$ delivered an impressive earnings report, with both revenue and EPS surpassing expectations. global paid memberships growth exceeded forecasts, and the company raised its full-year revenue growth forecasts. The post-market fluctuations were more a result of high prior expectations. Despite the recent tech stock pullback, NFLX has still gained over 30% year-to-date.

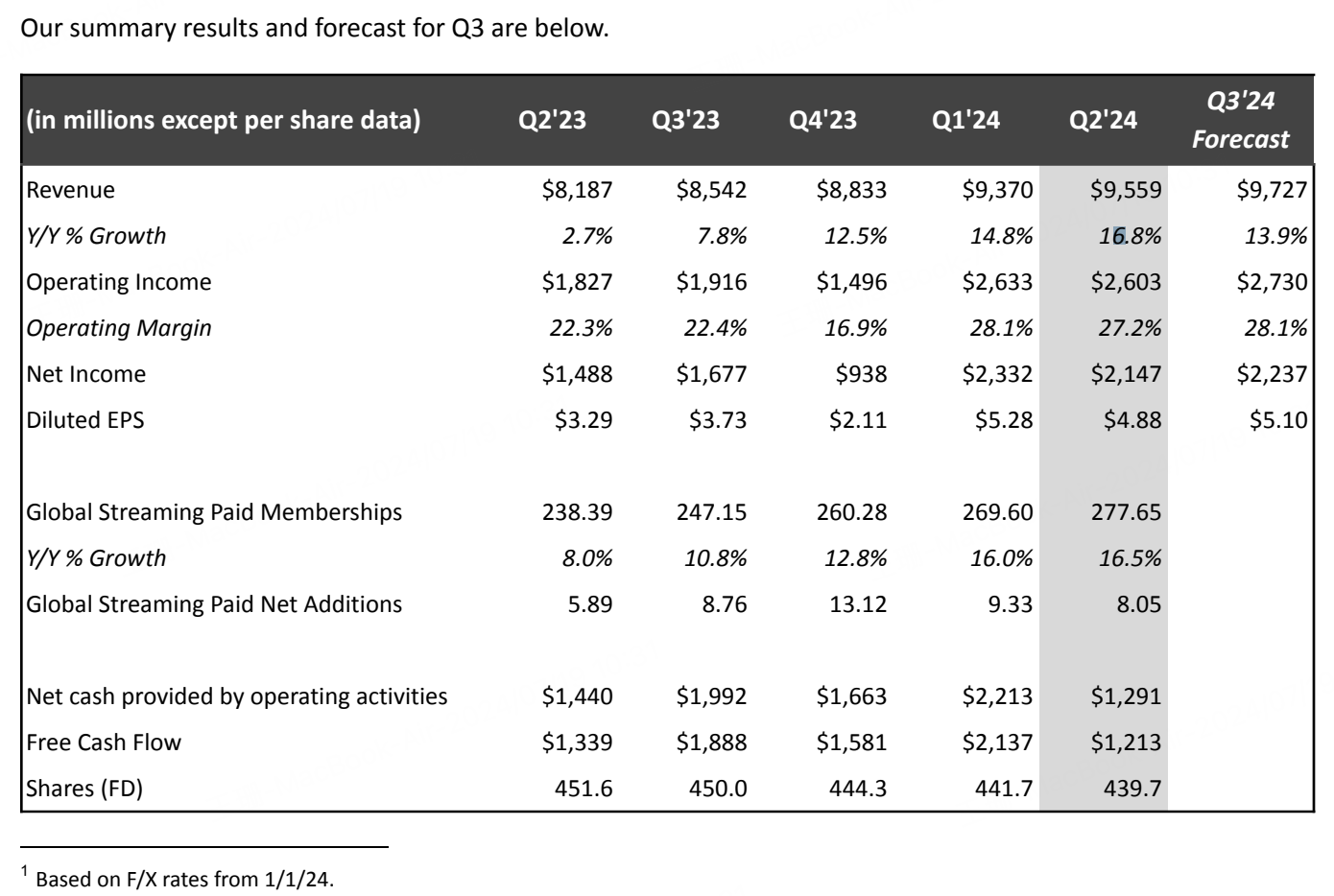

Q2 Key Financial Metrics:

Quarterly Revenue: $9.56 billion, up 16.8% yoy, beating the estimate of $9.53 billion.

Diluted EPS: $4.88, surpassing the expectation of $4.74.

Operating Profit: $2.6 billion, vs the expectation of $2.43 billion, with an operating margin of 27.2%, slightly lower than last quarter's 28%.

Global Paid Memberships: 278 million, with a net addition of 8.05 million for Q2, significantly higher than the expectation of 4.87 million.

Guidance:

Revenue: $9.73 billion, up 13.9% yoy, slightly below the estimated of $9.8 billion. However, the operating margin is projected to return to over 28%, with EPS at $5.10, beating expectations.

The company raised the midpoint of its 2024 full year revenue growth forecast from 14% to 14.5%, indicating optimism about its outlook.

In the previous quarter, while Netflix's earnings exceeded expectations, the announcement that it would stop reporting new subscriber additions and ARPU metrics starting in 2025 raised concerns about long-term user growth, leading to a 10% stock drop post-earnings in April.

However, this quarter's subscriber numbers indicate that growth has not slowed. The company stated that it will shift its focus from paid subscriber growth to revenue and operating margin as the main financial metrics.

After building a strong user base and stable subscription foundation, Netflix's second growth curve—its advertising business—is showing promise.

Currently, Netflix offers an ad-supported plan at $6.99 per month in 12 countries/regions. In Q2, the paid subscriber count for this ad-supported plan grew by 34% year-over-year. However, the company expects the advertising business will not be a major growth driver until 2024-2025.

Netflix Co-CEO Greg Peters noted in the earnings call that Netflix is focused on expanding its ad-supported user base. With the company on track to achieve its 2025 user goals, it is now shifting focus to monetizing its ad inventory. This will enable Netflix to further increase its ad-tier subscriber count in 2026 and beyond.

This indicates a strategic shift from a high-growth, low-profit model to one of steady growth and high profitability.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jazzyxx·2024-07-19Impressive earnings reportLikeReport

- LeonaClemens·2024-07-19Impressive growth and profitabilityLikeReport