How did AI boost Palantir?

Despite a thrilling Monday across the market, $Palantir Technologies Inc.(PLTR)$ reported strong results for 2024Q2 on Aug. 5 after-hours.

Investment Highlights

Overall revenues realized significant revenue growth, with a 27% year-over-year increase in revenues to $680 million in a single quarter.It exceeded the market consensus estimate of 6.53 there, showing a strong expansion of the company's business.

Among them, government revenue grew 23% year-on-year, continuing to pick up, the main factor is still the situation in some volatile regions of the world remains so, the demand for defense as well as foreign aid to generate a steady stream of new orders. q2 ringing Q1 contract size has increased significantly;

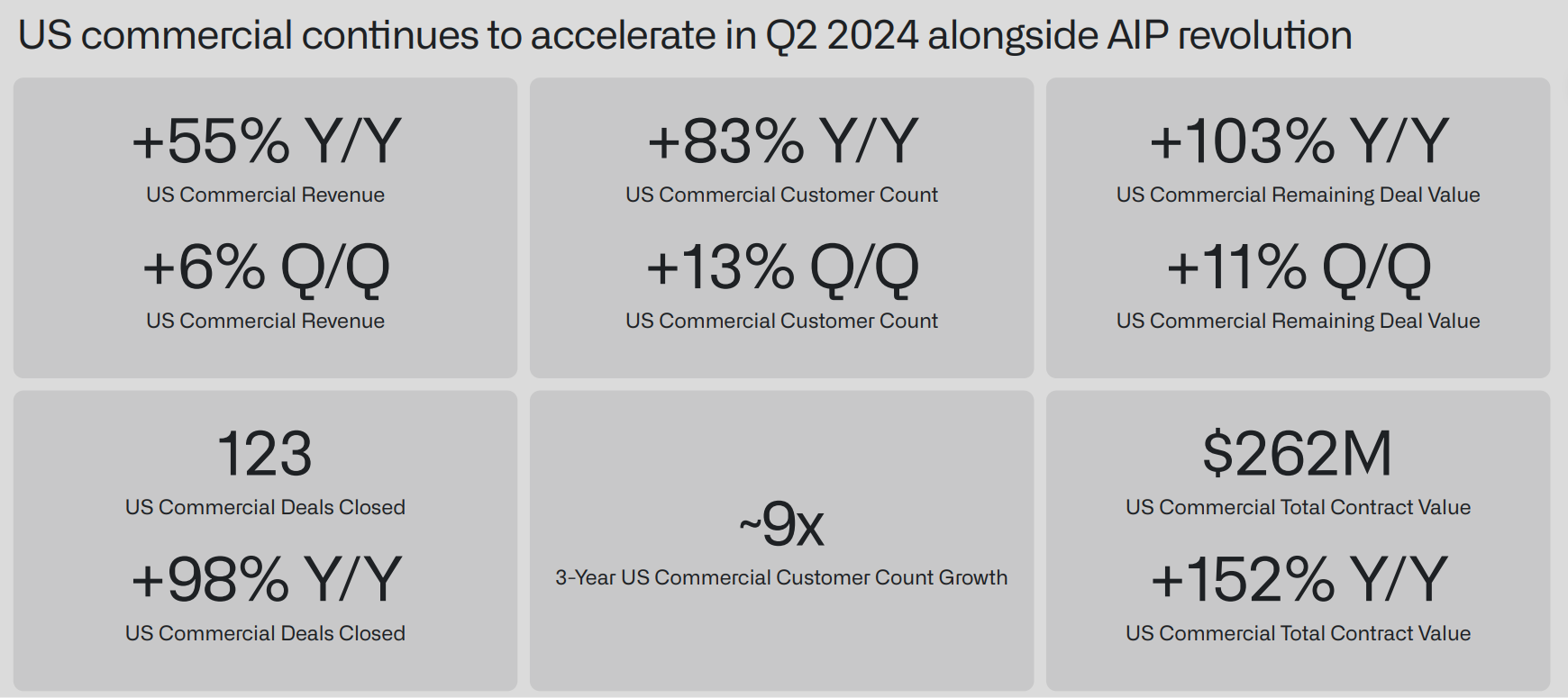

Meanwhile, the commercial growth rate also started to pull up, reaching 32.4% year-on-year, benefiting from the launch of the AIP platform and rising customer demand.This is a key underpinning of AI's rapid emergence as a key driver of commercial revenue growth.Since its launch at the end of April this year, more than 140 organizations have adopted its AIP (Artificial Intelligence Platform).Palantir is well positioned in the emerging AI market.

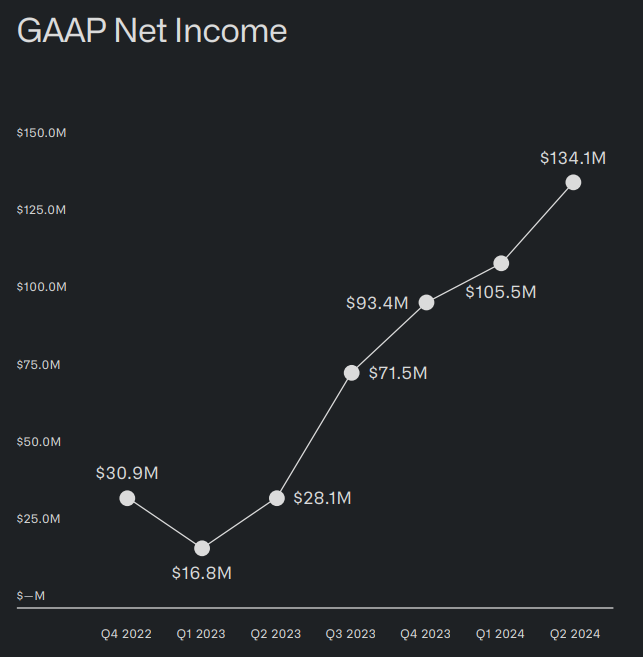

Significant progress has also been made on the profitability front. net profit of $122 million in Q2 was much higher than the $31 million reported in the same period last year.Adjusted net income was $254 million, above the market consensus estimate of $211 million.

The customer-side base continued to expand.The number of U.S. commercial clients grew 35% year-over-year to 376.This demonstrates the company's increasing penetration in the private sector and helps to diversify revenue streams.

Strong cash flow performance.Adjusted free cash flow for the second quarter was $20.5 billion, an increase of 13 percent year-over-year.This healthy cash generation capacity supports the company's future growth and investments.

Strongly Raising Full-Year Outlook Palantir raised its full-year 2024 revenue guidance based on a strong second quarter performance.The company now expects full-year revenues to reach $2.32 billion to $2.34 billion, which is higher than previous expectations.This indicates that management is optimistic about the company's performance in the coming quarters.

Market ReactionDespite the overall strength of the earnings report, Palantir's stock price fell after the release.This may reflect market concerns about the company's valuation or questions about the sustainability of future growth.But compared to Q1, which plummeted due to weaker-than-expected results, Q2 has been relatively more stable post-earnings.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Dumplinggogh·08-08Why is it not at 40 range despite all the AI hype and strong profitability? Technical data doesn't support market sentiments.LikeReport

- winzy·08-06Impressive results for Palantir in 2024Q2LikeReport

- Alex Puffin On Two Smokes·08-06hmmLikeReport