Disney Q3: What to expect & What to worry about?

Before the market opened on August 7, entertainment giant $ Disney (DIS)$ announced its fiscal year 2024 Q3 (ending June 30) earnings report, with a lot of highlights, and the market's reaction is also very real.

On the good side, the streaming business turned a profit ahead of schedule, the gradual price increase of packages has been accepted by the market, movie content has recovered from last year's "writers' strike" downturn, and sales of the experiential division have rebounded;

On the downside, theme park spending weakened ahead of schedule, mainly due to the decline in overall U.S. consumption and the depletion of residents' savings.

While Disney's management remains confident in its full-year guidance, investor feedback to the market has been poor, with concerns that the higher-margin theme park business will continue to languish, dragging down the company's overall performance, as well as concerns about intense competition in the streaming and content sectors.

Earnings overview

Overall Revenue and Profit: revenues for FY24Q3 were $23.16 billion, up 2% year-over-year above market expectations of $23.08 billion.Adjusted EPS was $1.39, higher than the market's $1.19 estimate.The main reason is that the company in a number of business segments in the "loss reduction" more than expected, at the same time, the proportion of high margin business back.

By business segment

Streaming business: turned a profit in the quarter, posting an operating profit of $47 million on revenue of $6.38 billion, compared to a loss of $512 million a year ago.This is a major milestone since the launch of Disney+ in 2019.Nonetheless, the streaming business had a weaker performance in India due to seasonality in sports programming;

The theme parks business underperformed, with Experiences segment revenues slowing significantly to 2.3%, while overall theme park operating profit declined to $1.35 billion, including a 6% year-over-year decline in the U.S. and Canada.

Traditional cable continued to decline, with revenues falling 7% year-on-year to $2.66 billion in the quarter, as more and more households canceled cable and affiliate fees fell sharply, while advertising revenues declined due to the launch of rival Neflix, although of course this part of the decline was expected by the market.

Investment highlights

New expectations in the content division.

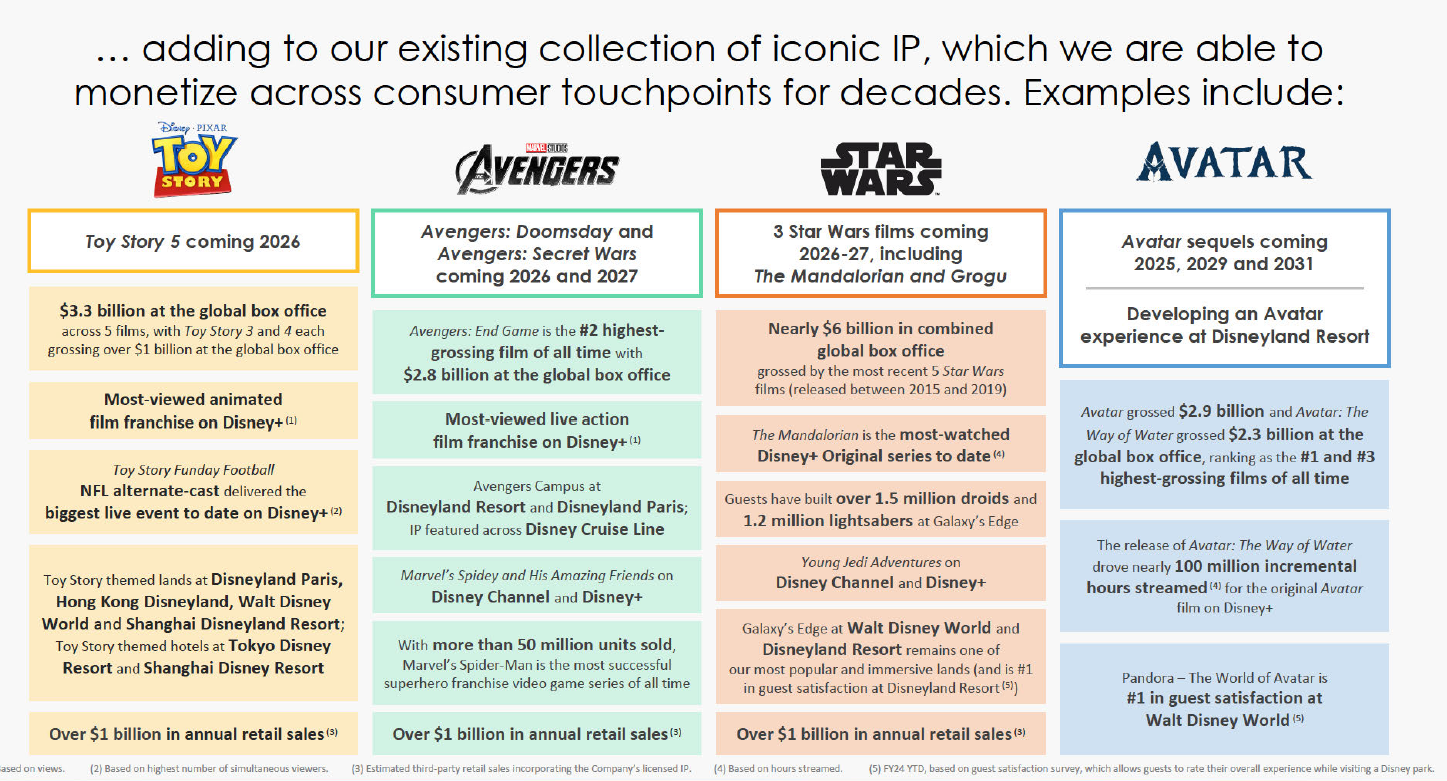

The movie division has recovered nicely in terms of profitability, and while a lot of fans are in disagreement with what comes after the Marvel Universe, Disney's creative credentials across the board are still on the line, such as this year's Brainiac 2, which once again was a word-of-mouth and box-office hit.It's also climbed out of the effects of last year's writers' strike, and will be followed by a number of heavy hitters over the next two years, such as Finding Dory, The Lion King: Mufasa, Captain America, and Snow White.

The cable division will keep slipping, that's the general trend, but the key will be to see if streaming, especially ESPN's sports streaming, can pick up the slack, and if the buttressing delivery of the advertising business goes smoothly. After Disney reorganized the business units, ESPN's strategic position has increased, the cable division of ESPN and streaming ESPN + a sports business unit, enough to see the importance of this business.

The launch of the all-new version of ESPN on the line in 2025 is equivalent to a bet on the sports track again; the new contract with the NBA will begin to take effect in fiscal year 2026, which is expected to bring hundreds of millions of dollars in revenue growth.

The streaming business turned a profit.

One uncertainty in the streaming business comes from negotiations with Hulu over its valuation, which would require a $5 billion charge if it loses.Because $ Comcast (CMCSA) $ also know the market situation, not easy to give in.

Disney's turnaround in streaming is actually partly due to the "Disney + Hulu" bundle, which makes it easier to allocate profits to the "Disney + Hulu" bundle.

At the same time, Disney for streaming media package prices often change, but the price change is not much, this is also with $Netflix(NFLX)$ to form a "tacit understanding".The change in ARPU is mainly due to the shift in bundling and ad-supported models, but the company is satisfied with the profitability of these models.

The outlook for theme parks is poor.

This may not be a problem for Disney alone, but rather a global slowdown in demand for these entertainments.Disney's theme park business, while flat in the quarter, has already seen a decline in margins in North America, and the company expects this slowdown in demand to continue for several quarters.Meanwhile, the revenue share of the Experience division, where the theme parks are located, has risen 10% while the profit share has risen 30%, and investors are very concerned that the waning of this high-margin division will drag down the performance of the entire company.

Of course, the company has some new plans, such as the launch of three new cruise ships in the next 18 months, which will have a positive impact on revenues, but will also come with some start-up costs.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- BlancheElsie·08-08Concerns rising! [Speechless] [Sad]LikeReport