How Warren Buffett "in love" with Ariana Grande?

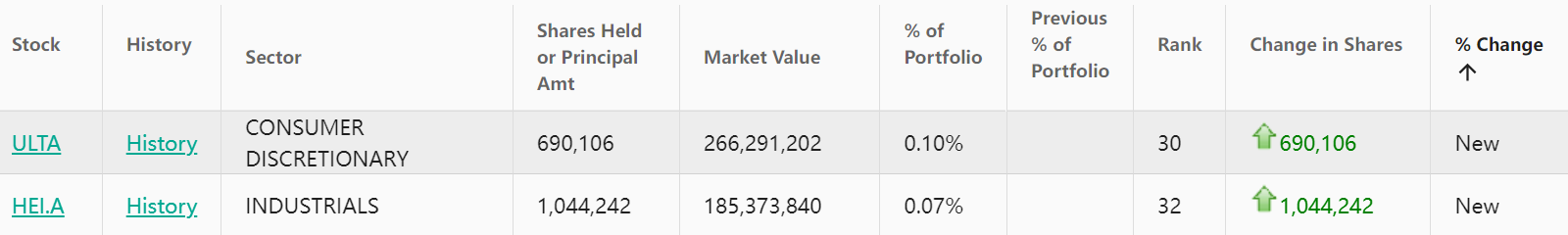

Buffett's announced 24Q2 13F featured one company that appeared out of the blue, in addition to the known big cut in Apple.Berkshire opened its first position in Ulta Beauty, a beauty and cosmetics retailer. $ulta beauty(ULTA)$ $Berkshire Hathaway(BRK.B)$ $Berkshire Hathaway(BRK.A)$

This position represents only 0.1% of Berkshire's portfolio.

After all, Warren Buffett "doesn't like to touch stocks outside his circle of competence."

Why Ulta Beauty?

Ulta Beauty's main products cover the following main categories:

Cosmetics: includes makeup, skincare products, tools and brushes.

Skincare: covers a wide range of skincare brands and products.

Fragrances: offers a wide range of brands of fragrances.

Bath and Body Care: includes bath products and body care items.

What's the advantage to be had?Not really, even if there is a bit more variety than peers (roughly 26,500 vs. Sephora's 16,500), it's not so much that it can be unique in this industry.Other operational aspects of the strategy include:

One-stop shopping experience

Digital marketing and online sales

Co-branding with the entertainment industry (Kylie Jenner\Ariana Grande)

This is a common strategy for consumer goods companies these days.

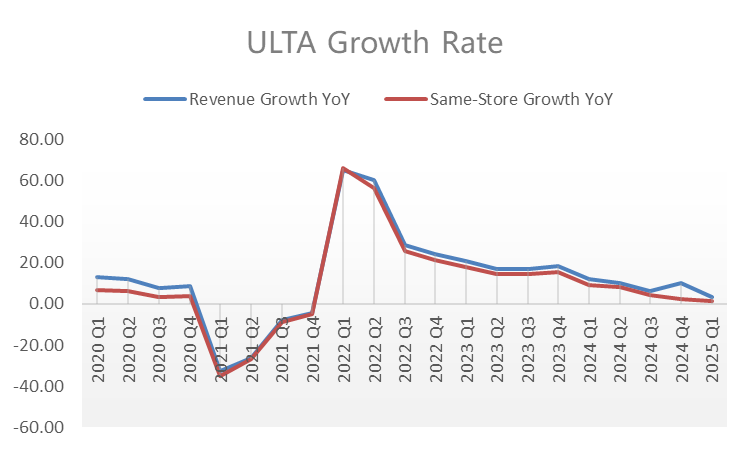

The only good thing that can be said about the performance is that it is relatively stable.With the exception of a few quarters during the epidemic, revenues have grown steadily, but it's not exactly a "growth company".

The key is that it does not pay dividends, so how did it attract the attention of Berkshire?

Does Buffett see an inflection point in the market, or is he trying to make an "alpha"?

Warren Buffett's positions all have these commonalities, and it just so happens that ULTA fits them all!

A deep moat (beauty)

Stable and upwardly mobile performance (although growth has fallen to single digits, it is still better than many consumer companies)

Lower valuation (current TTM PE of 12x)

Excellent cash, and preferably a dividend (better balance sheet, no dividend yet, but one is expected)

And choosing to open a position at this point in time

Left side traders opening positions can often be before the market bottoms out.Since this is a Q2 13F, judging by some of the consumer data released in July, it may not have bottomed yet.

It could mean that Buffett has "bottomed out" on consumption.Because the probability is that interest rates will be cut by 50 basis points in September, the high interest rate environment is very stressful for households with high levels of indebtedness, and if the rate-cutting cycle begins, it means that the U.S. consumer market may be in a turnaround.

Consumer Discretionary has been far more cyclically volatile than the broader market and is likely to be ahead of the indices.As you can also see from the chart of the last 10 years, this is a relatively low time for ULTA/SPX, and even if one were to bottom SPX, a position in select ULTA would likely have a higher alpha. $S&P 500(.SPX)$

How to beat magic with magic?

In fact, according to the current stock price, Buffett's deal is still in the "floating loss" stage, which is the probability of left-sided traders will encounter the situation.Even after the news was announced after-hours up 12%, at best, is close to his cost price.

In other words, if you buy now, you are "bottoming out" on Warren Buffett.

Of course, there is another way to beat the magic, and that is to "bottom" the Buffett way, by choosing Sell PUT options, which is a good choice for both premium income and position building.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- HunterGame·2024-08-15沃伦·巴菲特的有趣举动LikeReport

- BotakGuy·2024-08-15ThanksLikeReport