Alibaba Q1: Weak Consumption, Fierce Competition, High Valuation

E-commerce earnings report to see Ali, Ali earnings report to see Amoy days.Just out of the end of June earnings (Ali Q1 FY2025) still continue to last quarter's "mixed". $Alibaba(BABA)$ $BABA-SWR(89988)$ $Alibaba(09988)$

Worries

The most important domestic retail "Taotian Group" was unexpectedly Miss expectations, and because the market in the Q2 domestic consumption environment changes in the overall environment, has lowered expectations, so the consensus is more conservative, but also shows that Taotian industry is still under pressure.

The growth rate of international business, Cainiao logistics and other businesses is still optimistic, but since the market also has high hopes for this, expectations are higher, and the revenue side of the business is also slightly weaker than expected.

The growth rate of offline retail business is less than expected.

Overall margins declined and profits paid to grow, negatively impacting valuation

Pleasant aspects

International business and Cainiao logistics played more steadily, while losses decreased year-on-year, and although the Southeast Asian e-commerce landscape is still undecided, it is moving in a benign direction.

Revenue and profit performance of the cloud business both exceeded expectations, clearly driven by AI-related products as well as public cloud services.

Although the revenue of Cainiao Group was slightly weaker than expected, the growth rate was still 16%, and the impetus from cross-border logistics was a plus.

Other loss-making business "loss reduction" effect of a step up.

Investment highlights

Amoy Group's performance seems to be a clear sign that the rate rule adjustment is the biggest "hope".

"Taotian Group" performance is not as expected, the thing itself is not very surprising, because the overall consumer environment in Q2 so.The market naturally does not pay too much attention to macro-level factors, but focuses more on Ali's own changes to the merchant structure, the user side of the penetration of the effect.According to the CEO, it was "successful".

In terms of segmentation, the most important customer management CMR growth rate of less than 1%, first of all, can be positive growth is also good, at least the market will not be too worried about "Shake" and "Pinduoduo" to poach Amoy days of the base, but the growth rate is also worse than the market expected 3%.But the growth rate is also a little worse than the market's expectation of 3%, which also indicates that the market expects Ali to be more "aggressive" towards sellers, and of course this expectation must come from Pinduoduo (which is squeezing the merchants).Of course, the consequences of Pinduoduo's excessive pressure on merchants may not have reached the stage of centralized outbreak.

In July, the Taotian Group announced several important rule adjustments on the merchant side.Briefly it includes:

Disguised rate increases (basic software service fees), i.e., impacting platform realization rates.The effect is that it may bring up to tens of billions of dollars of new revenue to Ali for the whole year.

Changing the core scoring criteria and giving more "preferential treatment " to high-quality merchants; changing the distribution mechanism, implementing the survival of the fittest, and improving the viscosity of merchants.The effect is not to follow JD.com's practice of "tilting buyers" and treating merchants by category.

In fact, Ali launched these measures in July, but also certainly see their own (relative to peers) shortcomings (platform realization rate is not high enough), but also can not always be led by the nose in the competition ("only refunds"), In the long term, simply tilted to the buyers can not be stable growth.

In addition, from the consumer level, direct and other business fell 9% year-on-year.Considering that Taobao spun off "88VIP" to gain higher penetration in this year's 618, it actually shows that the overall purchasing power is indeed unsatisfactory, but this is a clear card.

The growth momentum of international commerce is still good, and cross-border logistics is supported in both directions.

The growth rate of international business remained at 32.4%, which was built on the high base foundation of the same period last year, as well as higher market expectations.But losses also zoomed up, to $3.7 billion from 4 hospitals last year, underscoring the fierce competition in overseas markets.

Trendyol and Sizzler grew at a more pronounced rate and the cross-border e-commerce business was a bit better, while Lazada's realization rate was also mentioned to have suffered.This was also reflected in Shopee's (SE) earnings beat from the other day.Southeast Asian e-commerce is also very much in the roll, but overall, under the multiple pressures of Pinduoduo Temu's low-priced attack, Shopee's market share gains, and Tik Tok's live-streaming e-commerce, it's not a bad achievement for overseas e-commerce companies such as Lazada and Speedway to hold on to their 32% growth rate.

Cainiao is a direct benefit of cross-border logistics growth, but the overall market is expected to be a little higher.The overall consumption level in Southeast Asia is still a bit worse compared to Europe and the US, so the low price strategy may not get the same effect, so the local channel may be more important.

AI brings surprise to cloud business, local life, entertainment and other businesses still pursue to improve efficiency

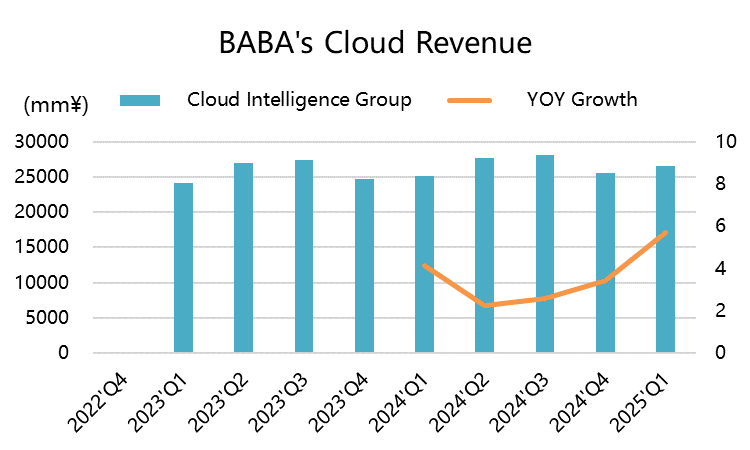

The revenue growth rate of cloud business reached 6%, outperforming the overall business, while the bigger surprise was that the profit greatly exceeded expectations, with EBITA margin reaching 8.8%, a new high after cost reduction and efficiency enhancement, and double-digit growth rate for the realization of AI products, as well as the pull of public cloud products, while the company is also taking the initiative to phase out the projects with lower profit margins.

The overall performance of local life, cultural entertainment, and other businesses (including Ali Health, Gaoxin Retail, Box Ma, etc.) has been sluggish, which is a drag item in the whole group, and is also due to the general environment of consumption.The good thing is that the effect of loss reduction is improving.

Overall margins are decreasing and next quarter margins become key, right now supported by buybacks.

Revenue is growing at 4%, but operating profit -15%, and even adjusted EBITA profit is -1%, which will somewhat allow valuations to get higher and higher (with rising profit multiples).

The culprit is still the main source of profits - the Taotian Group.So how much of the revenue from the important rule adjustments for merchants will turn into margin growth after next quarter will be critical to the company's valuation.

Meanwhile, buybacks reached $5.8 billion in a single quarter, which is a way to ride out the storm with investors until the general environment improves and the company's new rules are realized.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?