BIG TECH WEEKLY | How Institutions Take Big-tech Positions In Q2?

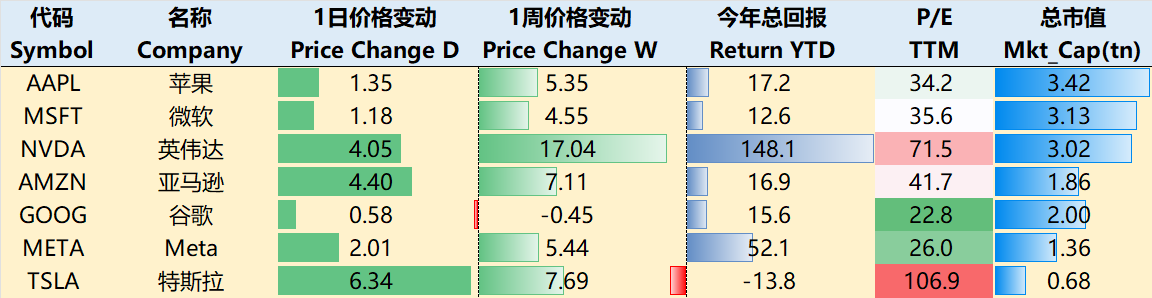

Big-Tech’s Performance

Since last week's feared sell-off, the broader U.S. stock market has rallied strongly in back-to-back weeks, and NASDAQ has regained the ground it has lost since August, with some tech stocks once again nearing new highs. the CPI data fell as expected, paving the way for the Federal Reserve to cut interest rates.The quant-led market is once again in a building rhythm, with the fear index at record lows.Typically, if the market enters a buying streak, that stacking effect causes the market to accelerate its recovery.

Through the close of trading on August 16th, the big tech companies factor rallied over the past week. $Tesla (TSLA)$ +6.34%, followed by $Amazon (AMZN)$ +4.4%, $Nvidia (NVDA)$ +4.05%, $MetaPlatforms(META)$ +2.01%, $Apple(AAPL)$ +1.35%, $Microsoft(MSFT)$ +1.18%, $GoogleA(GOOGL)$ $Alphabet(GOOG)$ +0.58%

Big-Tech’s Key Strategy

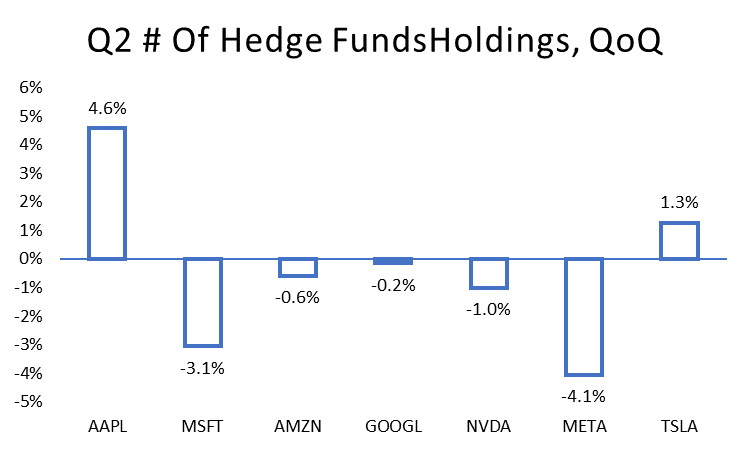

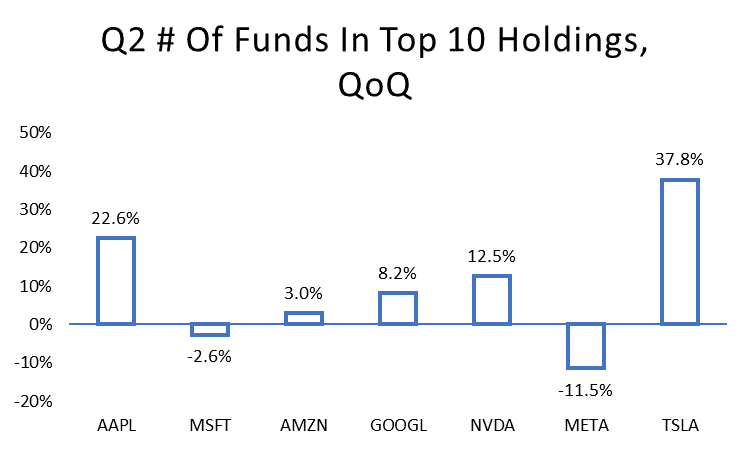

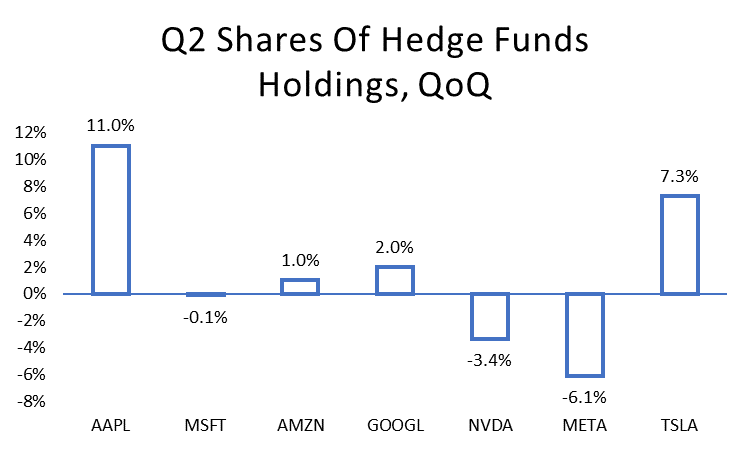

Did hedge funds start reducing their Big Tech positions in Q2?

With this week's concentrated 13F release, institutions' Q2 positions are at a glance.Since the turn in the market started in July, June remains the peak month for concentrated institutional positions.

Even with quantitative dominance and a large number of similar CTA strategies, not all institutions tend to trend trade.In particular, some active funds, including Warren Buffett's Berkshire, have begun to choose "different" operations, for example, began to "reduce" positions in large technology companies.

AAPL

While institutions remained stable, with hedge fund holdings of AAPL up 4.6%, hedge funds with AAPL in their top 10 holdings rose 22.6%, further validating the concentration of holdings.Hedge fund holdings were up 11%.Open positions and additions grew significantly more than liquidations and reductions.Additionally, Call's position rose 14%, while PUT's position rose 16% (both buy-side and sell-side).

The biggest change was that Berkshire halved its position, but remains the largest outside active fund, still accounting for 2.45% of Apple's total equity.In addition, eight active funds, which weight AAPL over 50% of their asset portfolios in equity assets, including Y.P. Duan's H&H, which saw its AAPL percentage rise to 81% despite a Q2 position reduction of 660,000 shares.

META

Passive institutional positions were relatively stable, but hedge fund positions decreased by 4.1%, while hedge funds entering the top 10 positions decreased by 11.5%, compared to a 6% decrease in overall holdings.The exact opposite of AAPL and echoing previous market concerns about META's performance.

But META remains the largest position of 42 institutions, including Zuckerberg's own foundation.In addition large institutions, including the Norwegian sovereign fund, have added to their positions in large numbers.

NVDA

Q2 positions in NVDA were little changed by institutions, hedge funds relatively also decreased by 1%, but due to its faster growth in market capitalization, it jumped into the top 10 positions of hedge funds increased by 12.5%.However, overall hedge fund positions decreased by 3.4%.New positions were down 39%, but additions were up 26% and liquidations were down 15%.On the options side, Call positions were down 29%, while PUTs were down 17%.

Overall, hedge fund attitudes towards NVDA diverged in Q2, where options Call/PUT have lowered their positions, and to some extent, speculative sentiment, and IV has been lowered along the way.

Big-Tech Weekly Options Watcher

NVDA, while not the main protagonist of earnings season, is still a major pull factor for the market, and its strength or weakness is representative of the market's strength or weakness.This week's consecutive rallies, once again standing at 120 also indicate the return of risk sentiment.

From the overall performance of options values, investors on August 23, August 30, the largest position in options have been lifted, Call were 105-115, PUT even to 105, which also implies that the market is optimistic about its expectations.

Big-Tech Portfolio

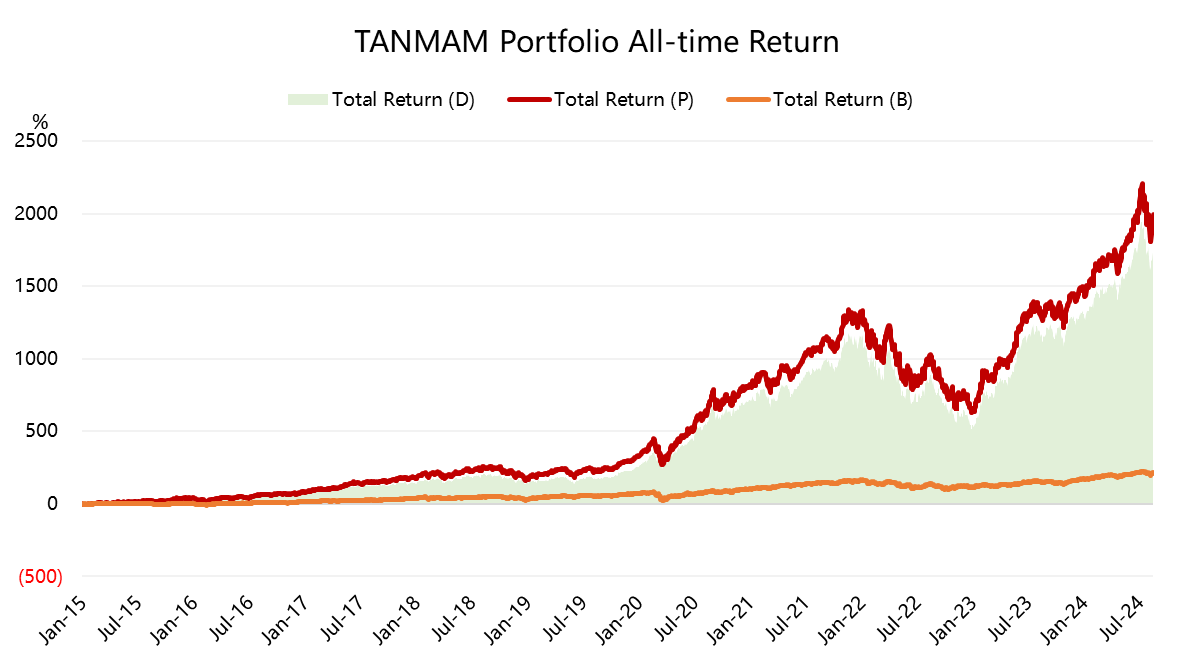

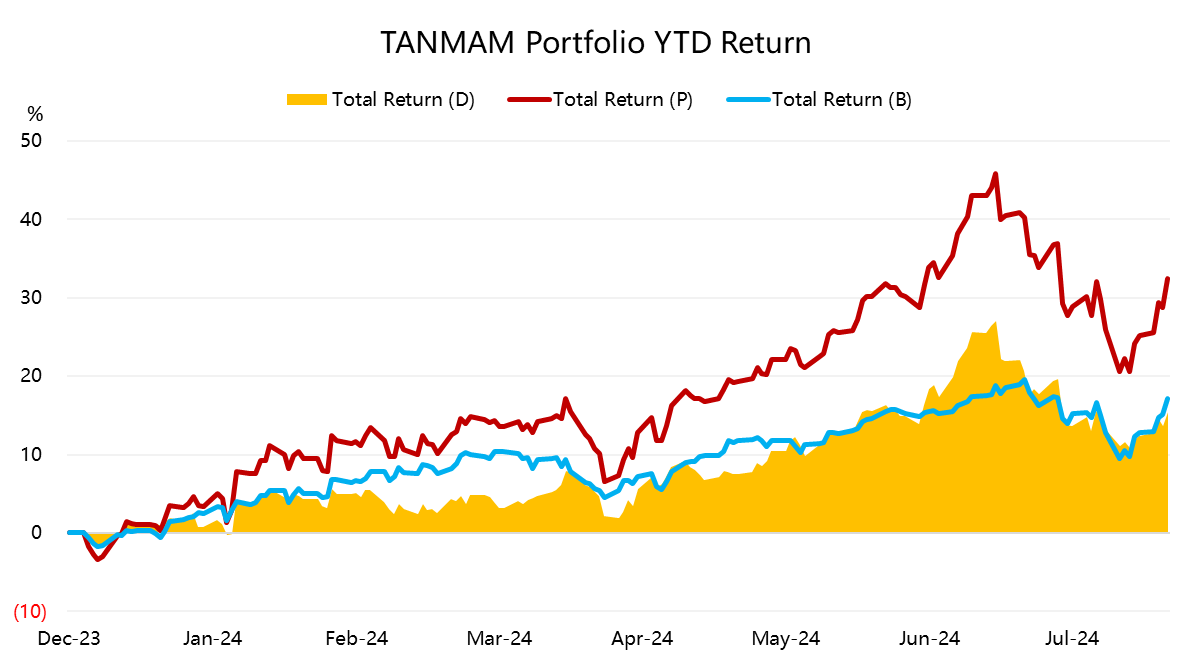

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtesting results are far outperforming the $S&P 500(.SPX)$ since 2015, with a total return of 1995.6%, while the $SPDR S&P 500 ETF Trust(SPY)$ has returned 218.5% over the same period, once again pulling ahead.

With the broader market pullback this week, the portfolio returned 32.5% year-to-date, outperforming the SPY by 17.1%.

The portfolio's Sharpe Ratio over the past year has fallen back to 2.0 compared to SPY's 1.8 and the portfolio's Information Ratio is 1.4.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

So much potential growth in India. Apple has only 6% market share but it’s growing 30-40%. Let’s go!

apple isn doing so well from iphone 15 lineups. Cant wait to see the new iphone 16

Apple will be the strongest stock today. Even on a red day will lead the pack!

These are the most profitable companies in the world!