How's US Retailors Q2 Earnings Reflecting the consumption?

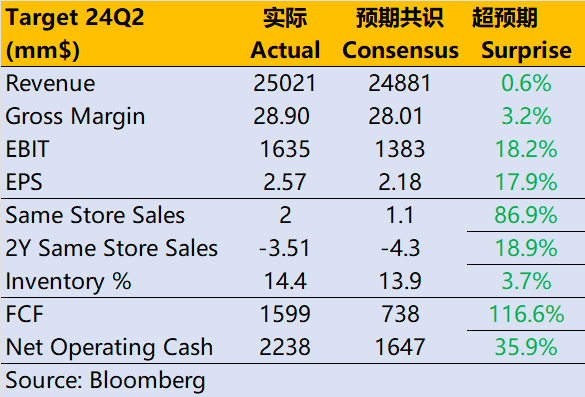

U.S. retail super are one after another announced the second quarter earnings, some of the super's fiscal quarter cut-off date for the end of July, so more reflective of recent consumer trends.

Overall, there are these three phenomena:

Food-related must spend more, but the unit price did not improve, go volume not price, can also exceed expectations;

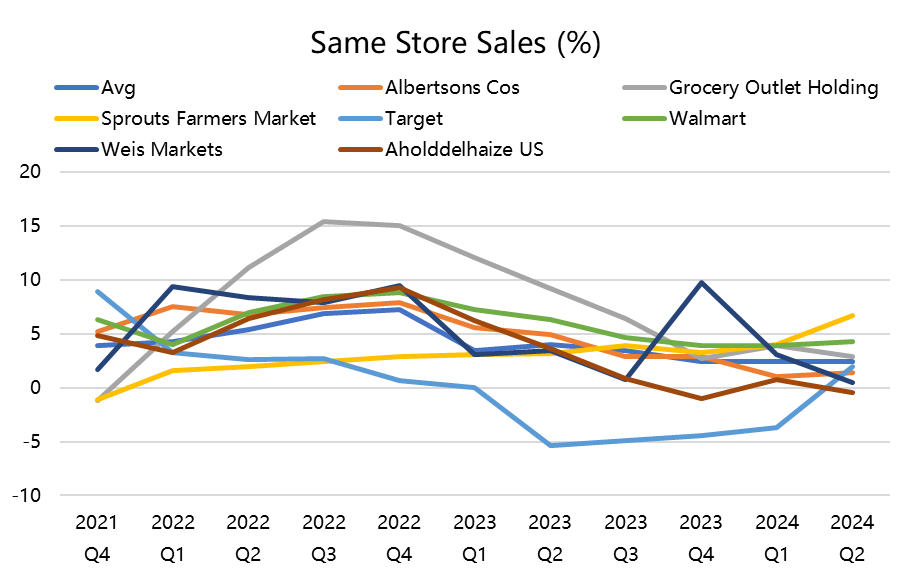

Consumption of other items of life, especially optional consumption further reduced, most categories of superstores performance to go worse, and less than expected;

Membership stores that also serve both online and offline gained further scale.

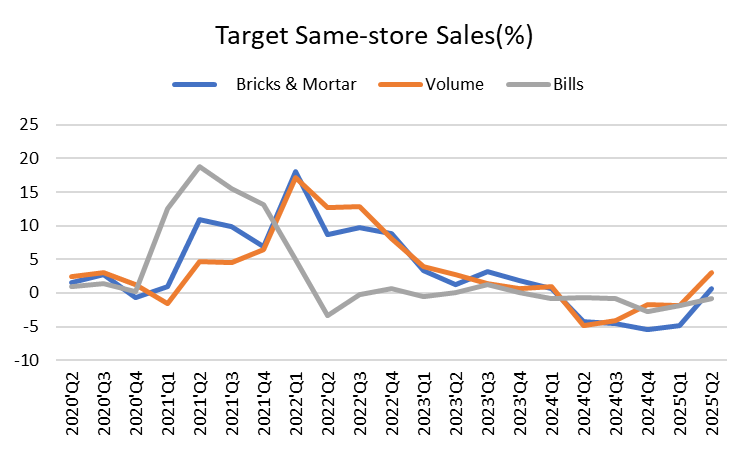

$Target(TGT)$ and $TJX Companies(TJX)$ which reported earnings on Aug. 21, showed similar signs, with brick-and-mortar same-store sales being lower than online.

In TGT's case, brick-and-mortar same-store sales of +0.7% year-over-year were unchanged from expectations, while online sales growth of +8.7% year-over-year was well ahead of expectations of 3.2%.

The 0.7% growth in brick-and-mortar stores included a 3% increase in volume, while single tickets were -0.9%.

Likewise, TJX performed similarly:

T.J. Maxx, which offers a diverse range of fashion apparel, home furnishings and accessories, with a special focus on upscale jewelry and designer-branded merchandise, declined year-over-year, and its counterpart, $Macy's(M)$ missed expectations and lowered its guidance;

Its largest discount retailer, Marmaxx, however, grew against the wind, with same-store sales +5% y/y.

As we've previously mentioned, $Wal-Mart(WMT)$ had an excellent quarter bucking the trend, with U.S. consumers eating out less ( $Starbucks(SBUX)$ and $McDonald's(MCD)$ re both down), while supermarket spending in the food category is bucking the trend.

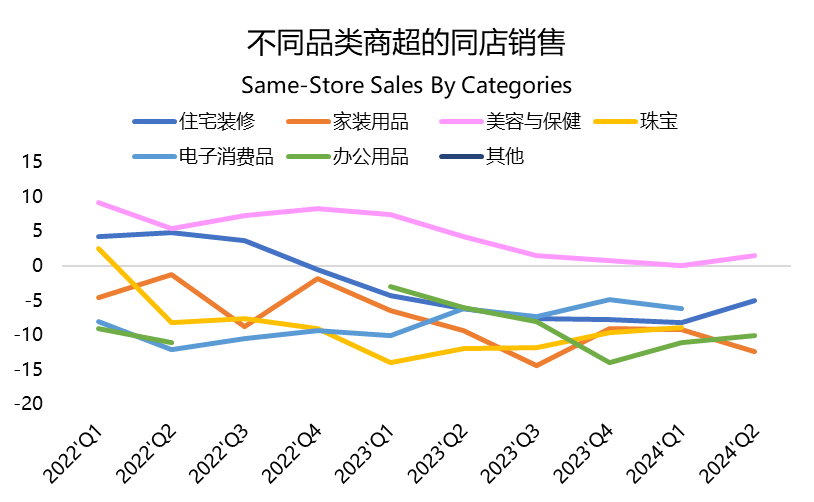

Taken together, same-store sales in the other categories are only a bit firmer in the Beauty & Health sector in the current dimension (still positive), but the trend is down in all sectors.

This is one of the "after-effects of inflation", but on the other hand, it is also a reflection of consumers' increased caution.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- glimmzy·08-22Interesting observationLikeReport