All You Need to Know About “ Buying the Dip Opportunities ” For US soybeans futures

There is a major trading opportunity for U.S. soybeans every four years. This rule has not changed in the past 20-30 years. This four-year rule is caused by the alternating cycle of weather.

The last important bottom of U.S. soybeans appeared in August 2020, which happened to be four years later in August 2024. Therefore, there is no reason for us not to pay attention to the important bottom strategic opportunities that may appear in U.S. soybeans.

Technical characteristics of the current bottoming out of US soybeans

The market of U.S. soybeans is usually based on the monthly line. Whether it rises or falls, it generally fluctuates unilaterally for 3-4 consecutive months. However, since June this year, it has fallen for 6-7-8 months. That is to say, September has entered the technical time for U.S. soybeans to rebound with a high probability.

In details, it is not ruled out that September will continue to fluctuate and fall, and it will rebound sharply during China's National Day . Although the lowest price in the history of US soybeans in the past ten years is still about 15% away from now, it is difficult for US soybeans to have such a big decline in time. Therefore, if you control the position well, you can hold and grasp this time well.

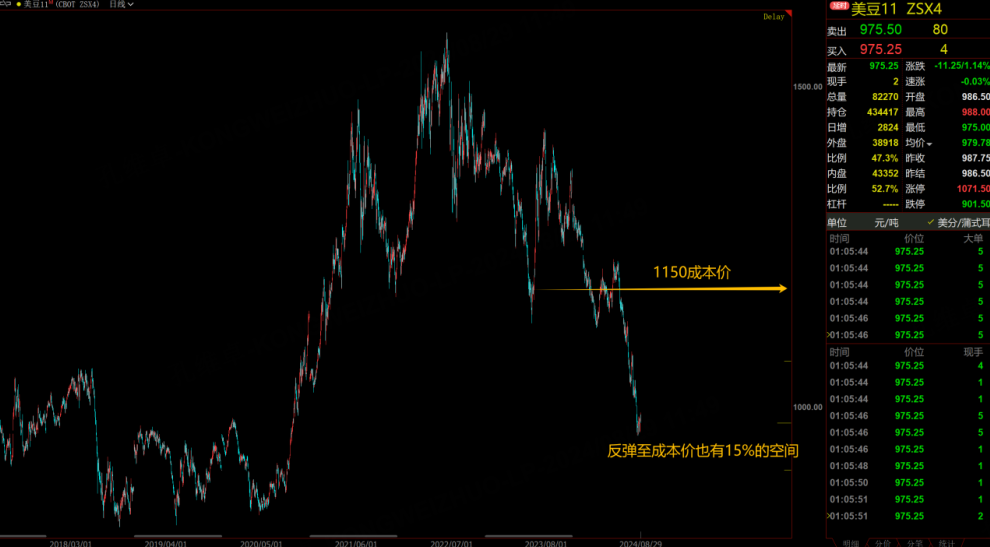

As I discussed with you in my previous post, the planting cost of US soybeans last year was between 1150-1200. This year's planting cost depends on changes in weather and energy prices.

So far, the weather in North America is normal, so the yield estimate is on the high side, so the price has fallen and the response has been completed; Energy prices are still fluctuating in a range, so the estimated planting cost of U.S. soybeans this year is generally slightly lower than last year's planting cost, and the estimated cost price is between 1050 and 1150.

Therefore, the current price of U.S. soybeans below 1,000 cents/bushel will cause farmers to suffer heavy losses. As the delivery time of the new crop of U.S. soybeans approaches, farmers will inevitably try their best to find reasons to boost prices, so that the harvested U.S. soybeans on hand can be sold to the market.

Therefore, this wave of rebound is fundamentally not low. Moreover, after September, the market subsequently began to price the weather in Brazil, the world's largest soybean producing area. Even if the weather is good, its cost price is close to that of U.S. soybeans, so in fact, the price risk is not high.

Trading the November U.S. soybean contract (new soybean contract), if the futures price breaks through the 20-day moving average in the short term, it will announce the end of the downward trend stage and enter the rebound time.

The trading can be divided into two parts. In the first part, regardless of the 20-day moving average, you can buy a small amount when you see a drop, this part of the position is a long-term investment position, do not act unless necessary, and wait for when it breaks through the 20-day moving average before adding positions.

The other part is waiting to be added when it breaks through the 20-day moving average. In principle, the added position should account for 50%-70% of the total planned position (if this position hits a new low in the previous period, it can be cut off). After that, the additional position will be gradually added depending on the strength of the trend. When the price rebounds to around 1130-50, profit will be taken at the stage, waiting for the next trading opportunity to come, or the profit will be locked in and reserved at the bottom position in exchange for greater market fluctuations.

$NQ100 Index Main 2409 (NQmain) $$SP500 Index Main 2409 (ESmain) $$Dow Jones Index Main 2409 (YMmain) $$Gold Main 2412 (GCmain) $$WTI Crude Oil Main 2410 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jollyfo·08-29I agree that buying the dip in US soybeans can be a great trading opportunity.LikeReport

- DonnaMay·08-29I love the strategy of buying the dip in U.LikeReport