Why you should consider investing in gold before November

There are only more than two weeks left before the US general election on November 5th. There are various opinions on American polls, and the results of different polls are that which candidate is ahead by a large proportion, which makes the poll results have little reference significance.

It seems that we will have to wait until the last polling day to know the results. Therefore, any current "Trump" or "Harris" transactions may be revised at any time. Everyone should pay attention to the market swing, and the general direction has not changed much.

The "Israel-Iraq conflict" boosts gold to a record high?

Current news points out that Israel plans to strike back against Iran, and it is rumored that the specific implementation time will take place before the US election, that is, further military actions may take place in the last two weeks.

If Israel takes action, then Iran will respond again, causing the conflict to fall into a "revenge cycle". Regardless of the effect of the attack, this will only boost the risk aversion of gold prices. Therefore, in the short term, gold prices are still easy to rise but difficult to fall.

Here, I would like to remind you of a risk time point, that is, from around the presidential election day to Double Eleven. After all, different presidents have different attitudes towards the war when they come to power. At that time, it will trigger a correction of the gold price. Pay attention to the timing. Moreover, around the last presidential election day in 2016, when Trump decided to win the election, the price of gold experienced a single-day bizarre fluctuation (the highest intraday increase was 4.8% on that day, and then all the gains were smoothed out at the close, which triggered a sharp drop in the subsequent gold price).

Therefore, although the current gold price is very strong, the rising logic is not very reliable, and the short-term decline is also very painful.

Israel dare not attack Iran's crude oil facilities?

The degree of Israel's retaliation against Iran actually depends on the tolerance of the United States. It can be seen from the Russia-Ukraine war that both parties to the conflict are very, very cautious in attacking nuclear facilities.

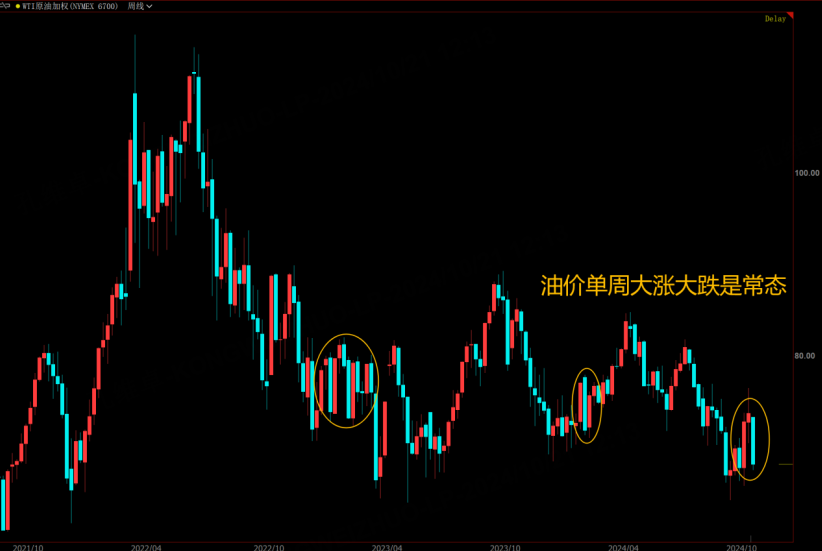

The United States also knows that attacking nuclear facilities will bring devastating consequences. Therefore, for Israel, the possibility of attacking Iran's nuclear facilities is very, very low. However, the consequences of cracking down on Iran's crude oil facilities are indeed relatively controllable. Although the United States will pressure Israel not to crack down on Iran's crude oil equipment in order to suppress inflation (last week's decline was caused by rumors that the United States asked Israel to give up cracking down on crude oil facilities), once it is hit, it will be a huge emotional positive for oil prices, and it can rise back as much as it falls.

I suggest you wait and see before the election to see what Israel's specific attack plan is before making a decision. If Israel really completely gives up the option of cracking down on crude oil facilities, oil prices will fall back into a negative market. Technically, the oil price is still in a volatile market. If it does not break through 78-80 US dollars, it is still not a confirmation of the upward trend. You may wish to continue to wait and see.

$NQ100 Index Main 2412 (NQmain) $$SP500 Index Main 2412 (ESmain) $$Dow Jones Index Main 2412 (YMmain) $$Gold Main 2412 (GCmain) $$Silver Main 2412 (SImain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.