How a war between Israel and Iran could impact oil prices and the whole market?

After the U.S. stock market closed over the weekend, it was suddenly reported that Israel's retaliation plan for the Iranian attack had been implemented.

Judging from the time when it occurred, it was obvious that Israel chose to close the financial market because it did not want things to expand. This is related to the approaching time of the U.S. election. Not unrelated. At the same time, the focus of Israel's retaliation is to attack Iran's related military facilities, avoiding crude oil and nuclear facilities, which is lower than market expectations. Therefore, if Iran does not take further actions after Israel's retaliation, the market will return to calm. But the question is, will Iran suck it up?

Profound impact on the crude oil market

If this "retaliation cycle" does not have a strong third-party mediation, the degree of retaliation will usually spiral up, which makes the market full of worries about the "Israel-Iraq conflict", which is fully reflected in the option quotations in the crude oil market.

At present, the implied volatility of the option premium of crude oil options is as high as 5-60% (equivalent to the level when the Russia-Ukraine conflict broke out), indicating that a large number of crude oil traders entered the options market to buy options to protect themselves from further conflicts.

Oil prices soared. Although the actual price of crude oil is much lower than that of the options market, the lesson learned from the Russia-Ukraine conflict shows that if Israel really directly attacks Iran's crude oil facilities, it is not an exaggeration for oil prices to fluctuate rapidly similar to that in 2022.

At present, Israel was asked by the United States to keep a low profile before the U.S. election. However, after the election, how the situation will develop can only be observed gradually. However, at least the conflict sentiment has not been lifted, and shorting oil prices is not optimistic.

Technically, if the current oil price does not break through $68, don't be bearish. Although it has been greatly impacted by the "revenge cycle" recently, fluctuations are inevitable, so wait patiently for further changes in the market.

Pay attention to the adjustment of the US stock index before the election

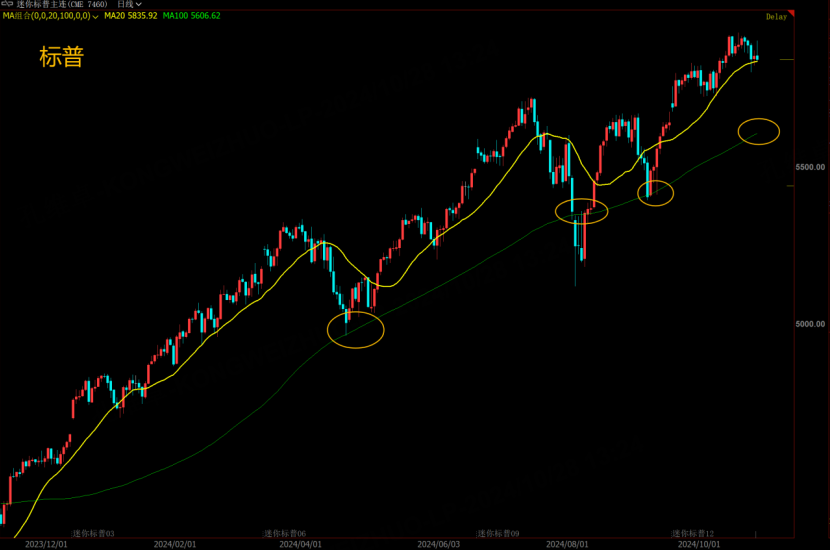

As the general election approaches, polls show that the support of the two candidates is still evenly matched (the data of various polling agencies are very different, and there is no unified expectation), which makes some capital take profit before the general election, which makes the U.S. stock index have recently adjusted, and October is the traditional risk month for the U.S. stock index.

Therefore, it is not ruled out that the U.S. stock index will make a rapid adjustment before the general election, and the capital will be deployed after the presidential election.

Technically, the S&P is close to the short-term long-short watershed area of the 20-day moving average of the index. If it falls below it, it is prone to rapid adjustments.

However, during the general election, I believe that if the index falls, the decline will be limited. The focus is on the support of the S&P around 5,600. If it does not break, the index will still fluctuate upward, so there is no need to pay too much attention to it. The key focus is still on the results of the general election, and we will make plans according to the results of the general election.

$SP500 Index Main 2412 (ESmain) $$NQ100 Index Main 2412 (NQmain) $$Dow Jones Index Main 2412 (YMmain) $$WTI Crude Oil Main 2412 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- happyli·2024-10-29Interesting insight.LikeReport

- zaza10·2024-10-29Interesting indeedLikeReport