Microsoft all in AI, but margins in danger?

$Microsoft(MSFT)$ announced Q1 earnings for fiscal year 2025 ending September 2024, down 3.7% after hours, not big compared to other technology companies, but not small compared to itself.

Although the Q3 results of the overall indicators in line with expectations, guidance is also healthy, but the market obviously expects "highlights" lack of good, and individual indicators have revealed some of the concerns.

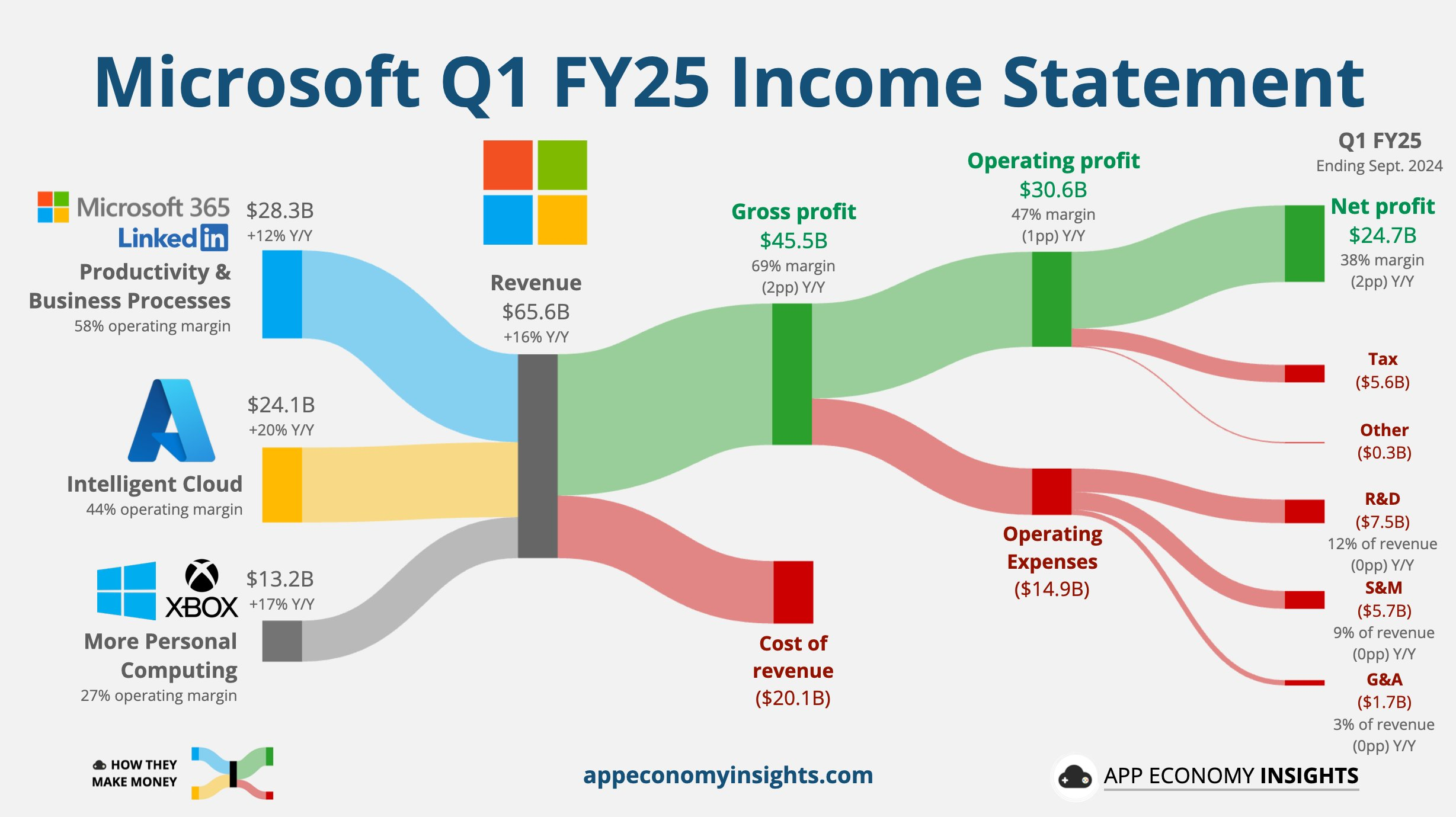

Because of the change in accounting caliber this quarter, the overall view of the company needs to be changed slightly.Total revenue growth of 16% year-on-year did not have much impact, operating profit of $30.6 billion, also better than market expectations, year-on-year growth rate of 13.6%, slightly worse than revenue, growth rate of consolidation of $Activision Blizzard(ATVI)$ impact.

Investment points

Cloud business performance, while stable, has flat growth and risks losing market share.

Continuing last quarter's trend, Azure's growth continued to slow to +33% year-on-year, a 1% decline from the previous quarter, while next quarter's year-on-year growth of only 31%-32% (vs. the market's expectations of 32-33%) was also a major source of investor disappointment.

The day before $Alphabet(GOOG)$ announced a slightly lower growth rate than Azure, but the trend was upward, with somewhat higher growth next quarter as well.If $Amazon.com(AMZN)$ 's AWS announces results tomorrow that are also trending upward, it would suggest that Microsoft's Azure's first-mover advantage in AI has gone down the drain.

The company has said that the slowdown in Azure growth is mainly due to optimization spending and macroeconomic factors in some regions, with some markets in Europe showing late stage weakness.It also does not rule out the fact that some of the contracts are still within the range of recognized amounts and did not materialize in the quarter.The oversupply of GPUs stage environment, but also the demand for cloud computing power leasing further reduced, coupled with the big manufacturers see competition.It is possible that the future growth trend will not be optimistic

AI brought limited growth to the traditional business, reflected more clearly in the search advertising business.

Revenue growth in the Office 365 business was the same at 15% as in the previous quarter, suggesting that Copilot 2.0 did not bring higher incremental performance, while guidance for the next quarter has slipped slightly;

The controversy over the partnership with OpenAI will have a further uncertain impact on the shape of the product side.

The search business may be the best way out, especially the advertising business which grew at 18% YoY and is a business with relatively optimistic marginal trends. the realization of AI functionality in search and real-world applications is still relatively intuitive.

In addition, the personal computing segment's quarterly revenue grew 16.8% year-on-year, relatively more than expected

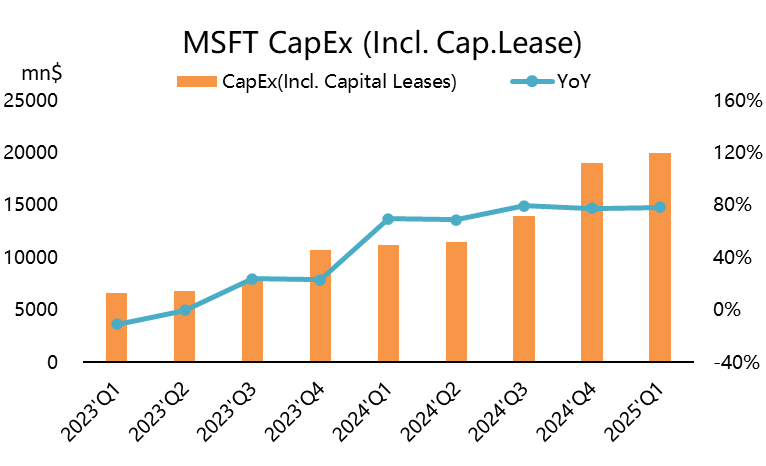

Capital expenditures further elevated while depreciation and amortization began to impact margins

Capital expenditures have risen to $15 billion in the quarter, with capex surging further, up 78.6% year-over-year including finance leases, up from 77.6% in the second quarter.Meanwhile on the call, Microsoft said it continues to increase its investment in AI infrastructure, and its investment budget for the next quarter is unabated and likely to exceed $20 billion.

To some extent, this confirms that Microsoft contracted a large number of orders for $NVIDIA Corp(NVDA)$ 's Blackwell in the remaining quarter of the year.

Profitability impacted: Gross margin for the quarter was 69.4%, down 1.8% year-over-year and lower sequentially, while operating profit was up only 13.6% year-over-year, with a profit margin of 46.7%, also down one percentage point year-over-year.

To a certain extent, there was the impact of consolidation;

However, mainly depreciation and amortization from capital expenditures began to show, and in the future, compared to revenue, the growth rate of profit was affected to a deeper extent;

Pulling down overall free cash flow, which has declined year-on-year again since last quarter and has fallen short of expectations, which could also affect future buyback and dividend programs

As with META, more internal cost reduction and efficiency may be needed to maintain margins, implying further compression of overhead and marketing expenses.

Slowing guidance, shrinking margins, valuations to come under pressure?

In terms of guidance for the next quarter (FY25 Q2), the growth rates of both the core Azure and Office 365 businesses have slowed to varying degrees, and guidance has continued to decline.

From a profit perspective, the median guidance for operating margins for the next quarter is 44%, and to a certain extent the company will also choose businesses with higher ROIs to focus its resources and, more importantly, to reduce other operating costs as well.

Trading as a Top 1 tech stock over a period of time, its less volatile stability has also attracted a lot of money with a lower risk appetite, but it has also managed to be able to trade at a forward PE of around 30x.

This valuation remains at risk going forward if the next few quarters are "margin neutral" from an operational standpoint only, but the impact of capital expenditures increases over time.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.