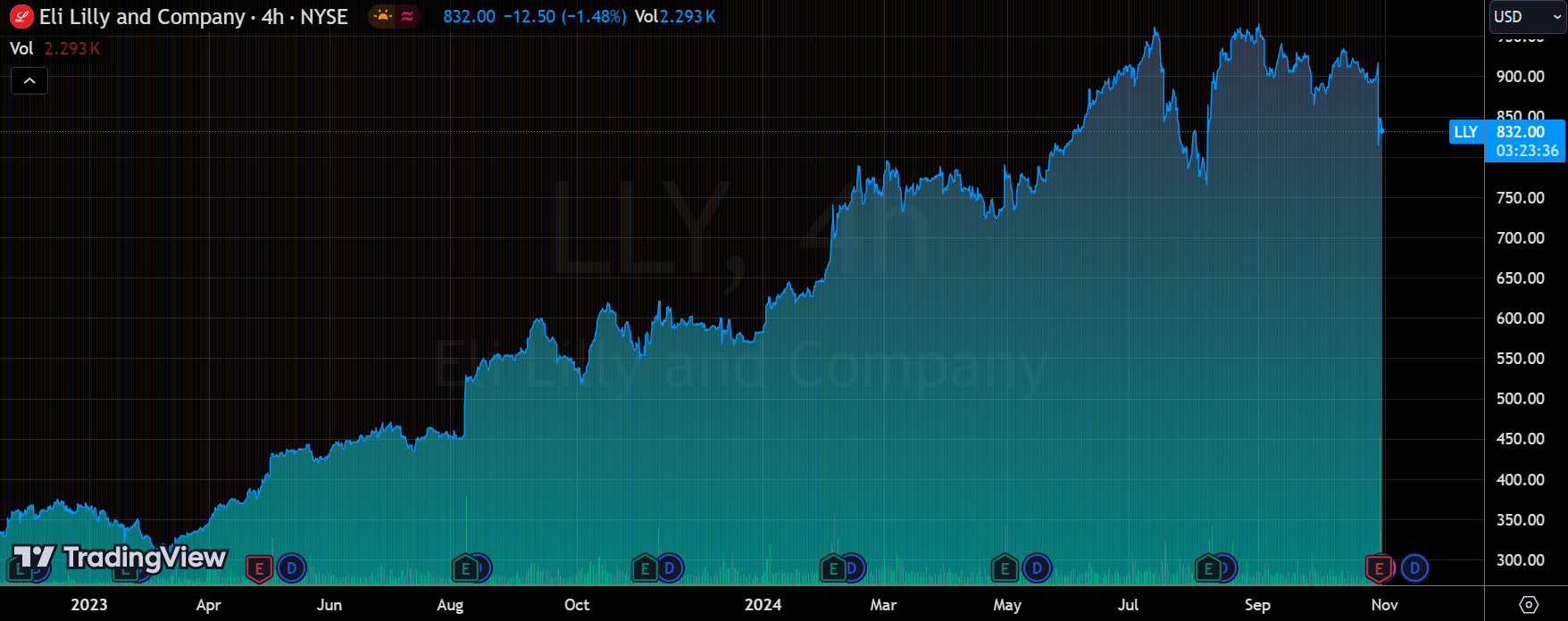

LLY Crashed?LLY's today is NVDA's tomorrow.

Note of this chart, you may need it later.

One of its leading products, the diet pills Zepbound and Mounjaro, sold poorly and guidance was lowered.

Lilly's explanation for this was that wholesale distributors had more inventory in Q3, which took time to deplete, and did not reorder.

The company's argument is far-fetched; if the market demand was strong, then distributors would have replenished as much inventory as possible, as they had done previously, rather than waiting for inventory to be depleted to a certain extent before waiting for the opportunity to replenish it;

It could be that the market demand for these high-priced drugs is slowing down in terms of momentum, or it could be that the distributors aren't betting as much as they would be if they were simply betting on one of LLY's products;

Previously, these diet pills were on the FDA's Drug Shortage List because of shortages, which meant that generic companies could legally sell generic formulas, diverting customers to a certain extent.The FDA announced on Wednesday that the list has been withdrawn from this type of simethicone, which is a big blow to the sale of generic drugs, but favorable to Eli Lilly and other original drug companies. $Hims & Hers Health Inc.(HIMS)$

Therefore, Wednesday's disk huge volatility, reflecting two expectations:

Slowing demand for weight loss drugs, performance guidance down, from the data point of view has passed the peak growth rate;

Generic drugs will be limited for a while, and there may be some "comebacks".

Eli Lilly's stock price is relatively high, and investors in the healthcare industry are predominantly institutional, so the big fluctuations indicate that many institutions have already started to "take profits".

In fact, this script is also fully applicable to AI chip, leading by $NVIDIA Corp(NVDA)$

At present, due to the strong demand for AI, major manufacturers have to order top chips, high-end chips in short supply, performance accelerated growth;

Once a quarter of the growth rate "stagnation" or decline, the institutions will be divided or even stampede;

At present, in view of the capital expenditure plans of large companies, NVDA's "J-type" growth rate can be sustained until the first half of 2025, but it is not sure whether the second half of the year will meet the expected downturn in the pace of AI investment slowdown;

Compared with other chip makers, Nvidia with higher technical barriers will benefit from growth for a longer period of time, because chips are more technically differentiated than diet pills, and even if the demand from head buyers slows down, there are other second and third tier software companies to fill inInstead, it's hitting other chip companies harder. $Advanced Micro Devices(AMD)$ $Intel(INTC)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.