Spotify:Profit running with share price

$Spotify Technology S.A.(SPOT)$ reported Q3 earnings on November 12 that showed a significant earnings beat, driving shares up nearly 7% after hours.Spotify's market performance has been steady and strong in the global music and audio streaming market.

Exceeding expectations performance boosted market confidence

Total revenues of €3.99 billion, below analysts' expectations of €4.03 billion;

Earnings per share (EPS) of $1.89, in line with Wall Street expectations;

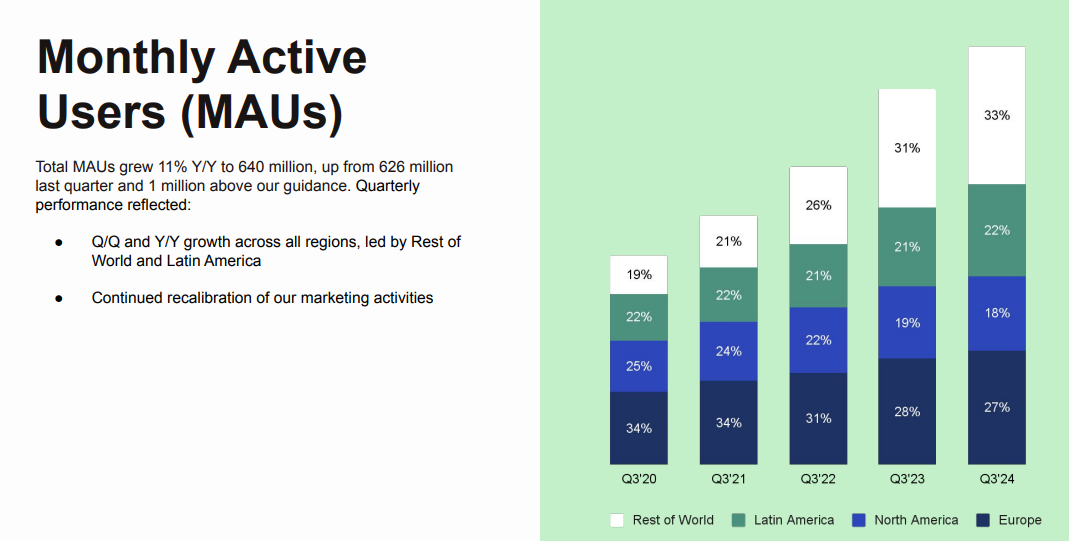

Monthly Active Users (MAUs): the number of monthly active users grew 11% year-over-year to 640 million, above market expectations;

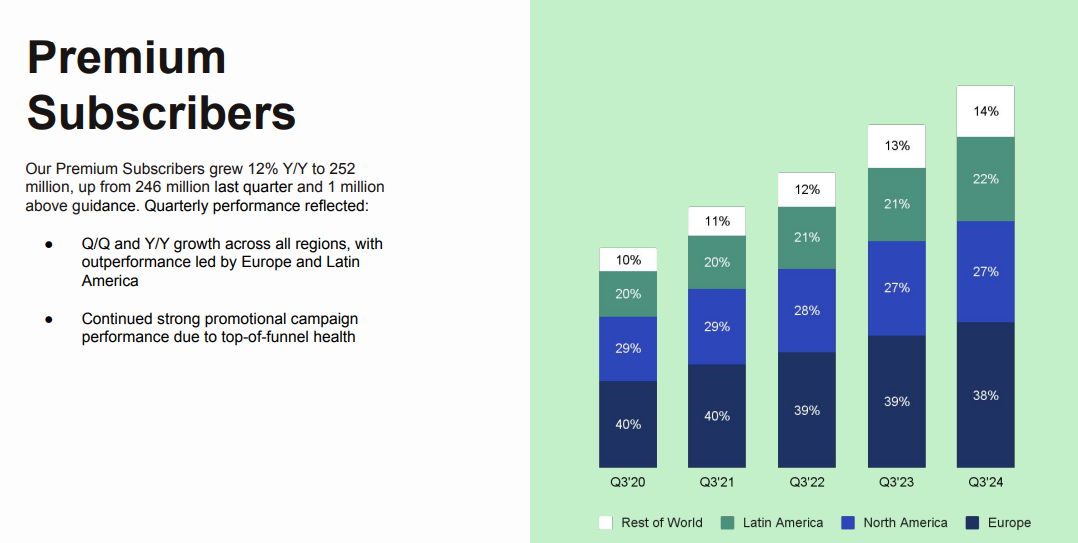

Premium subscribers: the number of premium subscribers grew 12% year-over-year to 252 million, above market expectations.

Q3's financial results exceeded market expectations, mainly reflected in the strong performance of key metrics such as earnings, gross margin and free cash flow.In particular, the improvement in gross margin and effective control of royalty costs brought good room for earnings resilience.

Investment highlights

Operating Profit Significantly Beats Expectations

Spotify's Q3 operating profit was significantly ahead of market expectations and guidance for Q4 was optimistic.Spotify's earnings were driven by improved gross margins and operating expense control.Continued compression was achieved in all three core operating expenses, with employee equity incentive expense down 26% year-on-year, reflecting the company's optimization of employee costs.Spotify further reduced costs through staff reductions and streamlined expense controls.

Gross margins improved thanks to content cost optimization, especially savings on copyright costs. spotify's bundled audiobook packages not only helped attract new paying subscribers, but also reduced its reliance on music royalties sharing, keeping content costs under effective control.It is worth noting that Spotify has gradually reduced its reliance on music from head labels, thus shifting to small and medium-sized labels and indie resources with lower share ratios.Such optimization measures have enabled Spotify to achieve a more resilient gross margin performance in the short term.

Subscription users still retained after price hike

In terms of user growth, Spotify's subscriber and monthly active user (MAU) growth exceeded expectations, especially Q4's guidance on subscriber numbers made the market more optimistic about Spotify's price hike strategy.Q3 results showed Spotify's global MAUs reached 600 million, while paid subscribers reached 250 million, an increase of 15 million from the previous year, with stable subscriber retention and new customer acquisition, easing theThe market's concern about the possible impact of price increases on user churn.

Spotify also performed well in terms of user acceptance of the price increase.Despite the price increase, Spotify justified the price hike through additional audiobook services and a higher quality music experience.This bundled pricing strategy effectively reduces subscriber sensitivity to price increases, and the bundled services increase subscriber loyalty.

Spotify expects subscriptions to continue to grow in Q4, a trend that suggests users are more receptive to price increases, and this price increase strategy provides strong support for future subscription revenue growth.

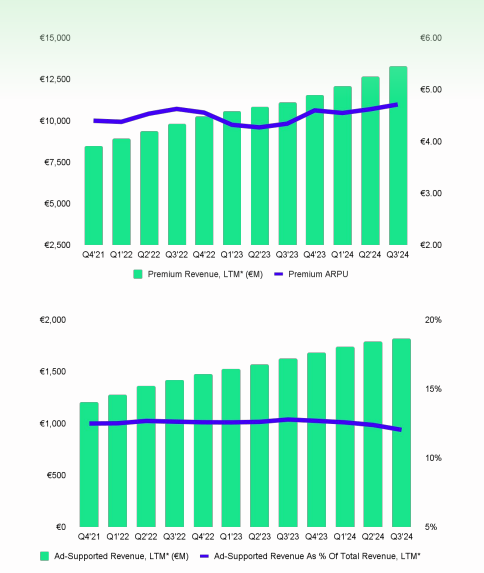

Slower growth in advertising revenue

Despite strong growth in paid subscriptions, Spotify still faces challenges in advertising revenue.Q3 advertising revenue growth was weaker than expected, mainly due to slow growth in advertising subscribers.The number of ad-supported subscribers reached 400 million in Q3, an increase of 9 million sequentially, which was lower than the market expectation, and the slowdown in advertising revenue growth also dragged down the performance of total revenue.Management expects that Q4 ad revenue may remain under pressure, indicating that Spotify still needs to further improve its realization efficiency in the ad business.

Among them, the main growth of advertisement comes from podcast content, but the realization efficiency of music advertisement is low due to the limitation of the advertisement realization scenario of music content.Currently, advertising revenue accounts for about 10-15% of Spotify's total revenue, and the company's future advertising growth will need to rely more on podcast content.Spotify also said in its Q4 revenue guidance that the advertising side will still face some pressure, especially in the level of advertisers' ARPU, which is still a big gap with paid users.

If Spotify's advertising continues to grow, it is expected to better support the stock price.

Significantly improved cash flow to support future expansion

Spotify's cash flow performance is also quite impressive.Free cash flow reached €710 million in the third quarter, a sharp increase of 229% year-on-year, and cash flow accounted for as much as 18% of revenues and exceeded the operating margin in the same period.Spotify's business model gives it a natural advantage in generating free cash flow.Spotify's cash flow has gradually shown significant expansion due to its solid industry position and relatively less investment in content.Stable cash flow not only enhances Spotify's financial resilience, but also provides a guarantee for its future expansion and investment in more emerging content areas.

Outlook: Strong fundamentals support valuation premium

Looking ahead, Spotify's strong fundamentals support its valuation premium in the near term.Currently, Spotify's Forward P/FCF is 25x and EV/EBITDA reaches 35x, which is relatively high compared to other U.S. tech leaders, but the market is assigning it a certain sentiment premium supported by its current fundamentals.

The market will still pay close attention to Spotify's profitability and subscriber growth.With the price hike strategy, Spotify's subscription revenue growth has been further secured.At the same time, the company has significantly weakened the proportion of music copyright costs while enriching the content ecosystem through bundling with audiobooks, podcasts and other content.Despite some disputes between Spotify and the royalty association over copyright sharing, the pricing strategy of bundled packages has gained the approval of the majority of subscribers, which will help boost the company's subscription revenue performance in the next 1-2 quarters.

On the advertising front, Spotify needs to increase ARPU for ad package subscribers to ease the pressure on ad revenue growth.The company may make a stronger attempt to cash in on podcast content to balance the revenue structure on the advertising side.

Taken together, Spotify's Q3 results give it a stronger competitive advantage in the streaming industry.Although the valuation is close to the market's optimistic expectations, Spotify's valuation premium in the short term is also somewhat reasonable given the strong performance of its fundamentals.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.