What is the key profit in Tencent's Q3 earnings?

After the Hong Kong stock market closed on November 13, $TENCENT(00700)$ announced its 24Q3 earnings.

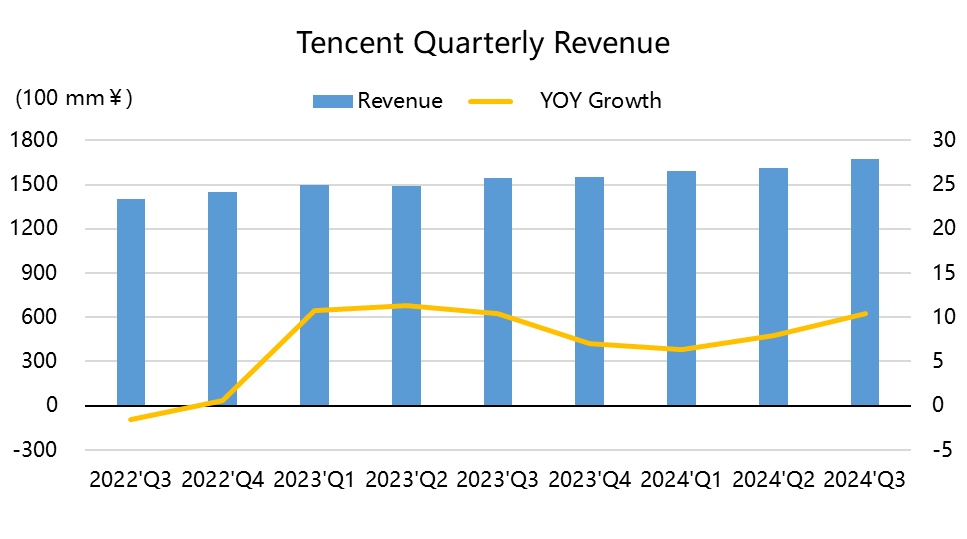

Q2 release did give a lot of surprises, investors' expectations of Tencent began to pull up, so also counted on Q3 results continue to be good expectations.In addition to the overall rebound of Chinese assets at the end of Q3, Tencent is now also becoming. Q3 earnings report is not too much of a surprise, but it is also "expected", at this stage of the environment, Tencent's performance is still noteworthy.

Key Takeaways:

Overall margins continued to rise steadily, with strong cash flow, also supporting further shareholder returns;

Games maintained the rebound trend, with domestic games surprising more, older games resuming growth again, and the industry as a whole picking up;

Social network year-on-year growth rate rose again, but the game and audio-visual business had a trend of this and that;

WeChat ecosystem advertising business maintained a 16% growth rate despite the Olympic cycle and slightly exceeded expectations

Fintech growth rate fell back, technology business remained stable, financial business polarization, one side of the wealth management business incremental surprise, the other side of the consumption is weak.

Investment Highlights

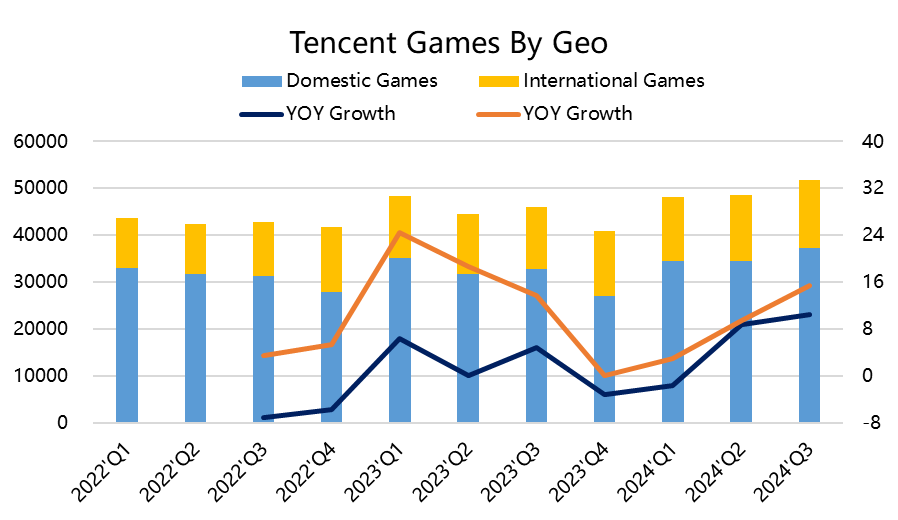

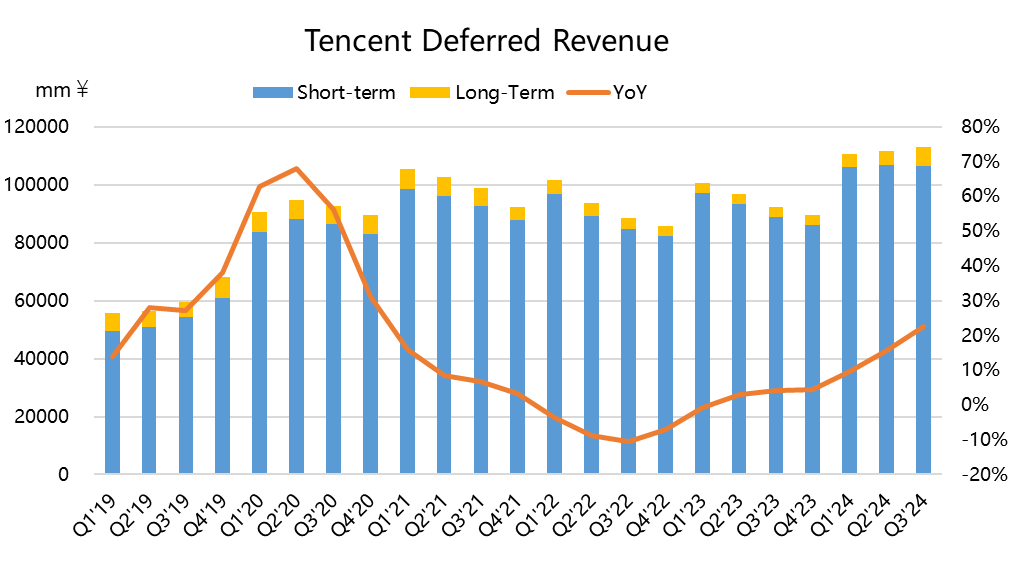

Game business continues to rebound, fueled by the alternation of old and new games, and overseas games adjusting to the deferred cycle.Tencent's game business started to bottom out in Q1, and the deferred revenue growth rate in Q2 showed that the following quarters would not be bad, so market expectations were relatively high.As a result, this quarter's game business was basically on par with expectations: revenue of 51.8 billion yuan, up 12.6% year-on-year, with the local and international markets growing 14% and 9% year-on-year, respectively.

Among them, the year-on-year growth rate of domestic games rebounded to 14.07%, the highest level since 2021, fueled by the combination of the old games "Honor of Kings" and "Peaceful Elite" and the new games "DNF Handbook" and "Fearless Pact".

Overseas aspects of the overall year-on-year rise of 9% with the previous quarter, the level of 14.5 billion slightly less than the expected 15 billion yuan, but mainly because of the retention rate increased, Tencent took the initiative to adjust the deferral cycle, the implication is that part of the incremental will be reflected in the later quarters

Q3 shows that the revenue growth rate is behind the overall water growth rate.For example, VALORANT expanded from the PC side to the PlayStation and Xbox platforms with the launch of a console version, which saw over 30% year-on-year growth in Q3's streams.

Deferred revenue of 113 billion yuan rose 22.6% year-on-year, continuing to hit a record high since the epidemic season, and 1.2% sequentially.

The importance of the WeChat ecosystem continues to grow.Revenue from advertising business was 30 billion yuan, flat quarter-over-quarter and up 17% year-over-year, slightly exceeding market expectations of 29.9 billion yuan.

In the overall environment, it is certainly not yet possible to say that the advertising business has rebounded, but there is no doubt that the advertising efficiency of the WeChat ecosystem has improved, including new games, online advertising for e-commerce, and advertising efficiency brought about by the use of AI technology.

In addition, the Paris Olympic cycle in Q3 also brought incremental brand advertising.

The Q3 launch of WeChat Xiaoshang leveraged WeChat's social interaction, content platform and payment capabilities to help merchants effectively reach customers and drive sales conversion.

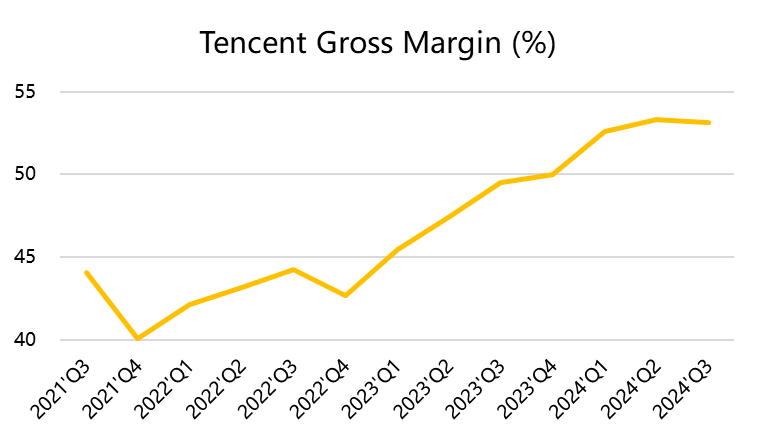

Gross margin for overall marketing services rose to 53% from 52% last year.

The cloud business remained stable, but the financial business continued to be a mixed bag.FinTech and Enterprise as a whole grew at 2%, also slightly below expectations.

After the growth in corporate services revenue, the margins improved and overall both started to improve, with the segment's gross margin remaining flat at 48% compared to 41% a year ago.

The most crotch-pulling sub-segment in Q3, as in Q2, remains weak offline spending, leading to weaker-than-expected payments and other financial businesses;

Interestingly, however, wealth management income remained up, suggesting that wealth is not disappearing, but just tending to be invested conservatively.Of course the rebound in equity assets after Q4 may have prompted more people to invest on more levels.

Gross margins remained at new highs, but marketing and R&D spending also began to increase as the company cautiously expanded.

Overall gross margin stayed at an all-time high of 53% due to faster growth in higher-margin businesses such as gaming and advertising, as well as lower cost expenses such as the cloud business;

Starting from Q2, Tencent intentionally increased its investment in marketing and general administration, with the growth rate of both expenses reaching 19% and 11% in Q3, both exceeding the revenue growth rate.This reflects the increased efforts in new game expansion and the company's new investment in R&D.

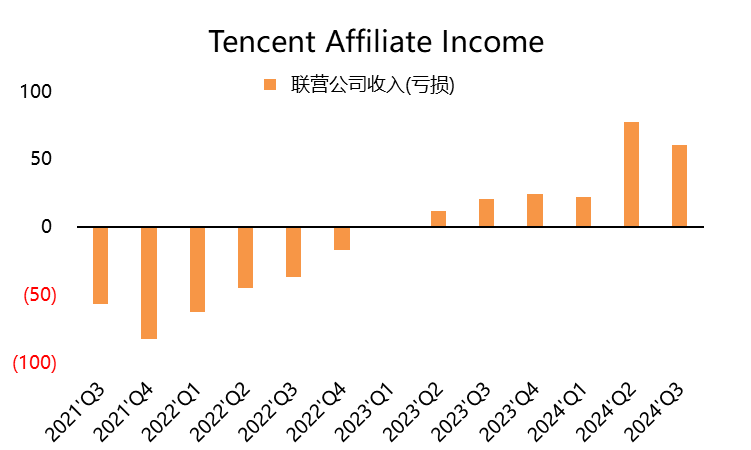

Non-operating income was impacted by the upturn in associates, and the increase in equity assets.Operating margins exceeded expectations.

Earnings from associates brought Tencent $6 billion in Q3, nearly three times higher than last year's $2.1 billion.

Interest income also rose 14% year-on-year to $4 billion, and the increase in overseas flows allowed Tencent to further take advantage of short-end U.S. bond rates remaining high.

Growth in equity holdings was even more rapid, up 47% year-on-year to 53.2 billion yuan, but this part of the business does not actually generate cash flow.

Valuation

Valuation base further improved.Final Q3 realized Non-IFRS net income of 59.8 billion yuan, up 33% year-on-year, but because investment income accounted for a relatively large portion.If you look at the adjusted EBITDA of $69.66 billion, the year-on-year growth rate was 13%, but also higher than the revenue growth rate.

As market expectations began to be more conservative, and some have recently begun to improve, but this result still greatly exceeded market expectations.Valuation is also further supported.Taking the closing price of HK$403.8 on November 13th.

If it is the adjusted EPS, the valuation TTM PE's slipped from 20.5 times, to 17 times.

If EBITDA, valuation TTM EV/EBITDA also slipped from 14x to 13.5x.

Also, in terms of shareholder returns, the disk continues to shrink as major shareholders continue to reduce their holdings and stop buying back, with major shareholder Prosus still holding about 2.21 billion shares of Tencent, which is expected to be disclosed by the end of this month.

In addition, repurchases totaled HK$35.9 billion in the first six months, with 94.9 million shares written off.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- HarryCox·11-13Looks like Tencent's profitability is on a promising path1Report

- AllwedoisOptionsNwinMoney·11-13shorts will get burntLikeReport