Q3 Earnings Digest! Disney is in Another Upward Trend?

On November 14, $Walt Disney(DIS)$ reported its fiscal 2024 fourth quarter financial results, which exceeded market expectations overall and is gradually regaining growth momentum after a challenging period.

Financial performance vs. expectations

Specific financials are as follows:

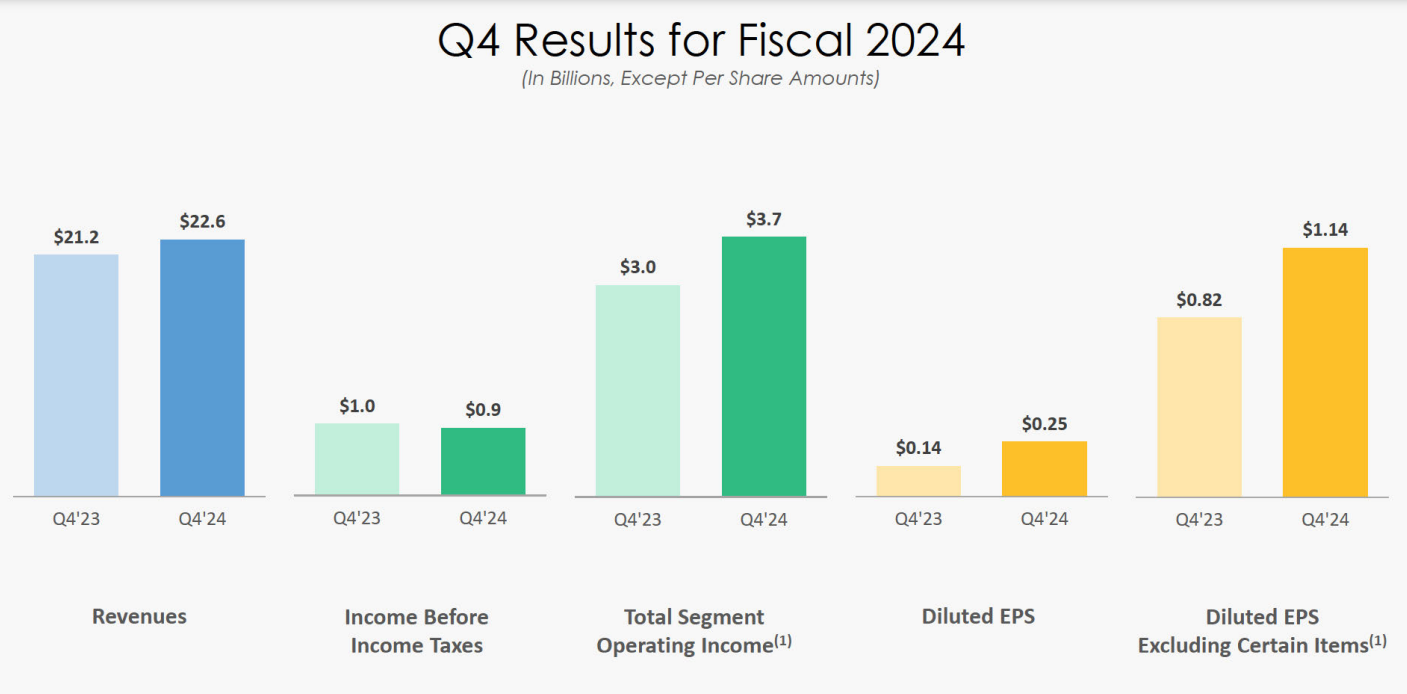

Total revenue: $22.57 billion, up 6% year-over-year, beating estimates of $22.35 billion;

Adjusted EPS: $1.14, beating estimates of $1.10;

Streaming business: revenue up 15 percent to $5.78 billion, operating profit of $321 million

Motion Picture: Earnings of $316 million, a turnaround from a year ago.

Guidance: Adjusted EPS is expected to grow in the "high single digits" in 2025, beating market expectations of 4%, and earnings growth should reach double digits in 2026 and continue through 2027.

By 2025, the company also plans to repurchase $3 billion in stock and achieve "dividend growth in line with earnings growth."

Business Segment Performance

Streaming Business

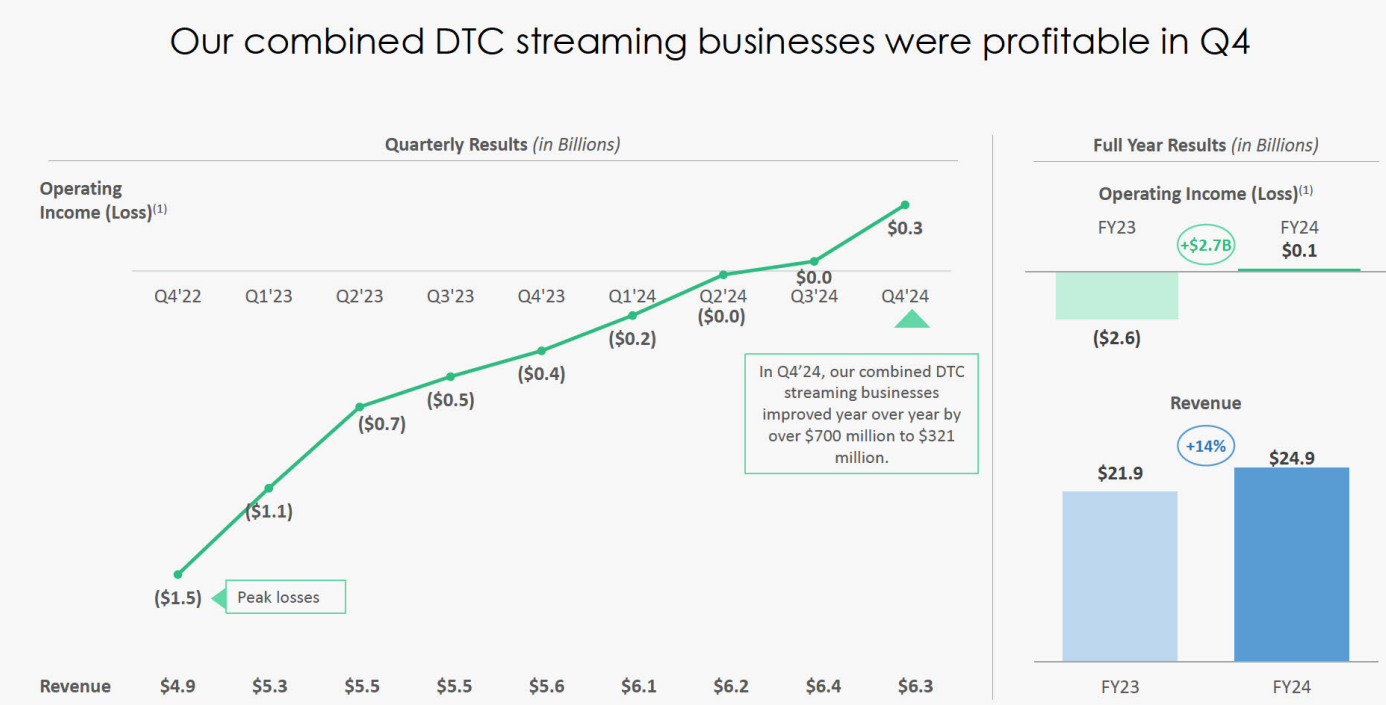

Streaming was the highlight of the quarter, with Disney+ and Hulu subscriptions totaling 174 million, including more than 120 million core Disney+ subscribers, an increase of 4.4 million from the prior year quarter.Operating profit for the Streaming segment improved significantly, moving from a loss of $420 million in the year-ago quarter to a profit of $321 million, demonstrating that the company's strategic realignment in the streaming space is paying off.

Movies

The Motion Picture Division also performed strongly, thanks largely to the success of hit films such as Mindhunter 2 and Deadpool vs. Wolverine.Earnings in this segment jumped to a profit of $316 million from a loss of $149 million last year, demonstrating Disney's strength in content production and distribution.

Theme Parks and Experiences Business

Although revenues in the Theme Parks and Experiences business increased 1% year-on-year to $8.24 billion, operating profit fell 6% to $1.7 billion.Earnings rose at domestic parks, but international parks faced competitive pressures and declining attendance, particularly when Disneyland Paris was impacted by the Olympics.

Earnings Analysis

Exceeded expectations for a number of reasons:

Successful streaming transformation: Disney achieved a profitable turnaround in its streaming business by increasing subscription prices and optimizing advertising revenues.

Strong movie box office: Successfully launched a number of blockbuster movies to attract audiences and generate significant box office revenues for the company.

Effective cost control: improved overall profitability by reducing marketing expenses and optimizing content strategy.

Reasons for falling short of expectations

Continued decline in traditional TV networks: Linear network revenues declined by 6% year-on-year, demonstrating the continued challenges to the traditional TV model.

Pressure on international markets: international theme parks experienced declines in traffic and profits due to economic factors and increased competition.

Investor Focus

Following the release of Walt Disney's earnings report, the company's stock rose more than 9% in pre-market trading.Investors are optimistic about the company's outlook for the future, especially with the strong recovery in the streaming business and the successful performance of the movie division triggering a positive reaction.

Investors should focus on the following focal points:

Future growth potential: Disney expects high single-digit adjusted EPS growth in fiscal 2025 and double-digit growth in 2026 and 2027.In addition, cost-cutting measures are expected to slow the decline of the linear TV business somewhat.

Streaming strategy: Streaming will continue to be an important driver of growth for the company as the subscriber base of Disney+ and Hulu expands and profitability improves.

Theme park recovery: As the economy recovers and travel demand picks up, whether the theme park business can rebound will be an important factor for investors to watch.

Changing of the guard in progress: current CEO Bob Iger is scheduled to officially step down at the end of 2026.Disney has announced that it will formally announce a new CEO in early 2026, with James Gorman, a current board member and former CEO of Morgan Stanley, spearheading the effort and serving as chairman of Disney's board of directors starting Jan. 2, 2025, according to the Wall Street Journal.

3 BILLION BUYBACK ADDED: The company approved a $3 billion buyback program through 2025.

$Netflix(NFLX)$ $Comcast(CMCSA)$ $Warner Bros. Discovery(WBD)$ $Sony(SONY)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?