Clear Secure: Long-Term Growth Limited By Potentially Unstable Business Model

- Clear Secure's sharp decline in post-Q3 earnings is due to slowing customer growth and declining net member retention despite solid sales growth and profitability.

- The company's focus on profitability over customer acquisition and retention may hinder long-term growth, especially with regulatory risks.

- Clear Secure must diversify beyond airport security to unlock its full potential, but its current strategy seemingly prioritizes short-term shareholder value.

- While YOU has substantial sales growth and a low forward P/E ratio, given its rising profitability, its business model and management focus raise long-term growth concerns.

- In my view, the company must prove that it is not a "fast pass" that benefits from price discrimination but actually fulfills an identification need, particularly outside of airports.

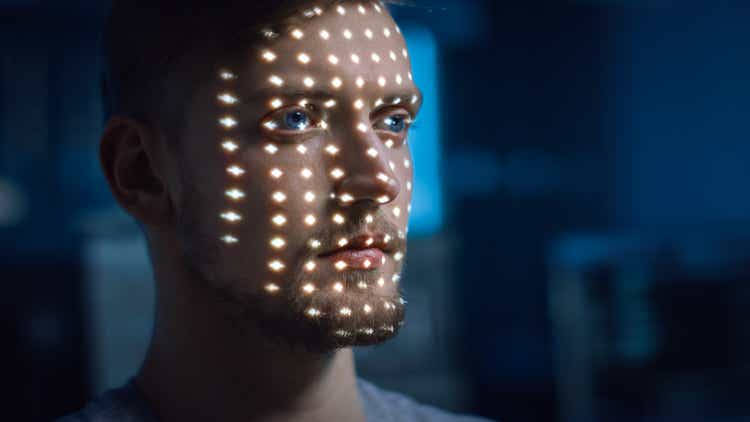

gorodenkoff/iStock via Getty Images

Clear Secure (NYSE:YOU) caught my attention recently due to its sharp decline following a relatively strong Q3 earnings report. The company operates biometric verification, notably used for air travel and stadiums, but now also for Uber (

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.