Review Ten Hot Options Opportunities for 2024

1. Capitol Hill Stock God Pelosi Profits Millions from Options, Stirring Public Outrage

In 2024, no politician's trading activities drew more attention than former U.S. House Speaker Nancy Pelosi. Pelosi and her husband Paul garnered widespread media coverage for reaping massive profits from stock and options trades. Earlier this year, Fox News reported that "Paul Pelosi made over $1.25 million in three months trading Nvidia stock."

According to reports, Paul Pelosi, who owns an investment and consulting firm in San Francisco, purchased $1-5 million worth of deep-in-the-money Nvidia call options on November 22, 2023. Nvidia's stock subsequently soared by an impressive 61% from January to February 2024. Pelosi’s choice of deep-in-the-money options allowed him to leverage the stock's rally while minimizing the impact of time decay.

Options Opportunity Analysis:

This case demonstrates the power of options as leverage tools, especially the strategic use of deep-in-the-money options. When a stock experiences significant volatility, such options not only provide higher profit potential but also reduce capital requirements. For retail investors, mimicking Pelosi's strategy by purchasing deep-in-the-money options can be an efficient way to participate in rallies of high-volatility stocks like Nvidia.

2. Retail Leader Returns: Bulls and Bears Clash on GME

On May 13, the long-dormant “retail captain” Keith Gill, known for spearheading the 2021 GameStop (GME) short squeeze, resurfaced on the X platform, reigniting investor enthusiasm for GME. On the same day, GME stock surged over 110%, triggering six trading halts and closing up 74.4%.

Options Opportunity Analysis:

For highly volatile stocks like GME, options are an ideal tool to capture short-term profits. Retail investors can buy call options to ride the upward momentum or use bull call spreads (buying one call and selling another at a higher strike) to reduce costs. Additionally, as implied volatility (IV) skyrockets during such events, investors can profit from volatility contraction by implementing short volatility strategies, such as selling straddles or iron condors.

3. Nvidia Stock Breaks $1,000, Announces Stock Split

On May 22, Nvidia announced exceptional earnings and declared a 1:10 stock split scheduled for June 7. Nvidia’s history shows that stock splits often lead to dramatic price movements, making it a prime candidate for options trading.

Options Opportunity Analysis:

Stock split scenarios provide multiple opportunities for options traders. During the initial announcement, buying call options can capture upside momentum. Post-split, as volatility normalizes, selling options can generate income. The adjustments to option contracts due to the stock split (e.g., changes in contract multipliers) may also create arbitrage opportunities. For investors uncertain about post-split movements, strategies like butterfly spreads can help manage risk while capturing potential gains.

4. Tesla Surges 30% During Independence Week

In the first week of July, Tesla surged 27% following a series of positive announcements, including Q2 delivery data that exceeded Wall Street expectations. However, Tesla’s post-surge history often includes short-term pullbacks.

Options Opportunity Analysis:

After Tesla's sharp rally, investors concerned about potential pullbacks can use protective puts to hedge their positions. Alternatively, collar strategies (buying puts and selling calls simultaneously) allow investors to lock in gains while mitigating downside risks. Aggressive traders can utilize short-term call options to capitalize on residual upward momentum.

5. August 5, 2024: “Black Monday” 1987 Revisited

On August 5, global markets experienced a flash crash driven by poor Q2 earnings, monetary policy shifts, and geopolitical unrest. The Nasdaq-100 futures fell over 5%, while the VIX surged by 180%, reaching extreme fear territory.

Options Opportunity Analysis:

During extreme market volatility, options become invaluable tools for hedging and speculation. Investors can hedge downside risks by purchasing put options or constructing bear put spreads. Additionally, VIX options offer a direct way to trade market fear, with call options on the VIX providing significant upside during panic selloffs. As markets stabilize, selling high-volatility options (e.g., straddles) can yield profits from implied volatility normalization.

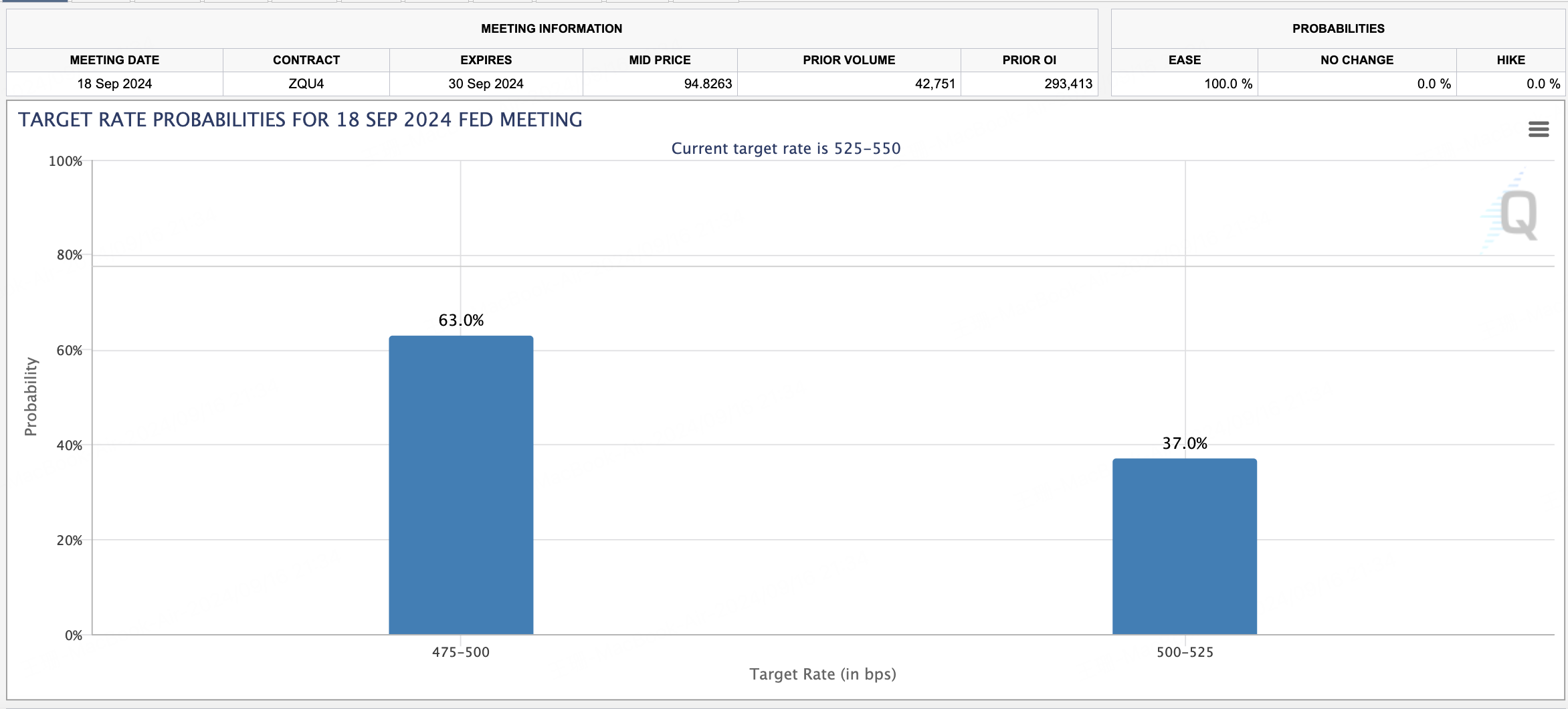

6. Rate-Cutting Cycle Begins

In September, the Federal Reserve announced a 50-basis-point rate cut, formally kicking off a rate-cutting cycle. This shift had profound effects on rate-sensitive assets and broader markets.

Options Opportunity Analysis:

During rate-cutting cycles, options strategies can focus on interest rate-sensitive assets like government bonds and financial stocks. Investors can buy long-term call options on bonds to profit from rising bond prices or use bull put spreads to participate in equity rallies driven by rate cuts. For uncertainty around rate cut sizes, straddle strategies can capture sharp market movements.

7. Chinese ADRs Skyrocket During National Day

Ahead of China’s National Day, a series of policy measures fueled a rally in Chinese ADRs on U.S. exchanges, even though the A-share market was closed for the holiday.

Options Opportunity Analysis:

To capitalize on this sudden rally, investors can use bull put spreads to profit from rising prices while limiting downside risks. For heavier positions, selling high-IV options can hedge against market volatility. Additionally, cross-market arbitrage opportunities may arise between Chinese ADRs and related ETFs, which can be exploited using options.

8. U.S. Presidential Election: Trump Wins

On November 6, Trump’s re-election spurred rallies in stocks tied to his policies, including Trump Media & Technology Group (DJT) and cryptocurrency-related companies like Coinbase (COIN), which surged 31%.

Options Opportunity Analysis:

For crypto-related stocks experiencing sharp gains, investors can buy call options to leverage upside potential or construct bull call spreads to reduce costs. Given the high volatility in these stocks, selling overvalued options can also generate income. Additionally, options on ETFs tracking the crypto space provide a diversified way to trade the trend.

9. Bitcoin Breaks $100,000

On December 5, Bitcoin crossed the $100,000 mark for the first time, sparking a new bull market in cryptocurrencies. MicroStrategy (MSTR), a Bitcoin proxy, announced an ambitious $42 billion financing plan to purchase more Bitcoin.

Options Opportunity Analysis:

Bitcoin’s extreme volatility makes it a prime candidate for options trading. Investors can use call options to bet on further price increases or create synthetic futures positions with options to capture short-term moves. For those wary of a potential pullback, protective puts or vertical spreads can provide downside protection while allowing upside participation.

10.Earnings Season Sparks a Wave of Volatility: Capturing Options Opportunities in Tech Giants

During each earnings season, especially when the four tech giants (Apple, Amazon, Google, and Microsoft) release their reports in quick succession, market volatility tends to peak. In October this year, Tesla's earnings report exceeded market expectations, with the company announcing further reductions in vehicle production and material costs, while reaffirming plans to begin producing ultra-low-cost vehicles and new models in early 2025. On the day of the announcement, Tesla ($TSLA) stock surged by 21.9%. Similar scenarios unfolded following Netflix and Amazon's earnings releases, with their stock prices soaring 11.09% and 6.19% respectively on their reporting days, drawing widespread market attention.

Options Opportunity Analysis:

Earnings season is one of the most crucial periods for options traders. Through precise analysis of individual stocks' historical earnings patterns, market expectations, and implied volatility changes, investors can design trading strategies with controlled risk and significant profit potential. In a highly volatile environment, the flexibility of options provides great convenience for capturing short-term opportunities.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.