Hindenberg's SHORT is fatal to Sezzle

Unlike Grizzly, Hindenburg Research has a pretty good shorting history.Yesterday it published a short on $Sezzle Inc(SEZL)$ , a report that sheds light on the company's financials, business model, and the risks it faces.

Here's a summary of the key takeaways:

Overachieving Financial Performance

Sezzle Inc. was founded in 2016 in Minneapolis, MN to provide Buy Now Pay Later (BNPL) services.In the third quarter of 2024, the company had 2.7 million active users and 23,000 partner merchants.Transactional revenue accounted for approximately 52% of its revenue and subscription services accounted for approximately 33%.

In the third quarter of 2024, Sezzle's total revenue jumped 71.3% year-over-year to $70 million, and net income jumped 1093% year-over-year to $15.4 million.These results have investors looking forward to the company's continued growth.

Risks and Challenges

While Sezzle's revenue growth is significant, its reliance on risky loans, financed through high interest rate capital, is a concern.The company's line of credit carries an interest rate of 12.65%, and the average interest rate for 2023 is a whopping 16.78%.Meanwhile, the provision for credit losses increased by 130% year-on-year, indicating deteriorating credit quality.

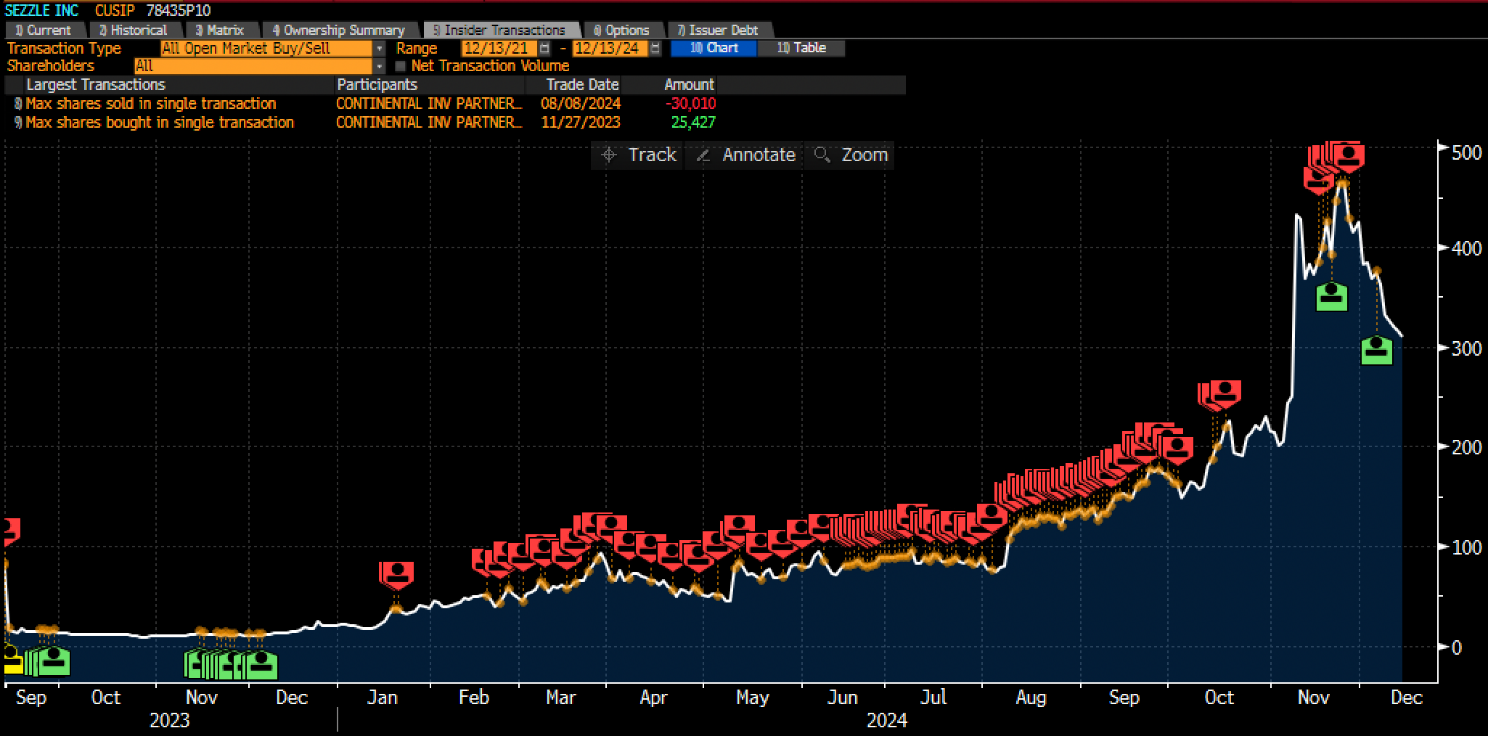

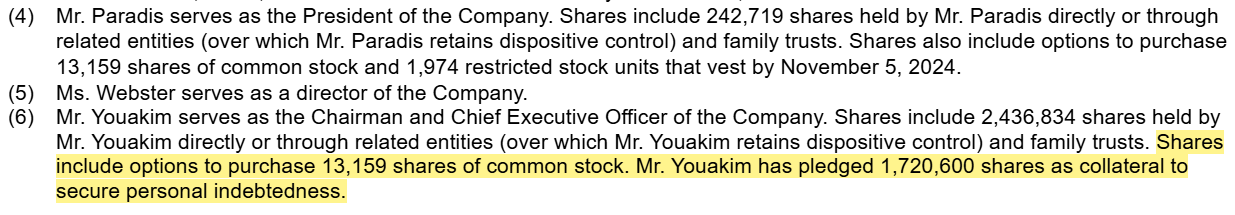

Insider trading and shareholder pledges

Sezzle Chairman and CEO Charlie Youakim has pledged 70% of his shares to a mortgage, which typically undermines investor confidence.

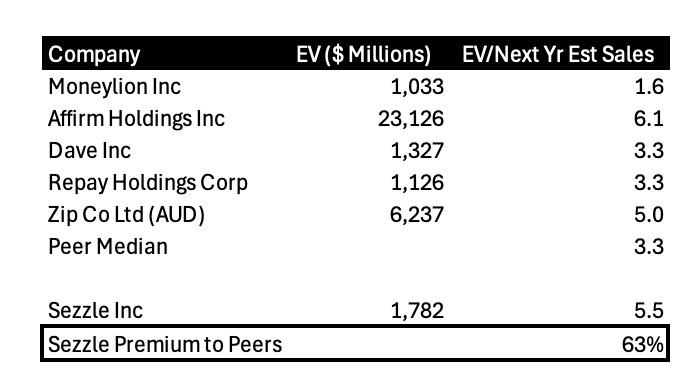

Valuation too expensive compared to peers

Sezzle faces stiff competition in the BNPL market, with companies like Affirm and Klarna putting a lot of pressure on it.Since 2021, Sezzle has seen a drop of over 51% in the number of active merchants, meaning it is losing market share at a rapid rate.Despite claiming 23,000 active merchants, data suggests that the actual number may be lower, further weakening its market position.And it is very much more expensive than its peers in terms of valuation:

User Experience and Consumer Feedback

Sezzle's user experience has been heavily criticized, with user growth for its subscription service stemming in part from users being automatically signed up without their knowledge.This led to a significant increase in consumer complaints, particularly regarding fees and hidden costs.

Sezzle has experienced strong revenue growth in the short term, however its risky lending strategy, insider trading practices, and declining market share make its future uncertain.Investors should carefully assess the company's long-term sustainability and potential risks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.