Holiday spirit trumps everything - A Christmas rally squeeze!

People emphasize festive atmospheres during holidays, especially this year with Independence Day, Christmas, and Musk's birthday. Even without favorable conditions, they'll create conditions to push the market up. I'm truly amazed.

Let me start with the important news: Chinese concept stocks have received several large orders, specifically on-exchange orders.

$KraneShares CSI China Internet ETF(KWEB)$

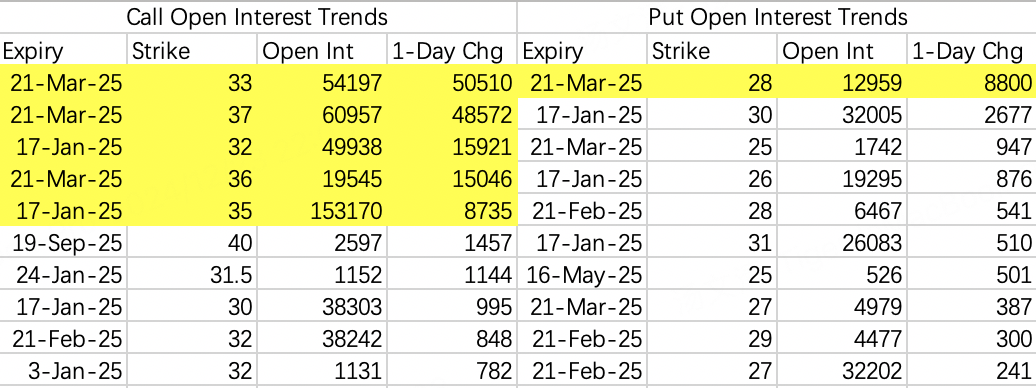

As shown in KWEB's Friday options opening details, there were many new positions exceeding 10,000 contracts, including 50,000 contracts each for March expiry calls at strikes 33 and 37!

These options typically come in pairs forming hedged strategies to minimize decay, showing very institutional trading patterns.

The three large orders were:

Buy $KWEB 20250321 33.0 CALL$ Sell $KWEB 20250321 37.0 CALL$

Buy $KWEB 20250117 32.0 CALL$ Sell $KWEB 20250117 35.0 CALL$

Buy $KWEB 20250321 36.0 CALL$ Sell $KWEB 20250321 28.0 PUT$

The first two pairs were institutional orders placed on-exchange, while the third's source wasn't specified but could be institutional given the timing. Perhaps these three traders had lunch together.

KWEB's orders clearly show professional institutional trading - traders who write weekly reports and attend Monday review meetings, hedging meticulously to justify their work to their bosses. In contrast, the $YINN 20260116 27.0 CALL$ order appears more retail-oriented, taking a more casual approach.

There were also some aggressive bullish orders, like buying 30,000 contracts of $ASHR 20250221 30.0 CALL$ without hedging.

Currently, my stance on Chinese concept stocks is to keep buying when appropriate, preferring stocks over options, longer-dated options over shorter ones, and hedged over single-leg strategies.

While I anticipated no dip on Friday, I didn't expect such a strong rally - up 2.5% from the low opening price! This severely punished the "shorts."

I put "shorts" in quotes because Monday's opening suggested few shorts were actually caught - it seemed they tried to trap retail shorts but found mostly their own positions, making it less interesting.

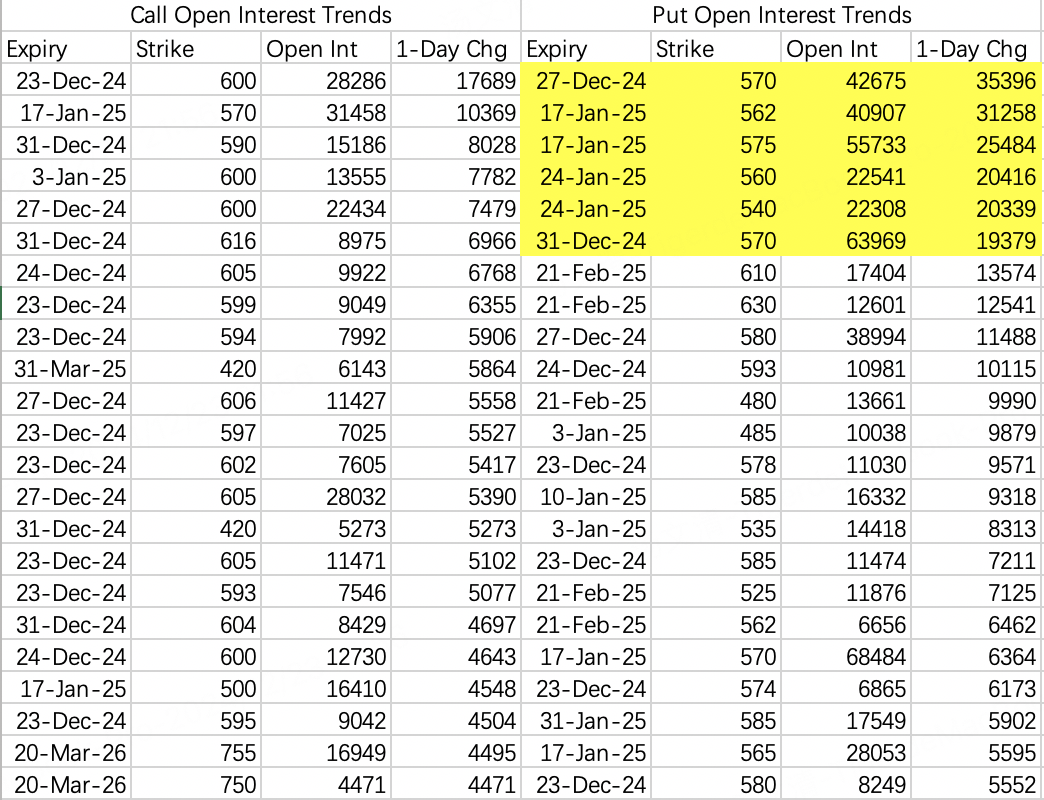

Friday's surge actually created an entry point for shorts. New options positions show significant volume in the 560-570 strike range. New lows after a crash might signal a bottom, but new lows after a surge could indicate institutional traps.

Tech stock short positions mainly used sell calls with extremely out-of-money strikes, like $AMZN 20250117 255.0 CALL$ and $AAPL 20250117 280.0 CALL$ , showing caution as peers often trigger short squeezes.

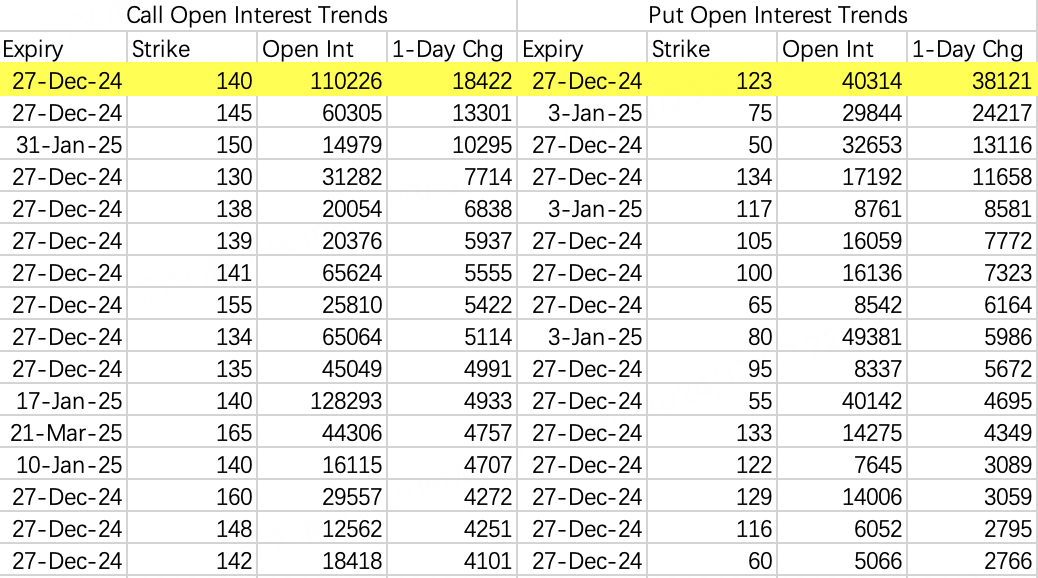

After Friday's squeeze, NVIDIA's options activity showed bullish baiting, likely anticipating Monday's probable squeeze targeting 140, though the weak retail participation made the momentum somewhat sluggish.

Put positions were scattered without clear strategy, except for the largest opening position of 44,000 contracts in $NVDA 20241227 123.0 PUT$ deliberately bought before close.

Given institutional efforts, the market should remain stable through Christmas, but post-Christmas trends become less certain.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Wheretotravel·12-24 19:27What an outstanding perspective on global markets. Your thoughtful analysis is much appreciatedLikeReport

- JackQuant·12-24 11:24Be sure to prepare for santa rally ! its coming to town…LikeReport