20 August 2021: Been adding in small volume even if Chinese market falls another 5%

$恆生指數(HSI)$ Hang Seng spot started the day with 200 points below yesterday close and struggled around 25,000 points this morning before plunging and breaking past the next support of 24,700 points strongly and hit around 24,580 before retracing to around 24,800. It would be important to watch if Hang Seng spot can regain and close above 25,000 points now. Readers should recall that I have cautioned on this Monday and in fact over the last 1 to 2 weeks that small bites were to be taken by me rather than to be aggressively acquiring shares at level around 25,700 to 26,000 points for Hang Seng index. Nevertheless, I saw readers commenting on my articles and said I was wrong and that long term investment in good companies should be a good entry point then. First of all, I am not debating that good investments cannot be made but the speed and pace of correction or even share price plunges can scare alot of novice investors and readers who end up taking losses at the exact bottom after seeing their investment retrace by another 30% despite their so called good entry for long term investment.

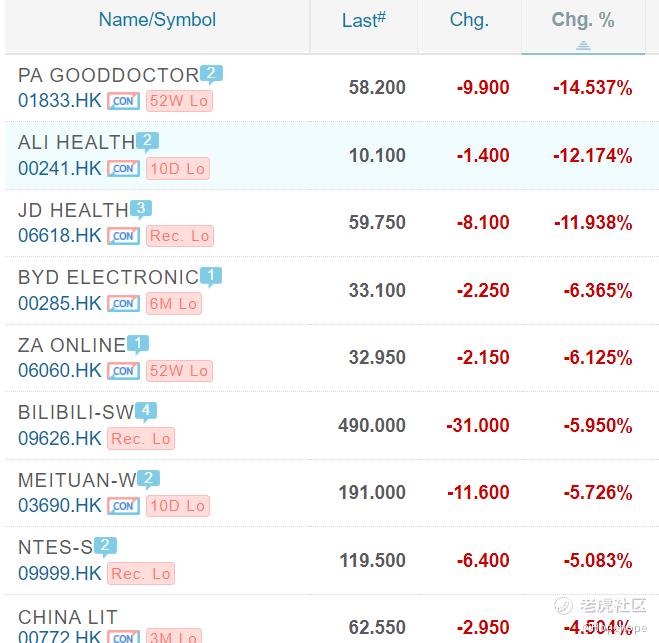

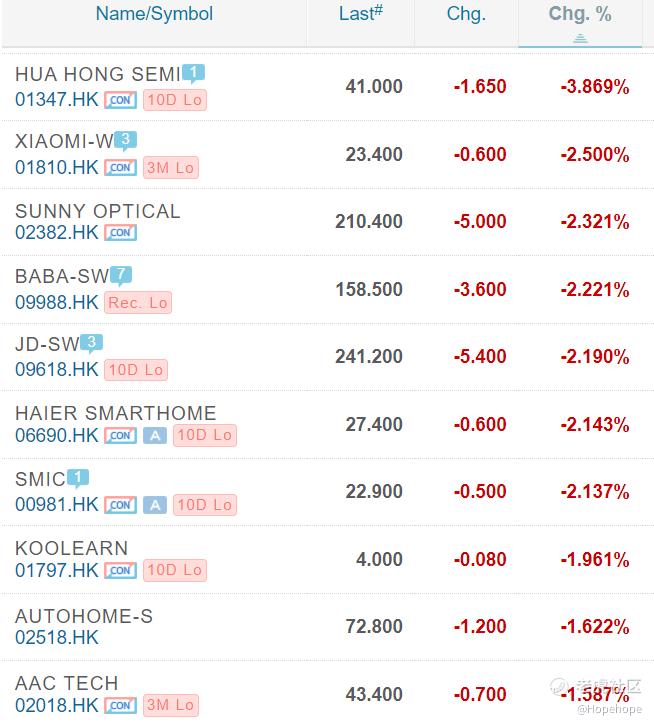

HS Tech index tanks over 3.5% now and is around 5,800 points though its day low is around 5,769 points. I expect another 5% correction as the maximum fall in the latest scenario take, which would see it around 5,500 points where strong support may be available. For readers who have read my yesterday article on "Scenario Analysis for those who have zero equity positions, it would be good to slowly acquire small position but bearing in mind that whatever entry points that you go in now may see another 30% decline". But why did I still proceed to make small bites in shares like $小米集團-W(01810)$ Xiaomi despite the fact that I have written an article that the price resilience of Xiaomi may not withstand the barrage of negative news sentiments surrounding the general broad market. Interested readers may read my article using the website link below:-

https://www.laohu8.com/post/830569864

I have in fact taken in additional small bites adding it to my BIG BLOCK OF XIAOMI SHARES. Today's entry points for Xiaomi was made at 23.2 and 23.5 HKD. If one does not have any equity positions now, there isnt really a big fear if one can hold on the investment (i am talking about investment and not trading) for 3 to 5 years to ride out the price volatility. I stand by the view that over the 3 years timeframe, I will not be surprised to see Xiaomi at a price of 60 HKD, which sees it at close to 200 billion USD market capitalisation. Only time will tell if I will be right in 3 years. I will also let readers know if I did decide to take profit if price hits within the target price range.

Readers should recall that I have written my price view of Alibaba USD shares and said it will fall to the price range of 160 to 165 USD. This was in fact realised relatively quickly last night in the US market. I am so not surprised and continue to hold the view that I will not acquire any Alibaba shares. The reason being that Alibaba is the Chinese Big tech that has the most attention from the regulators. Why should I put my investment in Alibaba when there are other attractive stock counters like that of Xiaomi? For Alibaba USD shares, if it cannot hold onto 160 USD price level, another leg down could easily see it to another 130 to 140 USD level. For Tencent, I stand by my view that the strong support is around 330 to 360 HKD and given current price level at 412 HKD given by the chart above, there simply isnt any reason to chase this price. But this is just for my personal investment take and risk reward preference. People with zero equity positions and believe in the moat and business fundamentals of Tencent may consider slowly acquiring bites in Tencent and even if it would eventually fall another 10 to 30%, the pain also wouldnt be that big!

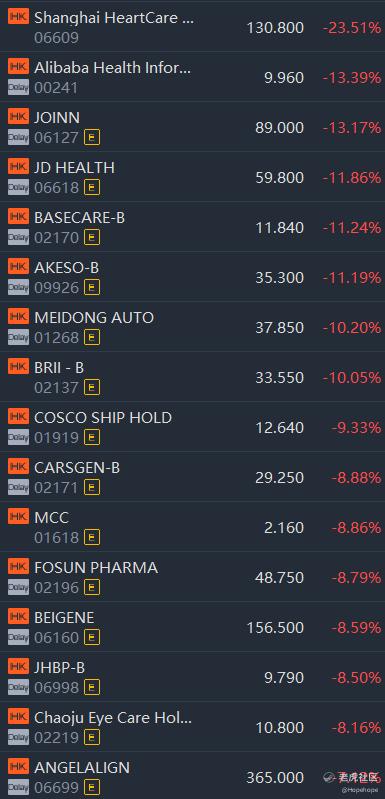

Readers should note that I will stay away from pharmaceutical and property counters. I do not believe the recent rally in Chinese property counters is sustainable. The reversal in price of pharmaceutical stocks has also seen me closing Guangzhou Baiyunshan Pharmaceutical stock a month plus ago that I am gladly to be out and escape from the rapidly 10% price correction of Guangzhou Baiyunshan Pharmauceutiacl. This morning news on the discussion with the alcohol industry practioners with the regulators as well as personal data protection acts introduction have again spooked the markets. But for the personal data protection act, why is there such a big hooha since it is also implemented in US and Europe and Singapore? I havent read the rules in details but why panick first? I think its just general market uneasiness to more and more rules.

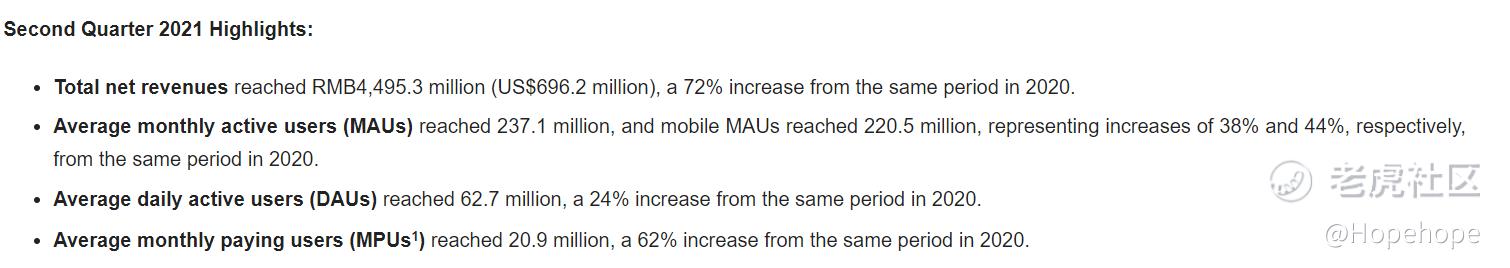

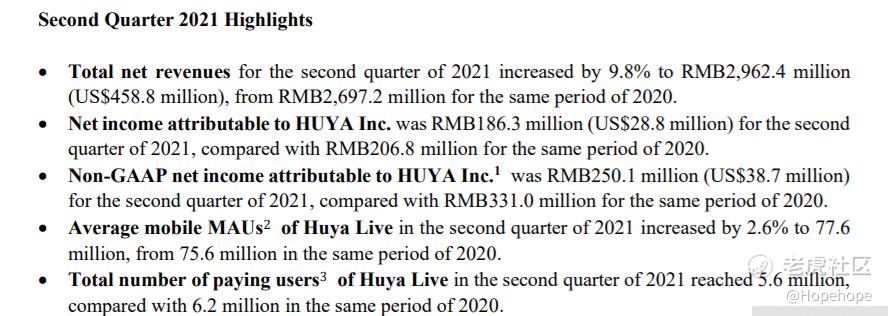

Bilibili's market capitalisation $嗶哩嗶哩-SW(09626)$ of 24.4 billion USD is 10 times that of Huya's market capitalisation of 2.26 billion USD though its revenue gap is only at 1.4x differential and paying users differential at around 3.5x differential and Monthly active users differential at around 3x differential. So I really do not have a good view of Bilibili as compared to Huya though Huya is still under the risk of potential regulations risk due to its business in the game streaming business. The good part is Huya's management has more foresight and better execution skills as I can see in comparison to $鬥魚(DOYU)$ and given the price stability within the price range of 9 to 9.5 USD for $虎牙(HUYA)$, I have added again in small volume for Huya. A cash balance of 1.5 billion USD plus a brand value of 1.5 billion USD for Huya has led to an aggregate value of 3 billion USD without even accounting for earning power for Huya. This gives me certain comfort that my investment (as long as there are no more stricter regulations being implemented for gaming and game streaming business).

I will continue to avoid shares like Haidilao which is on a downtrend as well.

As always, the above should not be construed as any investment or trading advice.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KYHBKO·2021-08-27pending your time horizon, maybe good to purchase the tech stocks if you intend to hold for long2Report

- Ermmmmmm·2021-08-28Nobody can predict markets butt need to have plans1Report

- Huat_the_fK·2021-08-25Chinese stocks will be back stronger ??2Report

- Finree·2021-08-23Let it form a good base first. Certainly the opportunity to come back again1Report

- Hktan·2021-08-30No worrIes! Well weitten n understood! Keep Up the effOrt! Enjoyed readIng itLikeReport

- finaldentiny·2021-08-23[财迷] [财迷]1Report

- Hinhin888·2021-08-23Alibaba no eyes see1Report

- JassyJas·2021-08-23thanks for sharing1Report

- Jway77·2021-08-23pretty cool lei1Report

- patricklowck·2021-08-25nice moveLikeReport

- CKWong0572·2021-08-23smart choiceLikeReport

- FrickL·2021-08-22Check If the company Fundementals is good, it will recover3Report

- Shan_2021·2021-08-22Good inpuTs . ThaNks1Report

- KLCC·2021-08-22Consistent dollar cost averaging is Best strategy2Report

- Hopehope赋予希望·2021-08-22I have been in the market for over 17 years2Report

- Jon1234·2021-08-23please like1Report

- yourself·2021-08-23if you have any questions or concerns please1Report

- evonnehon·2021-08-22thank you for sharing1Report

- croissant·2021-08-22very difficult. take care.1Report

- Tiger user·2021-08-22[美金] [美金] [美金] [美金] [美金]1Report