怎麼把$3200變成$50million?

上週很不幸被IB和CME邀請去參加了個關於 The profitability of market data analysis 的學術交流event,爲啥不幸呢?沒告知我我需要去演講,於是我啥也沒準備的就去了,到了後被一臉懵逼的請了上去,雖然我面無表情但是心理慌的一比,不過很快我就想到講什麼了:搭建個每天買spx call spread的組合,通過模型來算怎麼買和什麼價位最有可能變成百萬富翁,這樣應該能混過去

先聲明下這些數據都是臨時做的,雖然有些簡陋但請不要盜用謝謝

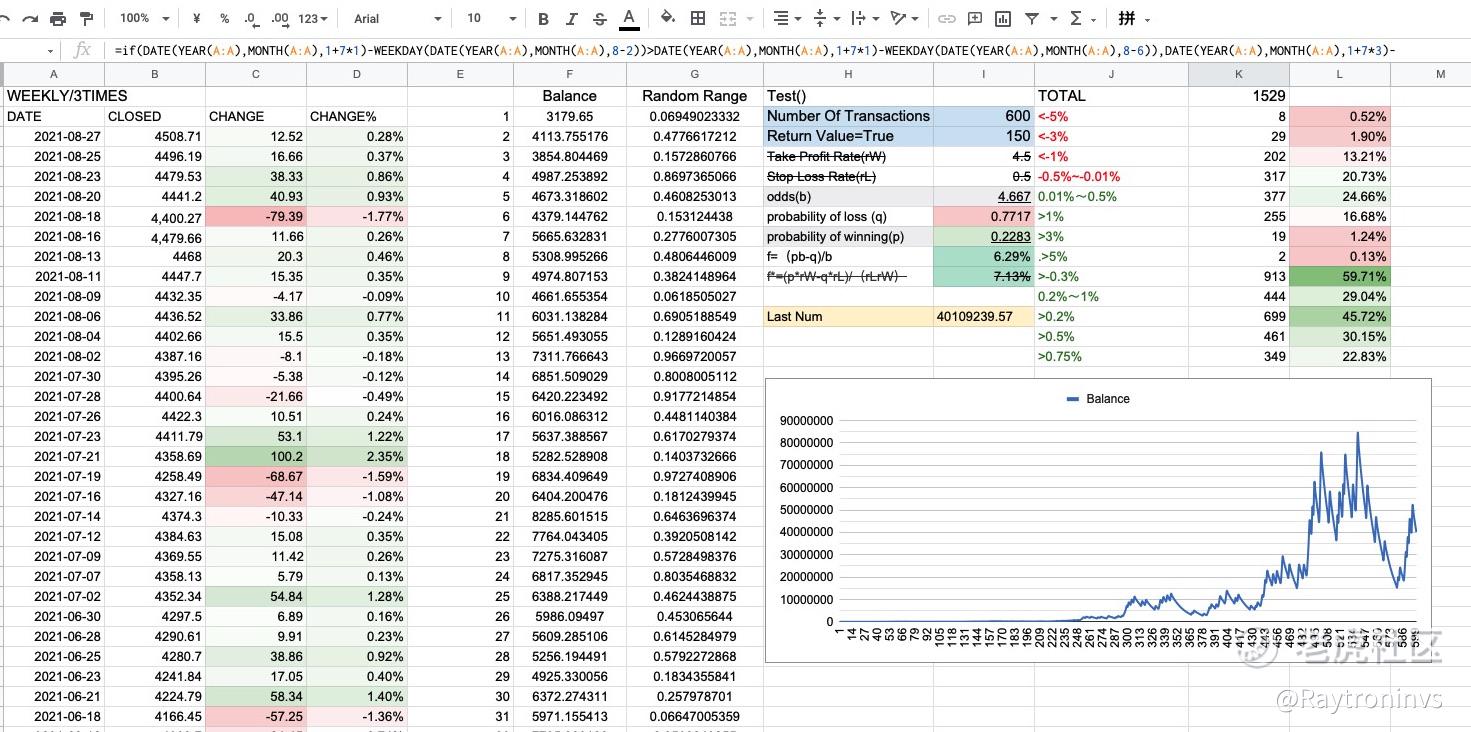

我抓取了spx指數在過去10年每個期權交割日的收盤價,一週三次,一共1529次(K1),J和K欄分別代表漲跌幅和次數,比如 J2和K2表示這十年內跌幅大於5%一共出現了8次。由於假定的是買方,要考慮概率成本和時間損耗,所以選格0.75%,高於0.75%出現了349次 佔十年交割總數的22.83%

至於應該用多少的本金和每次下注的金額,直接套用凱利公式,畢竟這個公式賊簡陋,只需要個贏得概率和賠率就行

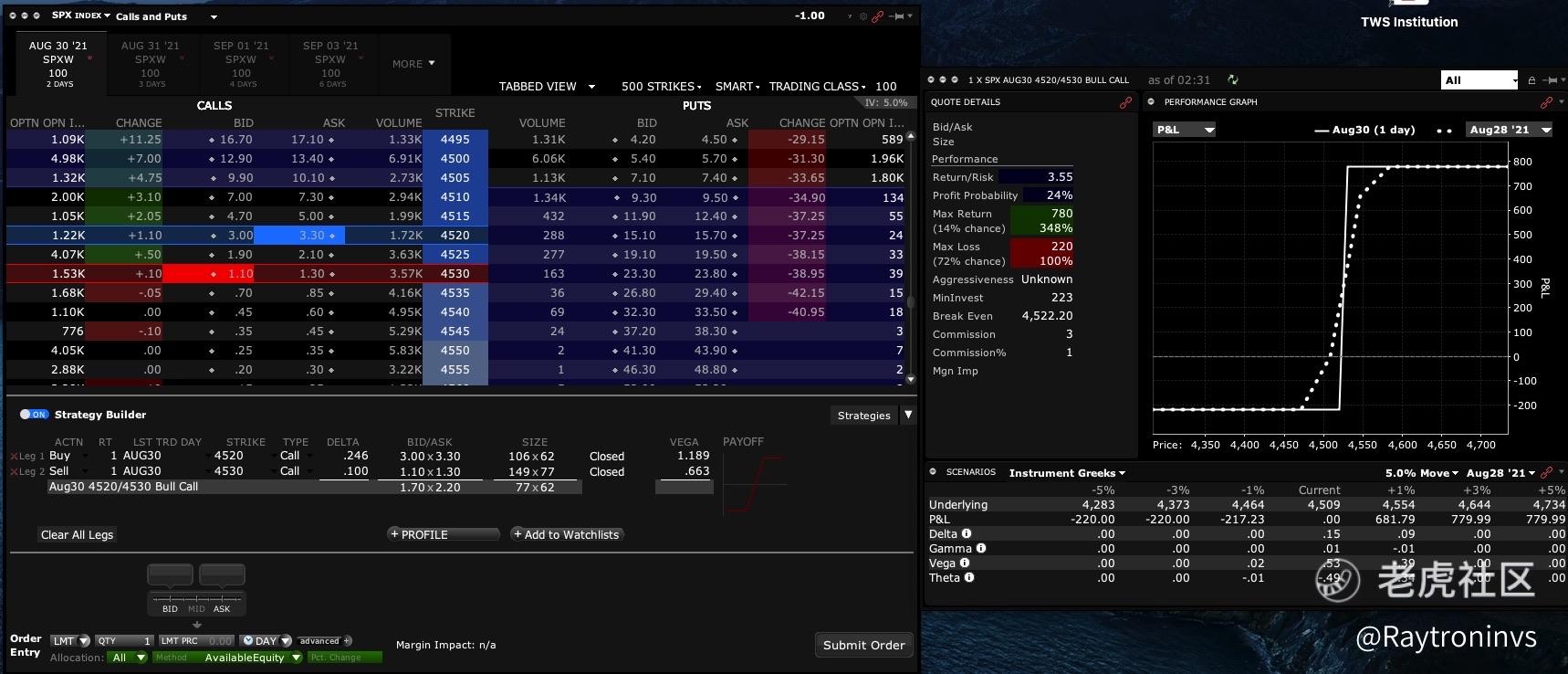

我們按照預計贏率隨便選個贏率相近的組合來計算賠率和投比,比如4520/4530,成本在180塊左右,最大盈利是720塊左右,所以賠率在4.667左右,帶入公式得出投比爲6.29%,反向計算本金+2次容錯值=3179.65,代入數據後輸出結果

第一組數據按照歷史數據來統計,在此之前的600個交割日中有150個交割日SPX收盤價高於前一個交割日收盤價0.75%,假設3.8年前開始每週開倉買入三次call spread,其餘時間不做任何交易,截止到上上週,持倉本金會從一開始的$3200變成現在的$40million

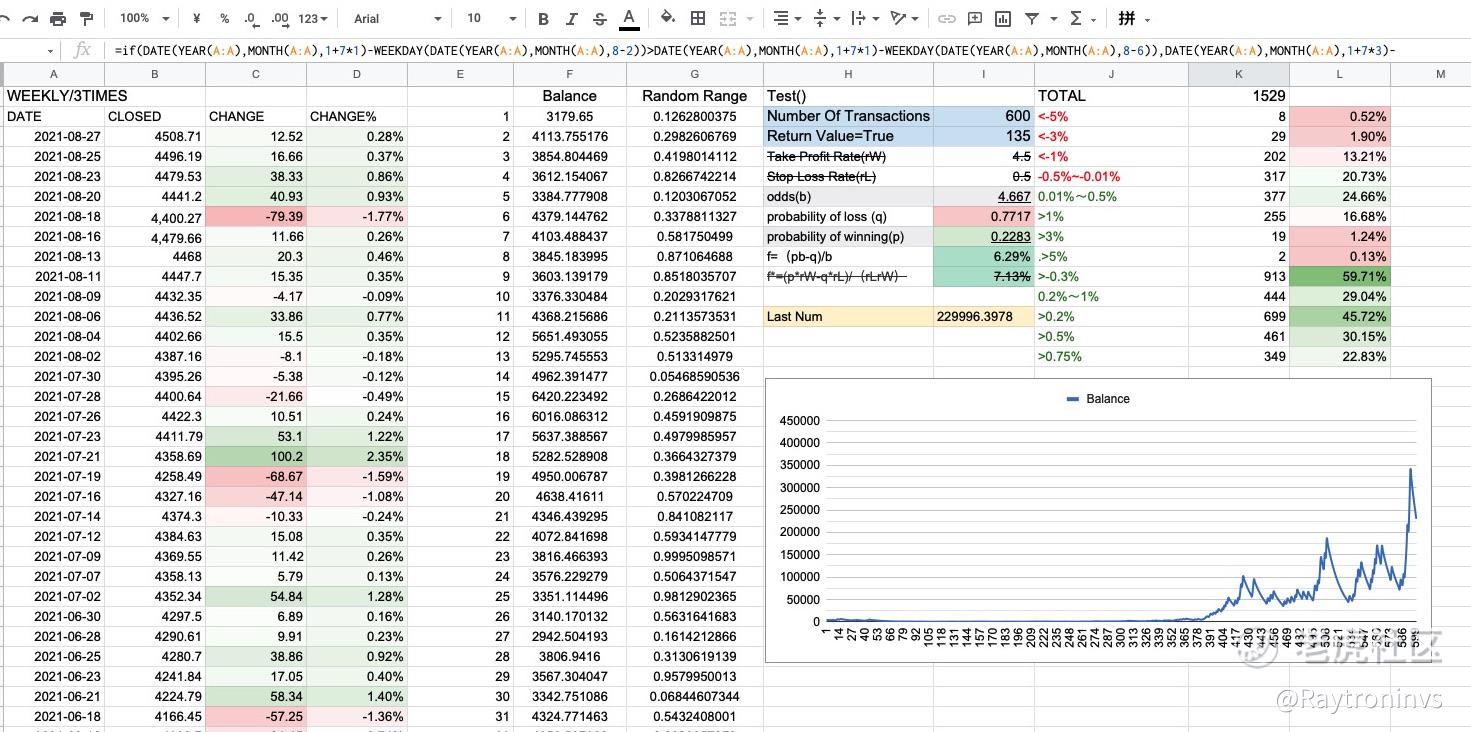

接下來我們帶入隨機概率值,回測區間不變還是600個交割日(L2)在每筆交易旁邊設置一個隨機概率值(G欄),然後用一個隨機概率返回值爲TRUE的次數來統計(L3),可以理解爲假如贏率爲25%,每筆交易都會有個隨機數字,高於25%爲False,低於25%爲TRUE,導入數據後輸出得到

由於改成了隨機概率,這次統計的擊中概率次數變成了135次(600個交割日內有135個交割日收盤價高於前一個交割日收盤價.75%)少了才15次,但收益去少了15倍不止

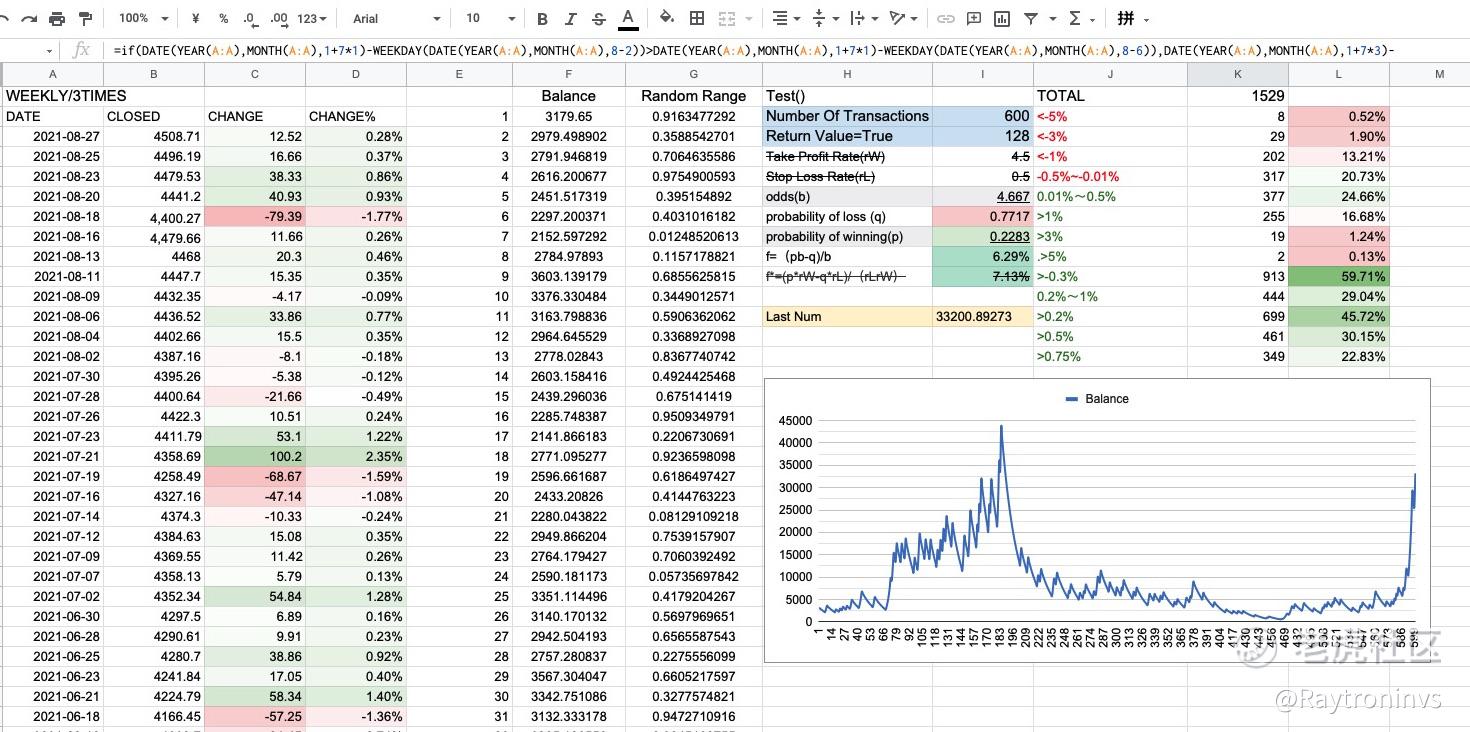

再導入一次試試

這次比前一次還要少7次,收益率也再次下降7倍

由此可見,去做市場數據分析還是很重要的,往往我們認爲不重要的其實很重要,比如百分之零點幾的概率差。而我們認爲很重要的可能根本就沒所謂,比如成功率的連貫性。

$NQ100指數主連(NQmain)$ $黃金主連(GCmain)$ $道瓊斯指數主連(YMmain)$ $恆生指數主連(HSImain)$

開了個公衆號:gammaspeed 歡迎關注

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Ag1718·2021-09-14☀️Hi, feel Happy & Sweet today.At the end of the day, the only questions I will ask myself are ..Did I love laugh? Did i laugh enough? Did I make a difference??16Report

- Ag1718·2021-09-20☀️ Positive thinking is more than just a tagline. It changes the way we behave. And I firmly believe that when I am positive. It not only makes me better ,but it also make those around me better.?LikeReport

- TheCrazyOne·2021-09-14not nice of them not informing you to prepare... but glad you pull it off10Report

- huaer8497·2021-09-17所以基本上你正在出售较低的执行价格期权并购买另一个较高的执行价格电话以确保你的头寸损失概率LikeReport

- kgb·2021-09-20问一下,IB是什么?LikeReport

- ReneS·2021-09-14????????????????????????????????????????????????????????????????????????????????????????????????????5Report

- 我是温斌·2021-09-14一些人还是脑子清楚点,别人作者是什么都没准备,所有数据和paper都是现场写和现场做的。还看不到差距在哪吗?3Report

- Kw0526·2021-09-14hi bro, so basically u are selling lower strike price option and buy another higher strike price call to secure ur position losses probability1Report

- 乐飞鱼·2021-09-14股市的水太深,要先学会游泳,熟悉水性,再慢慢的下水!1Report

- Jenjorjack·2021-09-14Thats amazing. sounds like bitcoin2Report

- pipiso·2021-09-14数据分析有一定程度道理,但市场是千变万化的,绝不能光看数据分析2Report

- Kentlieu·2021-09-14They are a good company and these are the kind of company to buy the dips on. Be patient and get rewarded.LikeReport

- Sinlin·2021-09-18看不懂呢.[捂脸]1Report

- 邢林林·2021-09-14股市的水太深,要先学会游泳,熟悉水性,再慢慢的下水!LikeReport

- 深情地与她对视了一眼·2021-09-14告诉我也没用,那么多钱我不知道怎么花,还是不赚了LikeReport

- iris小艺·2021-09-14在股市大起大落中浮沉.2Report

- HH浩·2021-09-14凯利公式已经被证实可以拉长生存机率。1Report

- lewisleeks·2021-09-14Great [Cool][Cool]1Report

- 一点恩·2021-10-13参考你之前卖put,感觉周期好长LikeReport

- 汪汪呢称·2021-09-22Good informationLikeReport