As the year-end is approaching, it‘s difficult for the ng market to be "pleasantly surprised"

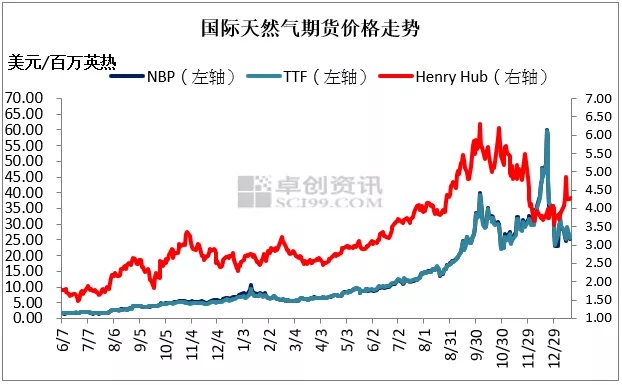

I. Review of the Trend of International Natural Gas Market

Review of natural gas futures market this week

On Tuesday (January 18), NYMEX Henry Hub natural gas February futures (contract code: NGG2) owned by Chicago Mercantile Exchange was US $4.283 per million British thermal units, up 7 cents from the previous trading day. The opening price was US $4.356, the highest price was US $4.390, the lowest price was US $4.216, and the closing price was US $4.332, up 1.64%.

This cycle, the US natural gas market is running at a high level as a whole. During the cycle, the central and eastern parts of the United States were affected by cold air, and the demand for natural gas heating stimulated the market to rise, which also laid the tone of high market in the whole cycle. However, the profit-taking of traders in the cycle makes the market fluctuate slightly, but it has little impact on the overall high operation of the market.

Natural gas inventories declined from the previous week. According to the US Energy Information Administration report, in the week ending January 7, the US natural gas inventory was 3,016 billion cubic feet, down 179 billion cubic feet from the previous week, 199 billion cubic feet lower than the same period of last year, down 6.2%, and 72 billion cubic feet higher than the five-year average, up 2.4%.

In terms of weather, in the next three days, there will be small to medium snow or sleet in Alaska, the northwestern United States, the southern Hudson Bay Plain, the eastern and southern Labrador Peninsula, and the Great Lakes region, and there will be heavy snow or blizzard in the local area. Among them, there is heavy blizzard in the southwestern part of Canada; There are small to moderate rains in the southeastern coastal areas of the United States and Cuba Island. At present, the overall temperature in the United States is relatively cold, which is beneficial to the demand for natural gas power generation and heating. In addition, the European natural gas crisis has not been lifted, which also has a certain positive effect on American natural gas exports. On the whole, it is expected that the US natural gas market will continue to fluctuate at a high level in the short

In terms of spot CIF price of LNG in Asia, the market is weak and volatile in this cycle. There has been a short-term rise in the European natural gas market during the cycle, so there has been a wave of rise in the Asian LNG spot market supporting this cycle. However, under the background of weak demand and sufficient natural gas inventory in Northeast Asia, the overall LNG spot market in Asia continues to be weak in this cycle.

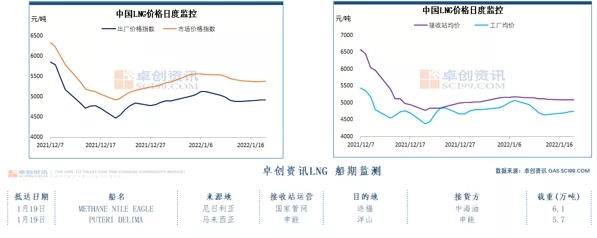

II. Review of China's LNG Market

Downstream demand is average, and LNG prices fluctuate within a narrow range. According to the monitoring data of 239 LNG plants in China by Zhuo Chuang Information, as of Wednesday (January 19th), 147 LNG plants started, and the average weekly start-up load of LNG plants was 47.17%, down 1.22% from last week. The average weekly daily output of LNG plants is 70.65 million cubic meters, down 1.83 million cubic meters from the previous month. (Note: Since January 5, 2022, the number of LNG plants monitored nationwide has been adjusted to 239)

As of January 19, 2022, the average price of LNG market was 4,902.56 yuan/ton, down 135.44 yuan/ton or 2.69% from the previous month. Recently, the output of domestic liquid plants decreased from last week, and the shipments of receiving stations remained low, among which the shipments of receiving stations in Tianjin were small, while the shipments of receiving stations in Ningbo gradually increased. From the demand side, some areas are still affected by public health events. In addition, the impact of domestic cold air is small, and the terminal demand is limited. In Hebei, Beijing and other places, due to the continuous low shipment volume of receiving stations in Tianjin, the inflow resources of liquid plants in Inner Mongolia and Shanxi increased.

Compared with the LNG price trend between China and the United States, there are differences in the recent market trends between China and the United States. In the United States, recently, the central and eastern regions of the United States were affected by cold air, and the demand for natural gas heating increased, which boosted market performance and supported the rebound of natural gas prices in the United States. From the perspective of China, some areas in China are still affected by public health incidents. At the same time, the recent domestic temperature performance is stable, the demand for urban fuel replenishment is not ideal, and the rebound of LNG prices is greatly resisted.

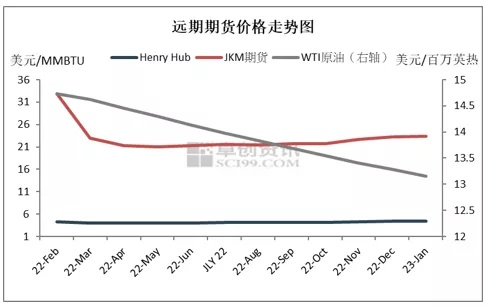

III. Forecast of International LNG Market Trend

This cycle, Henry Hub futures market is running at a high level as a whole. During the cycle, it is affected by cold air in some parts of the United States, which stimulates the demand for natural gas power generation and heating, and plays a supporting role in the market. In the medium and long term, from February to March next year, with the arrival of spring, the temperature will gradually warm up, the demand for terminal heating will weaken, and the natural gas market is expected to decline.

In terms of JKM futures, in the medium and long term, with the gradual increase of temperature in February-March next year, the demand for peak shaving gas in Northeast Asia and other regions will gradually disappear, and the market will decline to some extent. However, due to the continuous upgrading of environmental protection requirements in various regions of Asia, it is expected that the overall consumption of natural gas will maintain a certain growth, which will play a role in restraining the decline.

IV. Forecast of China's LNG market trend

In terms of weather, according to the forecast of meteorological agencies, the average temperature in southwestern Shaanxi, western Henan, western Hubei, Tibet, southern Qinghai, western Yunnan and eastern Sichuan will be 1 ~ 2 ℃ lower than normal in the next 10 days, while the temperature in most other parts of China will be on the high side, among which the temperature in some parts of northern Xinjiang, Inner Mongolia and northern Zhejiang will be 2 ~ 4 ℃ higher. There will be rain and snow in North China and Northwest China, which will have an impact on local logistics and transportation, and then affect the demand of LNG filling stations. As the Spring Festival approaches, the operating rate of domestic terminals will continue to decline. Under this background, the weak performance of domestic demand will have a partial impact on the LNG market. On the whole, it is expected that the domestic LNG market will run steadily and slowly in the short term, and some liquid plants will flexibly adjust their quotations according to the inventory situation.

$Natural Gas - main 2202(NGmain)$ $Light Crude Oil - main 2203(CLmain)$ $E-mini Nasdaq 100 - main 2203(NQmain)$ $YMmain(YMmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

👍