Case Analysis: How to Survive a "Choppy" Market?

With the escalating Russian-Ukrainian conflict and incoming Fed rate hike, “choppy” seems to define the stock market in 2022. In addition to the downside risks, the volatility is worse for retail investors who can never timely catch up with the market trends. How to hedge risks in a volatile market?

In last article, we shared two ways to short the market (buy call options, you can click How to Get Quick Money From a Downside Market). Today, we gonna show you how to use Short Put/Call to confront with volatility.

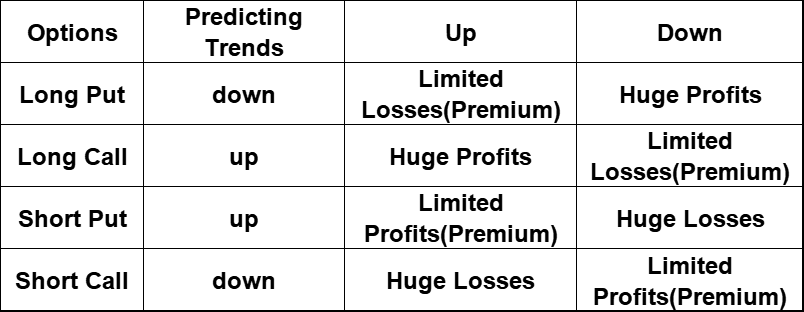

Before we get started, a quick wrap-up about call/put:

To put it simply:

Long Call/Put: you need to buy a contract. When you can correctly predict market trends, you will make a huge profit from it; if you fail,the loss is limited, i.e. the contract premium.

Short Call/Put: you don’t need to buy a contract. If your speculation is right, you earn the premium, which is limited; if it’s wrong, the loss is unlimited.

Besides the trading types, there is a very important concept called "Premium".

Here is a chart to help you understand:

Why do we trade with limited profit and potentially huge losses?

Short Put/Call can work in the volatile markets.

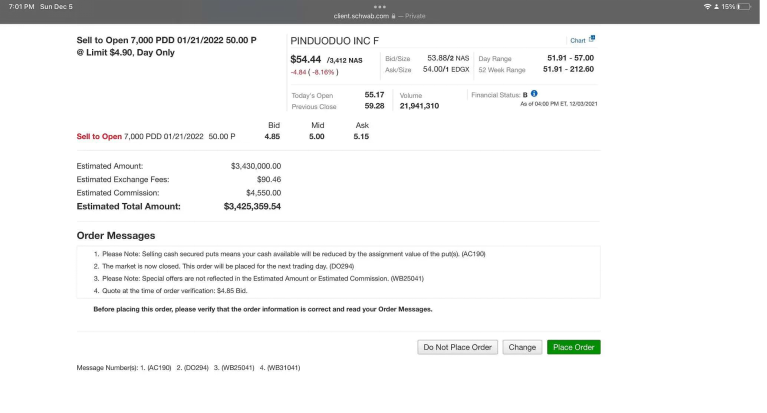

Let's take PDD as example:

In December 2021, Duan Yongping, known as China's Warren Buffett, traded 7,000 PDD Sell to Open PutOptions. The expiration date is January 22, 2022, with strike price at $50. One PUT containing 100 shares, and a premium of $4.90 per share.

- If $(PDD)$ share price is above $50 and Duan gets 7,000*100*4.9=$3.43 million (the total of premium).

- If PDD share price is below $50, Duan gets $3.43 million, but he also needs to fulfill his obligation to buy 700,000 shares at $50. It may lead to a huge loss = ($50 - closing price) * 700,000 - $3.43 million

With such a big risk, Duan trades the Sell Put for 3 reasons:

1. He is convinced that PDD will not fall below $50.

2. He deems that PDD less than $50 is worth buying.

3. He thinks PDD won’t surge in the short term, otherwise he would long call.

If I compare sell options (Sell Put/Call) to insurance, you can get it better.

When you Sell Put/Call, you act like an insurance company and immediately get the "car insurance premium"; but if there is acar crash, you need to pay a lot.

But generally, very few cars have accidents. That is to say, when you predict that the stock won’t fall below or rise above a certain price, you can trade Sell Put/Call.

In a volatile market, you don’t have to specifically predict the trend, rather to trade Sell Put/Call in a certain range. It will be easier and safer relatively.

But you should always be cautious about the losses, and the trend is the most important factor in your option trading!!! Don’t gamble on something you are not familiar with!!!

What's your opinion on PDD Short Put?

Do you have the plans for Short Put?

Share your thoughts with me and other Tigers~

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- koolgal·2022-02-25Thanks for sharing your insights on how to trade the current volatile market using options. It is definitely important to know the parameters before embarking on this trading strategy & risk appetite10Report

- RoaringTiger·2022-02-25Losses need to be assessed in the long term. If I short put at a price I deem good and ended up getting the stock at bargain price, it can bring huge profits in the long term. Else, it's gambling.6Report

- Sing Options·2022-02-24在当前市场上,许多人在交易期权轮策略时被屠杀。轮子实际上是我的fav策略,除了它必须调整以适应波动的市场,否则投资组合全红。4Report

- Anzygart·2022-02-25People who trade options need to be watching their trades closely or it could be a huge surprise if the stock goes the other way. Some stocks move so fast that by midday, the loss can be huge3Report

- HM0510·2022-02-26Options can be like gambling if one Didnt study the stOck mUch enough. So do your homework, onlY buY when you have extra cash.3Report

- Remotecam·2022-02-27Gambling is an addiction. The dopamine rush you get from the very few times you win is enough to make you forget huge losses. Trading in euphoria is dangerous.LikeReport

- 666huat666·2022-02-24stop trading the usa market take a break as this may take more days....2Report

- Eatmi·2022-02-27Learning from all of you how to make investments. Thanks for your sharing.1Report

- 1billions·2022-02-26I love dji1Report

- labbiT·2022-02-26Thanks for sharing2Report

- CharlesW·2022-02-26Stay invested and take the opportunity1Report

- highhand·2022-02-25lower the anchor to the sea bed1Report

- rin.·2022-02-24You simply hold and pray.1Report

- aunteenat·2022-03-01Great ariticle, would you like to share it?LikeReport

- HL Chua168·2022-02-26Buy Defendive stocksLikeReport

- Olegarki·2022-02-25Like back please…thanksLikeReport

- bukit timah·2022-02-25please like1Report

- Mr Mooney·2022-02-25buy more with cheap price or sell all?LikeReport

- Keke123·2022-02-28yeaLikeReport

- ykc5020·2022-02-28good read1Report