8 Charts Help You Getting the Trend of U.S.Stock Market

Key Takeaways:

- Take History as A Mirror: The U.S. Stock Market Will Rebound From the Correction Zone

- Under the Strong Economy and High Inflation: The Investment Cycle Reached Overheating

- From the Relatively Lower Valuations Perspective: How Will The U.S. Stock Trend go?

The S&P 500 slumped on Tuesday, slipping into correction territory for the first time in two years and joining the Nasdaq Composite, as Russia sends troops to pro-Russian regions in Ukraine and tensions escalate.

Craig Johnson, chief market technician at Piper Sandler & Co. says the S&P 500 is “living on the edge of support” around the 4,300 level. He’s sticking with his 5,150 year-end price target for now.

On contrary, Richard Ross, the technical strategist at Evercore ISI says that his work continues to suggest the S&P 500 is headed toward a deep drop. He predicts a break below 4,200 could take the index to 3,600, a decline of roughly 16% from where it closed Tuesday.

How do you think the U.S. stock market fluctuate next? Below presents some data from historicaltrends, economic fundamentals, and the valuations of the stock market for you to measure the trend andopportunities.

1. Take History as A Mirror: The U.S. Stock Market Will Rebound From the Correction Zone

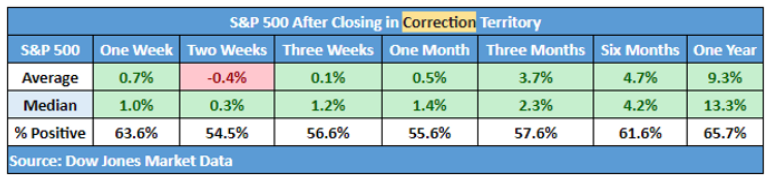

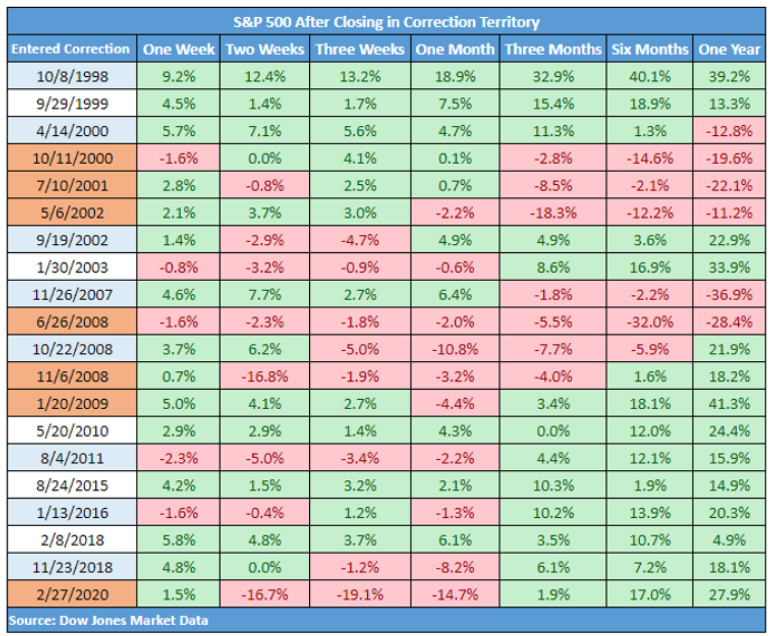

On average, the S&P 500 gained 0.7% in the week after falling into correction territory and lost an average of 0.4% in the two-week period. From the perspective of three weeks, one month, three months, six months and the whole year, the market all ended higher, especially the one-year increase of nearly 10%.

2. Under the Strong Economy and High Inflation, The Investment Cycle Reached Overheating

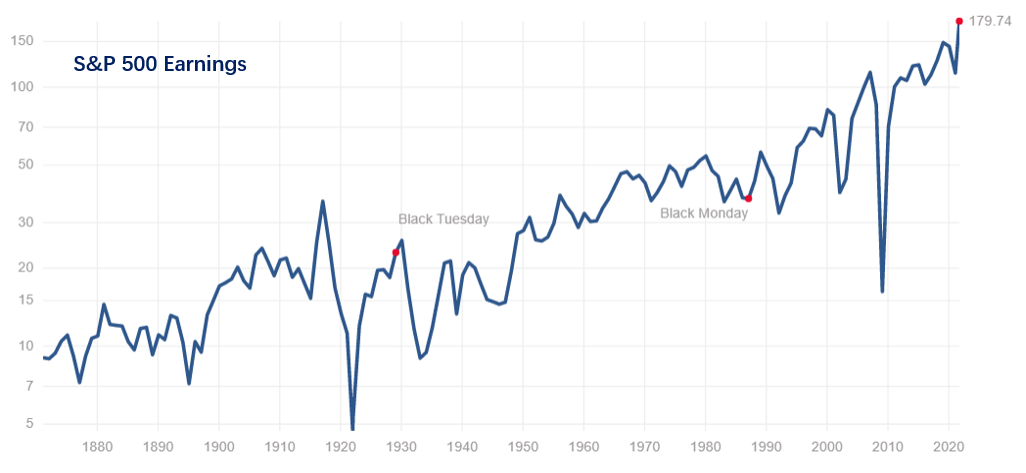

From a Macro Economic perspective, The U.S. Economy grew 5.7 percent in 2021, the fastest full-year clip since 1984, despite the ongoing pandemic. Meanwhile, the S&P 500 is reporting earnings growth of more than 30% for the fourth straight quarter and earnings growth of more than 45% for the full year.

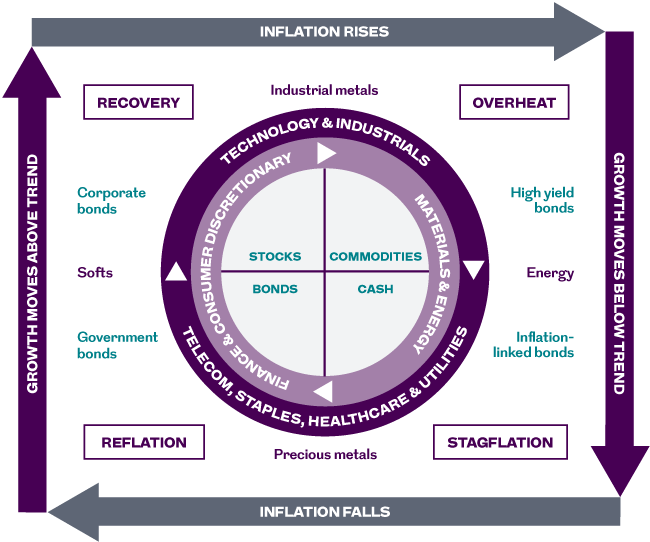

While the U.S. inflation has hit the highest in 40 years, therefore, this stage is an overheating period of Merrill Lynch's Investment Clock.

Analysts are expecting growth to slow this year, as the government scales back stimulus spending and the Federal Reserve raises interest rates.

The World Bank is predicting theU.S.economy will grow by 3.7% this year, in line with other forecasts.

Joseph LaVorgna, former chief economist for the National Economic Council said“The economy is decelerating and downshifting, It’s not a recession, but it will be if the Fed tries to get too aggressive.”

As an investor, for sure it is necessary to maintain cautious expectations for the Fed's interest rate meeting in March, May, and June.

3. U.S. stock Valuations Relatively Lower, How Will The U.S.Stock Trend Go?

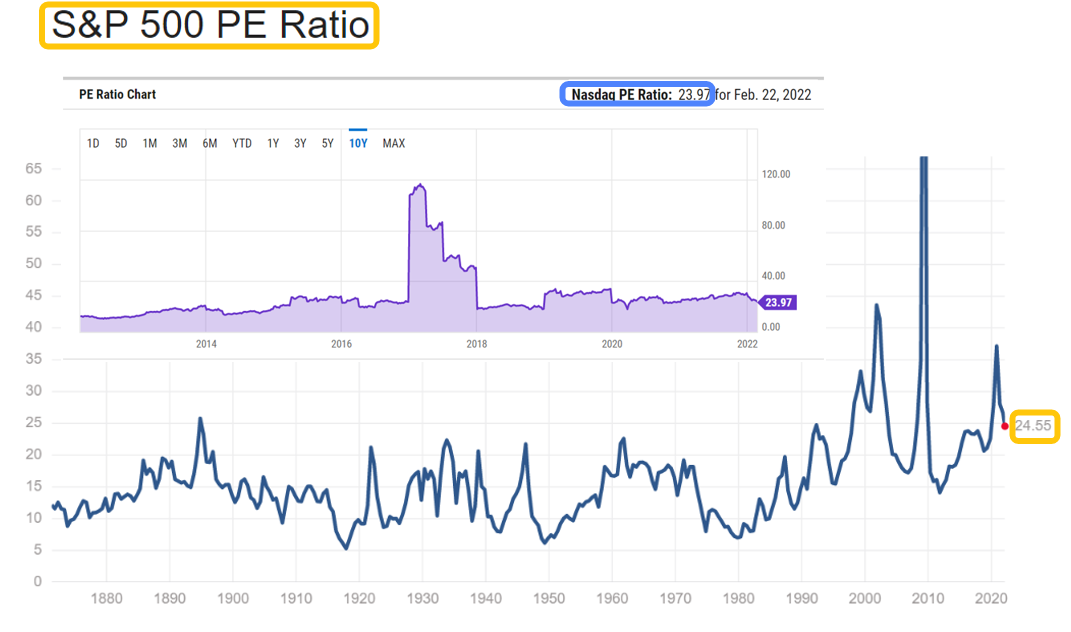

From a valuation perspective,The current S&P500 P/E Ratio24.55, this is 24% above the modern-era market average of 19.7, The Nasdaq Composite PE Ratio 在23.97.

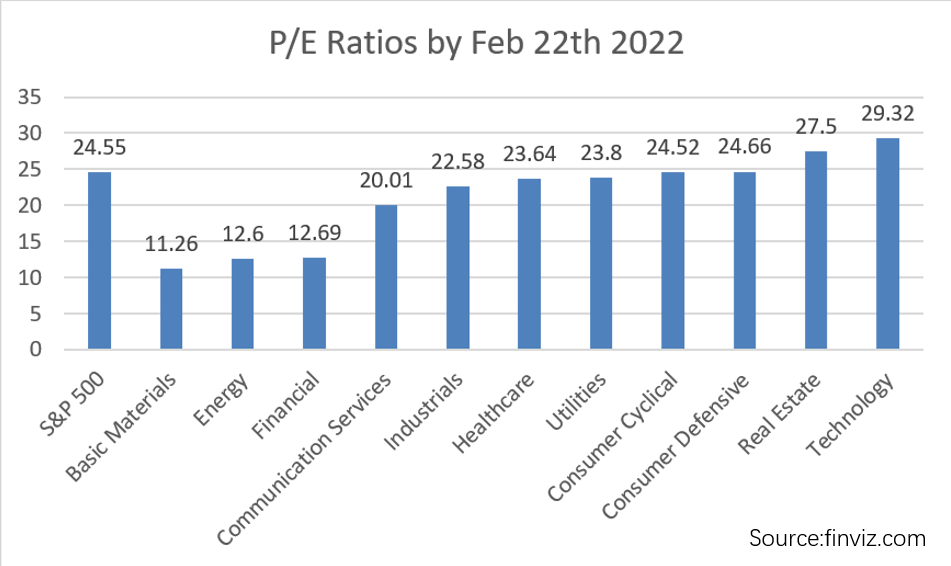

The Price to Earnings Ratio (PE Ratio) is calculated by taking the stock price / EPS (ttm). This metric is considered a valuation metric that confirms whether the earnings of a company justify the stock price.It shows as below that the current U.S. stock valuations are not that high, but specifically, the valuations between sectors of S&P 500 are divergent and even polarized.

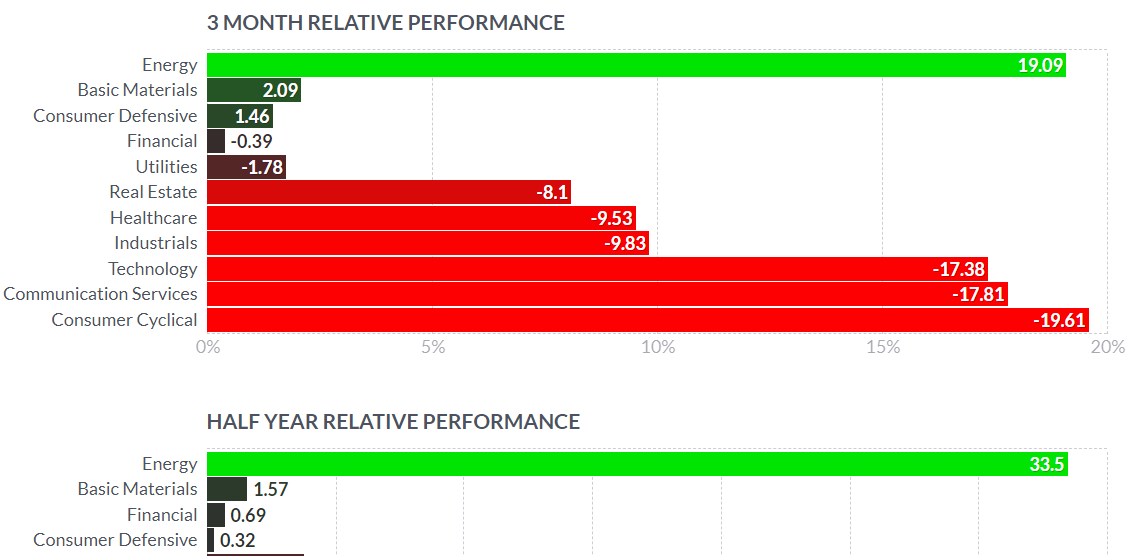

At present, the valuations (P/Es) of Basic Materials, Energy, Financial sectors are lower than the P/e of S&P 500 index, while Technology, Real Estate, and Consumer Defensive sectors' P/Es are higher than the S&P 500 benchmark's P/E.

Overall, the valuation of U.S. stocks do not seem to beextremely high, based on the strong y-o-y growth of the economy and the environment of high inflation and interest rate hikes, how will the trend of U.S. Stocks will perform, it could continue to go down?

Lindsey Bell, chief market and currency strategist at investment firm Ally Invest, noted: "Investors are de-risking as the situation escalates and uncertainty mounts on the road ahead... Markets could be on edge in the coming weeks."

Wall Street's most bearish analyst, Morgan Stanley's longtime bearish chief U.S. stock strategist Michael Wilson, said :" the market is sending mixed signals as the situation in Ukraine escalates."

Wilson reiterated his view that the U.S. stock market correction has not yet been completed, the market faces the risk of a correction, and the S&P may continue to fall by more than 10%.

It sounds like things are still shaky right now, and no one dares to assert that the sell-off is over.(Tiger Charts: What Sectors Can Survive in Rate Hiking Cycles)

In addition, yesterday we collected the market movements after the war and post-conflict , which also did not seem to be scary.(What happens to the stock market amid geopolitical shocks)

All the above data tells us that even under the cloud of high inflation and war, there is not necessarily a big bear market. If you are still interested in the stock market expectations in 2022, welcome to review (Bullish or Cautious? 10 Wall Street strategists' 2022 Outlook tell you! )

Recomend Reading:

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

pls like