Weekly Recap: After a 5-week Decline, Stay on FED’s Rate Hike Decision

The S&P 500 fell nearly 3%, declining for the fourth week out of the past five and extending the stock market’s rough start for the year. The war in Ukraine continued to drive markets.

The NASDAQdropped 3.53% on last week, putting the technology-oriented index into bear-market territory, as it fell more than 20.0% below a recent high set in November.

The Dowfell 1.99% for last week, leaving that index in a correction, or more than 10.0% below a recent high in January.

Weekly Index Returns From Last Week

Other Markets:

- After closing around $115 per barrel the previous week, the price of U.S. crude oil surged as high as $130 early in the week as the United States announced a ban on Russian oil imports and Russia continued its invasion of Ukraine.

- Although its overall weekly gain was modest, the price of gold surged to as high as $2,072 per ounce on Tuesday, surpassing its previous record closing high set in August 2020.

- The price of nickel roughly doubled on Tuesday as the war in Ukraine fueled concerns of supply disruptions for the precious metal, a key component of electric-vehicle batteries.

- European stock index rose 2.2% for the week, while Germany’s main index climbed 4.1%, gaining back some of the ground lost in a sell-off the previous week that saw some European indexes fall more than 10.0%.

- After finishing the previous week at 1.73%, the yield of the 10-year U.S. Treasury bond jumped on Tuesday, Wednesday, and Thursday, when it breached 2.00%—a threshold previously reached in mid-February, but not sustained for more than a few days.

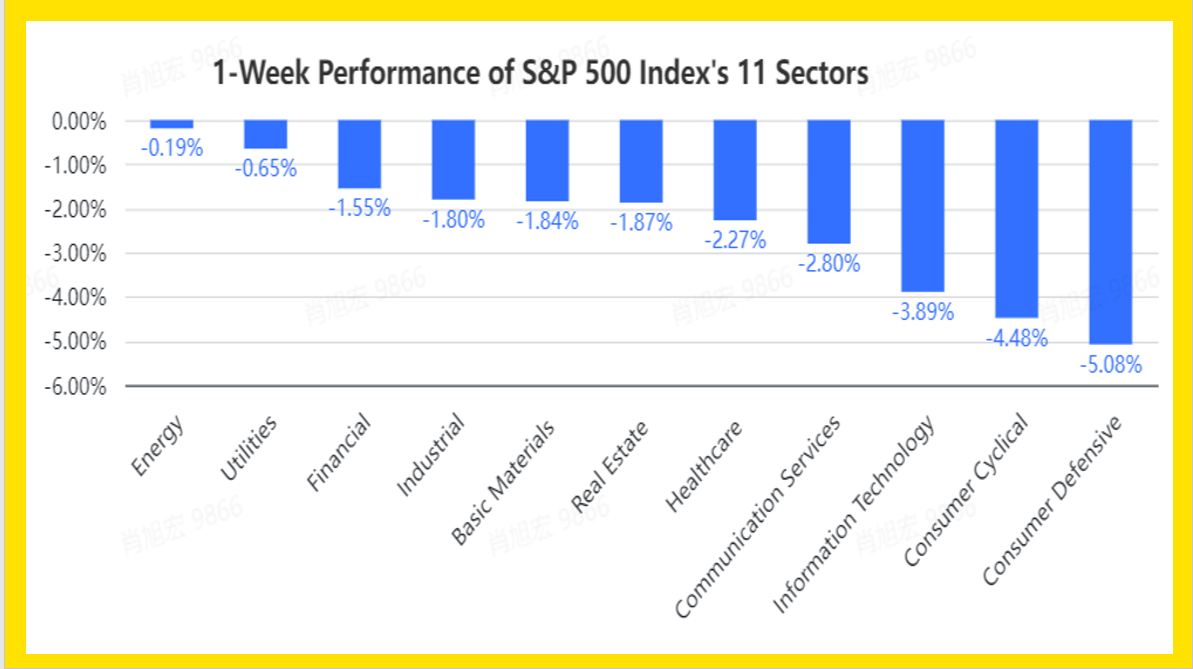

S&P 500 11 Sectors Performances:

Last Week, all sectors fell, Consumer Defensive and Consume Cyclical dropped the most; Energy, Utilities dropped the less, Other sectors declined from 1%~3%.

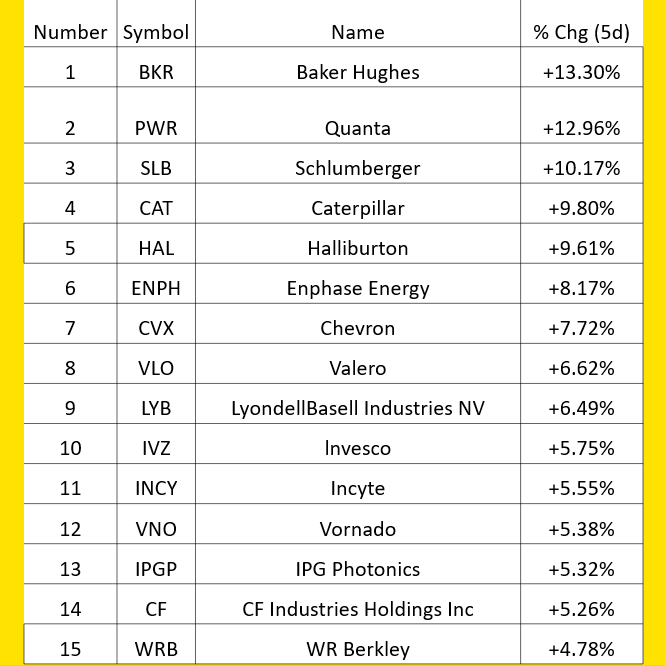

Stocks With Top Weekly Returns from S&P 500 Index Component are: $(BKR)$, $(PWR)$, $(SLB)$, $(CAT)$, $(HAL)$, $(ENPH)$, $(CVX)$, $(VLO)$, $(LYB)$, $(IVZ)$, $(INCY)$, $(VNO)$, $(IPGP)$, $(CF)$, $(WRB)$.

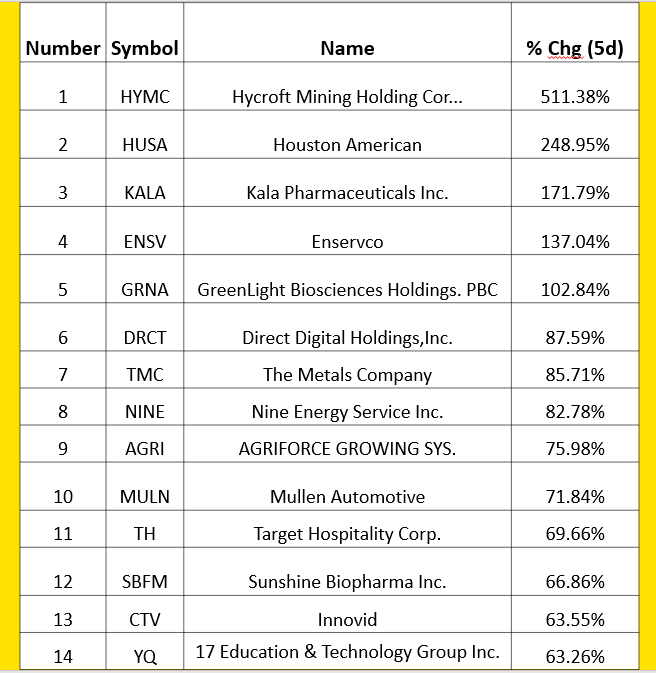

Top Weekly Returns of all Market are: $(HYMC)$, $(HUSA)$, $(KALA)$, $(ENSV)$, $(GRNA)$, $(DECT)$, $(TMC)$, $(NINE)$, $(AGRI)$, $(MULN)$, $(TH)$, $(SBFM)$, $(CTV)$, $(YQ)$.

Macro Data:

With inflation surging at a 7.9% annual rate, U.S. Federal Reserve policymakers are widely expected to begin lifting interest rates when they conclude a two-day meeting on Wednesday. Federal Chair Jerome Powell told Congress earlier this month that he was strongly inclined to support a quarter-percentage-point rate increase, rather than the half-point jump that some have supported for the upcoming meeting.

Prices of stocks and bonds fell on Thursday after the government reported that U.S. inflation accelerated at a 7.9% annual rate in February, eclipsing the previous month’s 7.5% figure. Excluding food and energy—both of which moved sharply higher during the month—core inflation still rose 6.4%.

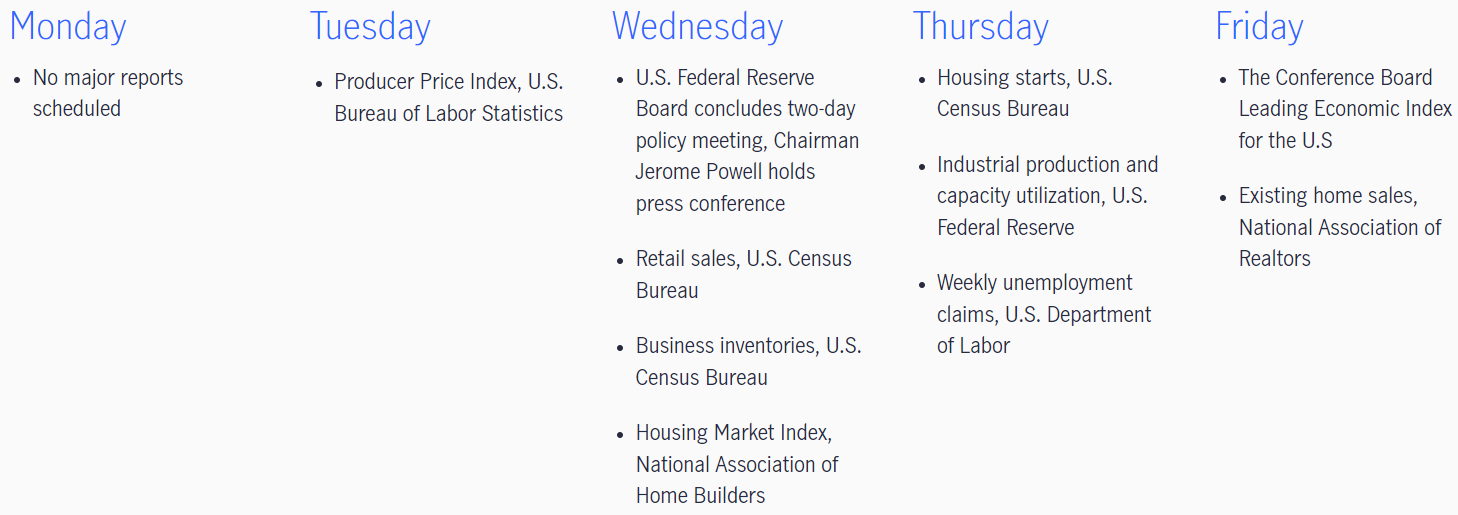

The Week Ahead: March 14-18th:

Dollar General (DG) and FedEx (FDX) will highlight a relatively quiet earnings calendar this week.

The Fed’s interest rate decision on Wednesday will be the primary focus. An increase of 25-basis points is expected. The announcement of new quarterly expectations and how many more boosts we can expect in 2022, will be key.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- gongfucat·2022-03-15better stay out for a couple of months. increasing risks of recession seen.4Report

- Asphen·2022-03-15seems like every FOMC will have an increase, going to 1.752Report

- Favian·2022-03-15cant imagine the fed hiking 0.5 this meeting3Report

- matrix20xx·2022-03-15wait for the right timing [Happy]2Report

- mrniceguy·2022-03-14Wait for tjis week2Report

- 淡宾尼魔·2022-03-15Go big or go home1Report

- asr68·2022-03-15looks like more room to go down1Report

- Ericdao·2022-03-15Bear mkt is here to stay for a while1Report

- MatInvester·2022-07-27[smile]LikeReport

- Jovin82·2022-03-15nice1Report

- BobbyRemora·2022-03-15[Miser]1Report

- 苗派·2022-03-15🤢🤮1Report

- 1billions·2022-03-15长1Report

- Kevin28·2022-03-15Ok1Report

- CExecutive·2022-03-15Oo2Report

- albert77·2022-03-15oh no2Report

- sickeninglim·2022-03-15👌🏻👍🏻1Report

- Kenwong·2022-03-15👍3Report

- JCJC87·2022-03-15Great2Report

- Sing Options·2022-03-15kool2Report