Buffett's acquisition of Alleghany: conservative appreciate each other

When the news of the acquisition came, Berkshire and Alleghany both closed up. A good acquisition is probably about this effect.$Berkshire Hathaway(BRK.A)$$Berkshire Hathaway(BRK.B)$$Alleghany(Y)$

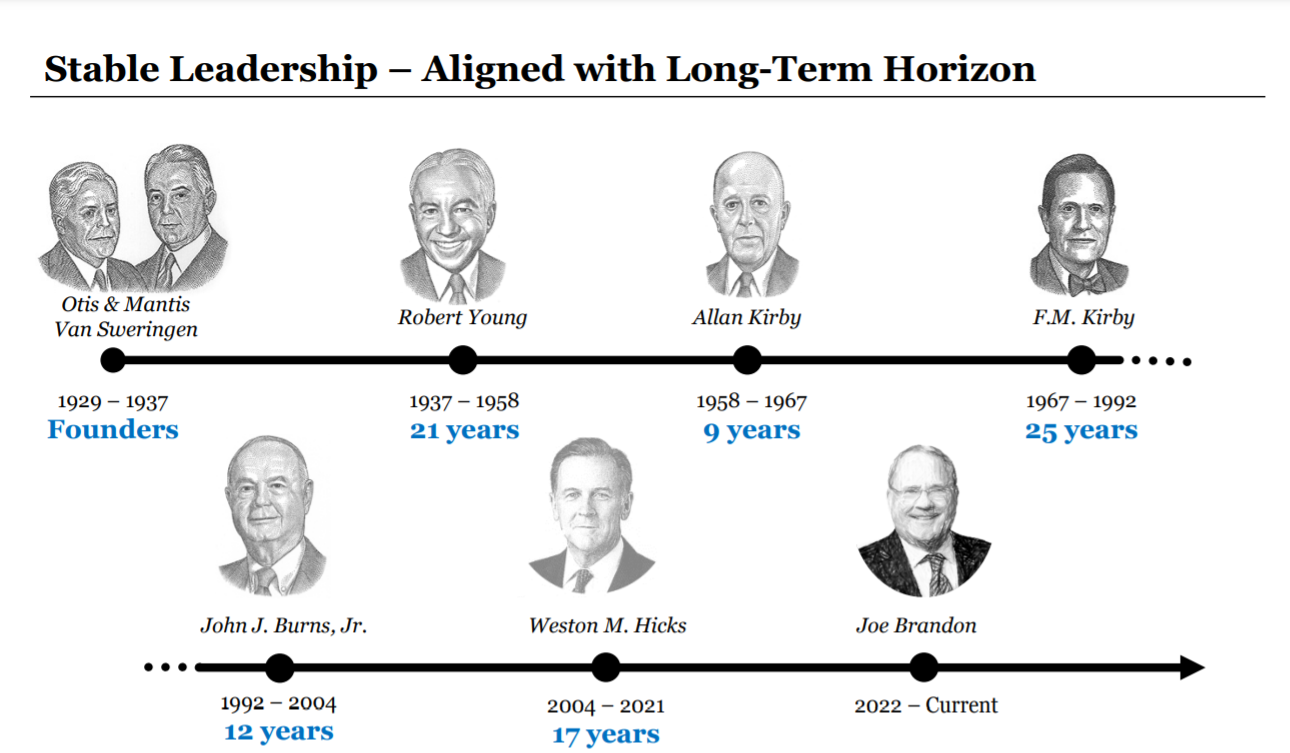

The stock god himself voiced that he had been paying close attention to this enterprise for 60 years. Alleghany was founded in 1929 and is almost the same age as Buffett.

So roughly, it was 1962 when Buffett was 32 years old.

AboutAlleghany

In fact, Alleghany's current CEO, Joseph Brandon, was the head of Berkshire's General Re.

Alleghany also occupies a core position in the field of property insurance and reinsurance, and the three major insurance-related businesses constitute most of Alleghany. A decade ago, it acquired Transatlantic Holdings, also known as TransRe, which offers a full range of reinsurance products. RSUI Group underwrites wholesale professional insurance, while CapSpecialty provides professional insurance such as commercial property, accidental injury, loyalty, guarantee and professional insurance for the small and medium-sized enterprise market.

Like Berkshire, Alleghany also has non-financial businesses, using its wholly-owned subsidiary Alleghany Capital to hold and manage these businesses. Alleghany Capital's assets include machine tool specialist Precision Cutting Technologies, customer trailer and track body manufacturer RC Tway, structural steel manufacturer WWSC Holdings, Wilbert Financial Services and parts and assembly supplier Piedmont Manufacturing Group.

FromPBTalking about the valuation of financial companies

It is not easy to value a company, and you may need to invent something yourself. As a famous saying goes,

Ben Graham created the asset valuation model for steel companies, Buffett developed the valuation model for franchise companies such as media companies and consumer companies, and Bill Miller perfected the valuation theory for technology companies.

Berkshire paid the following price for this acquisition:

Berkshire paid a premium of 25% over its original share price. By the end of 2021, Buffett acquired Alleghany's share price at 1.26 times its book value, but in March 2020, Alleghany's share price was 1.35 times its book value, while Berkshire's share price was 1.5 times its book value

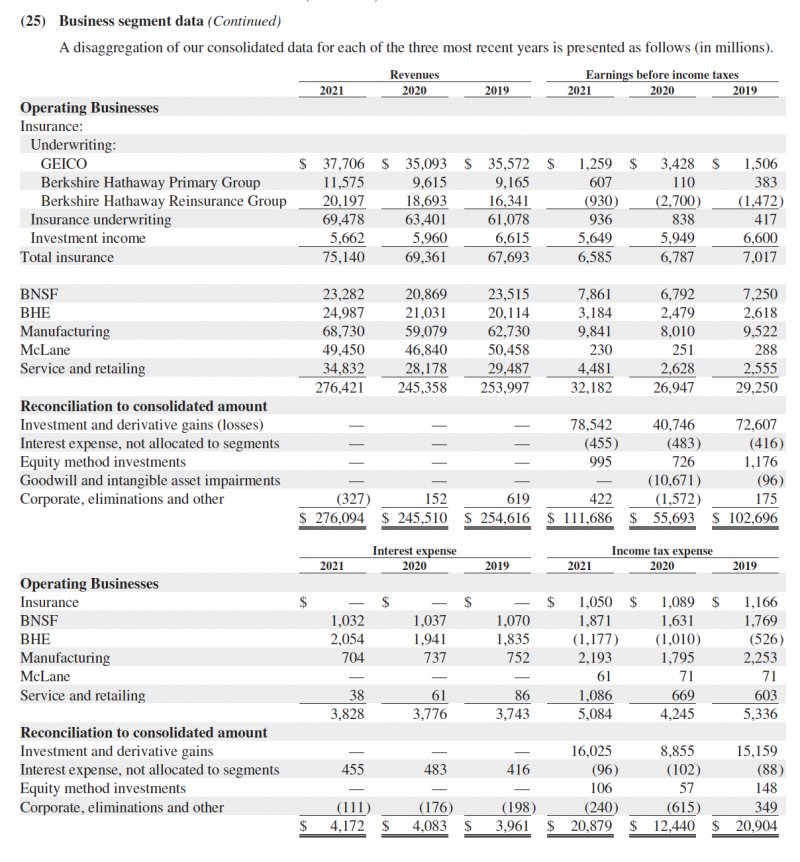

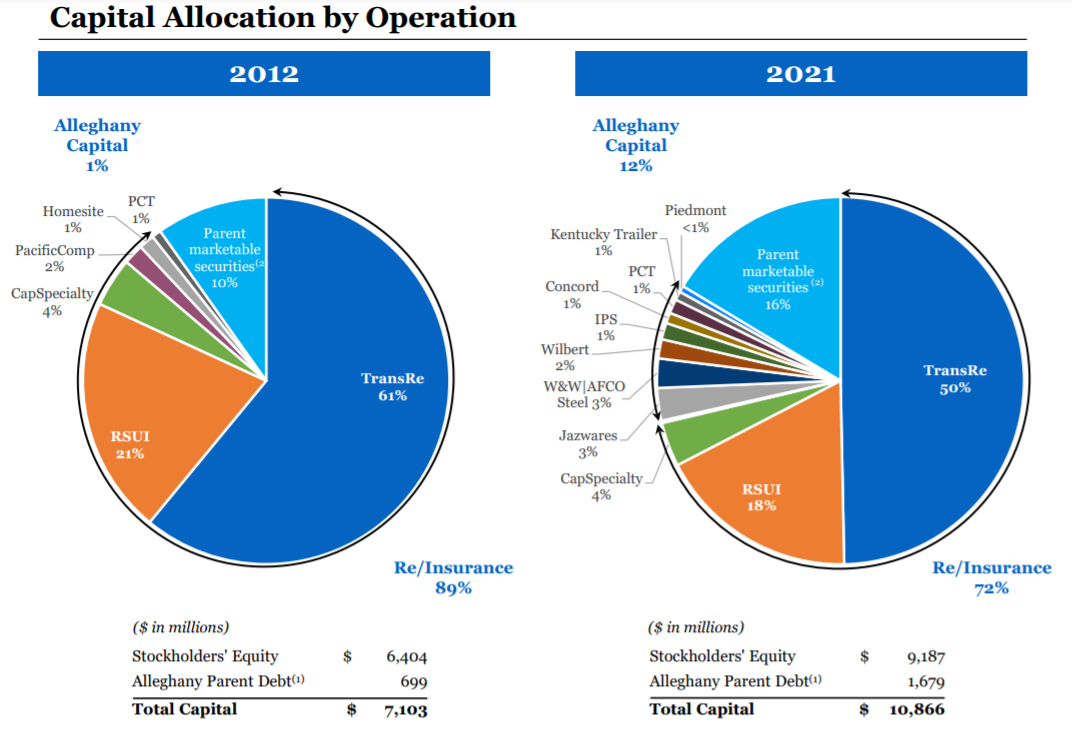

You know, companies like Berkshire and Alleghany are actually like small ETFs, which contain a lot of companies. The revenue part of Berkshire's financial report is to sum up the revenues of various companies.

Including financial and insurance business, transportation, energy, manufacturing, retail and service business, Berkshire is regarded as a financial company because of the dominant proportion of insurance business, and its valuation is applicable to the unpretentious PB index.

As to why financial enterprises should use PB as valuation measurement, I have searched for some reasons for tiger friends' reference.

P/B ratio is mainly applicable to industries with a large number of fixed assets and relatively stable book value, as well as financial industries with high current assets such as banking and insurance, because the net assets of these industries are of great significance and relatively stable to the production and operation of enterprises. And the periodicity of the financial industry is obvious.

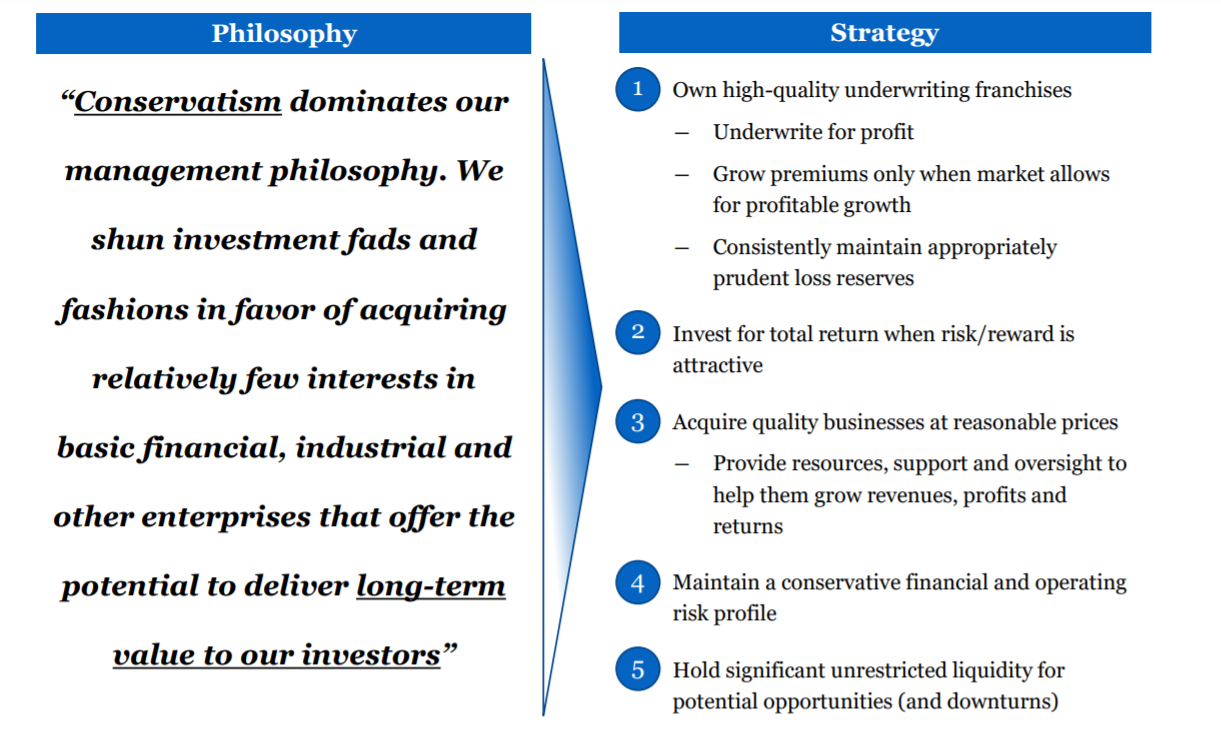

As a company that is very similar to Berkshire, we see Alleghany summarizing its business form into three parts,

Insurance and reinsurance business accounted for the largest proportion, accounting for 72% in 2021. Then there are various entities under the name of Alleghany, accounting for 12%. Finally, the securities portfolio, accounting for 18%.

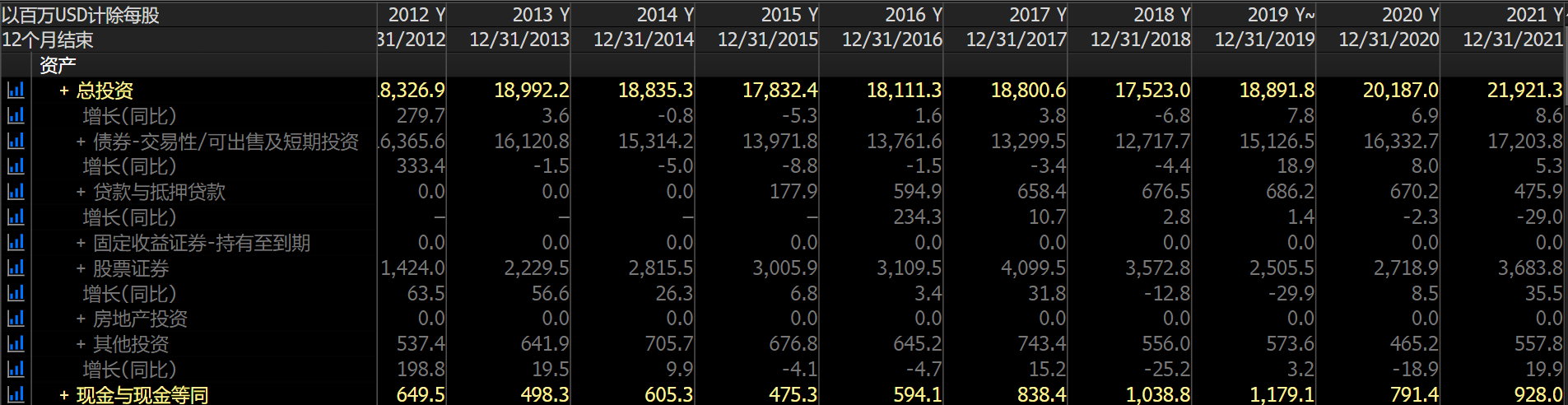

Frankly speaking, if you look at Alleghany's balance sheet and see the bond investment in the total assets column, you will feel excited and want to revalue it.

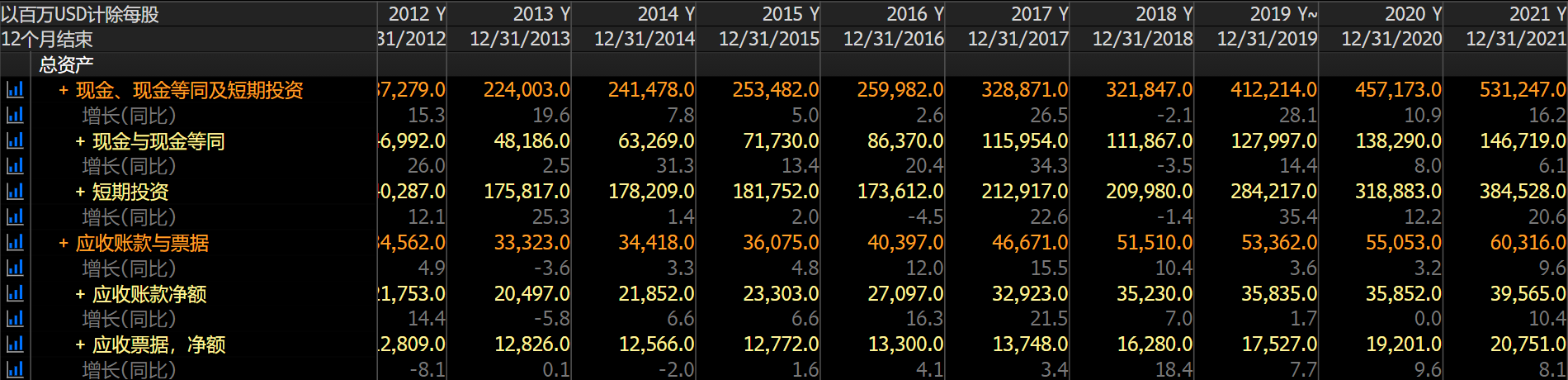

As we know, Berkshire is already rich with $146.7 billion on its books, but there are still more short-term investments of $384.5 billion.

Acquisition multiple is lower than Berkshire valuation

Buffett's own attitude towards Berkshire is to buy back if the P/B ratio is lower than 1.2. This valuation level, 1.26 times that of Alleghany's acquisition, can be called "fair price".

Premium acquisition is the routine operation, although it is indeed at a premium compared with the current market valuation.

Different from the usual premium acquisition, the share price of Berkshire, the acquirer, also rose.

On the one hand, it can be considered that the market is optimistic about this acquisition, on the other hand, it can be considered that it has the effect of pulling up the valuation.

At present, Buffett paid 1.26 times PB when he acquired Alleghany, while his Berkshire is currently valued at 1.5 times. After Alleghany consolidated, it will naturally follow Berkshire's valuation, so it should rise.

Conservative philosophy

What kind of business philosophy should companies engaged in insurance business uphold? Alleghany, a nearly 100-year-old enterprise, has given its own answer:

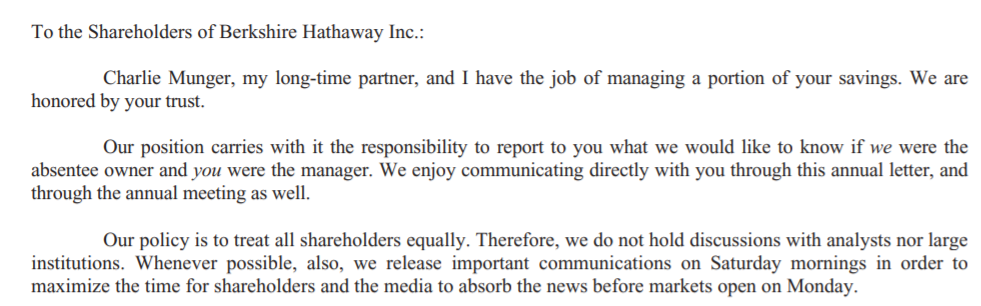

Personally, I think this passage is consistent with what Buffett said at the beginning of his letter to shareholders in 2021.

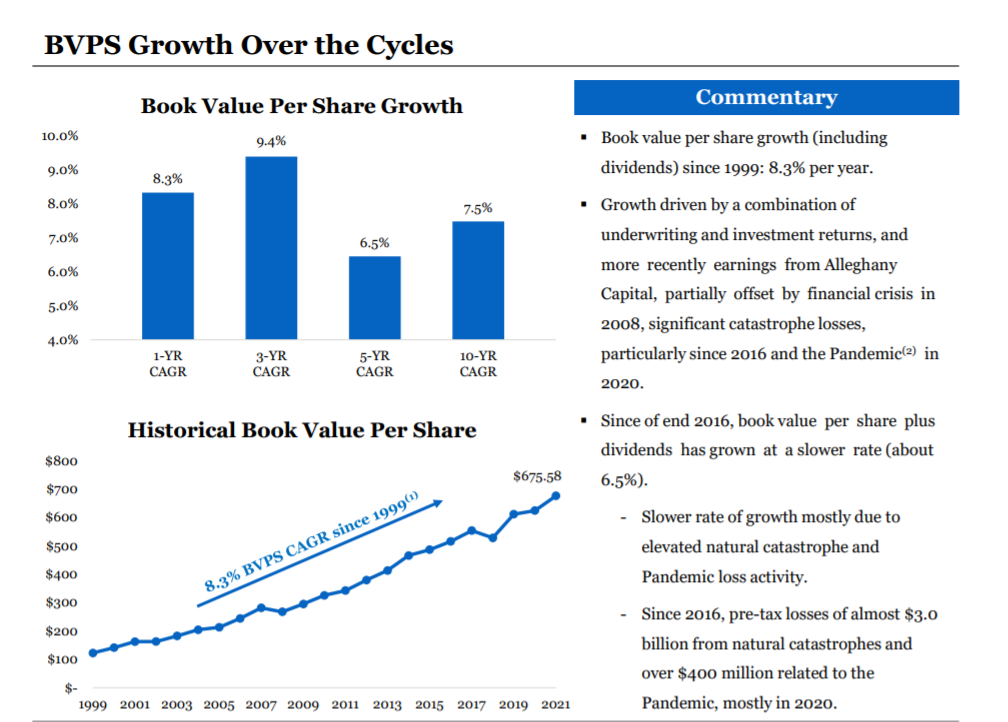

Conservatism and the explosive growth of open innovation represented by Internet enterprises are probably two aesthetic systems. Fortunately, they are effective. As mentioned earlier, PB is a key valuation indicator for financial companies. Alleghany himself attaches great importance to the accumulation of net assets of US stocks, and has made a special table to signal investors. It must be said that this slope is an enviable one.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

HJ go go go